By Colin McKerracher, Head of Advanced Transport, BloombergNEF

At the beginning of each year, BloombergNEF’s transport team reflects on what has happened in the industry and gathers its thoughts on what to expect for the coming 12 months. These 10 things to watch are a snapshot of what we think will be some of the most noteworthy developments in 2024.

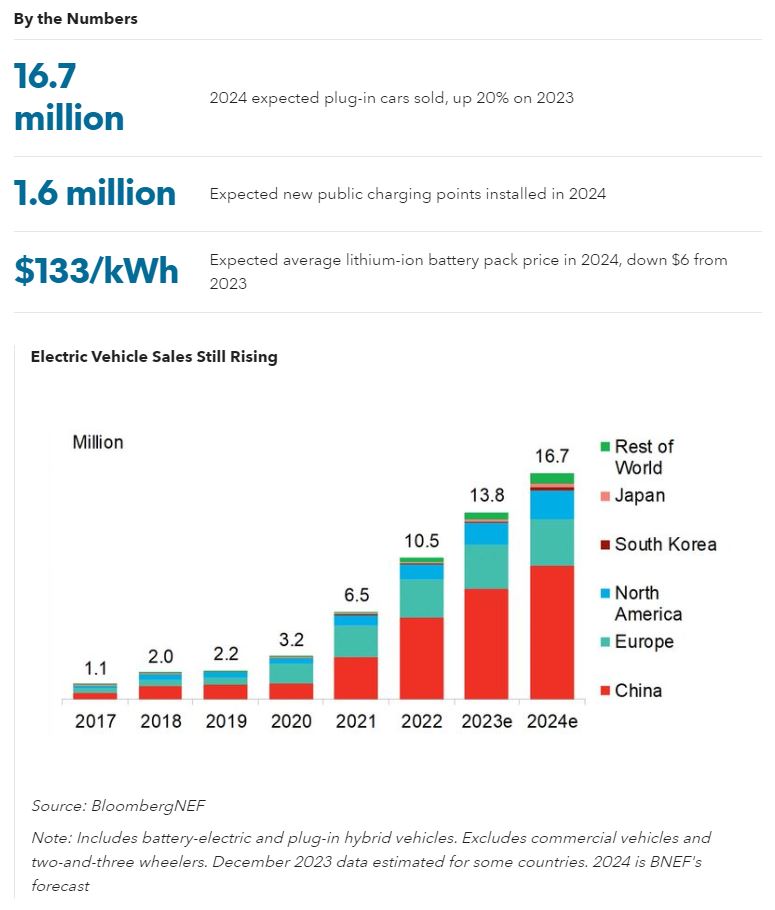

- EV sales are headed for another record year in 2024. We expect 16.7 million passenger EVs to be sold and another million commercial EVs. About 20% of new car sales this year will be electric and the number of EVs on the road should reach 57 million by the end of the year. That is over 4% of the fleet, and is starting to make a material dent in fuel consumption in some countries.

- Still, there are reasons for caution. Nearly 60% of global EV sales this year will be in China, while markets like Europe and the US are set to slow due to a combination of reduced incentives, a pullback from established automakers, and squeezed consumers. The US election could upend the EV market there if Trump is elected in November.

- 2024 will also see further thinning of the herd of EV startups that stampeded into the market in the last four years. We expect more bankruptcies and consolidation.

- We expect a record 1.6 million public EV charging connectors to be added in 2024, up from 1.2 million added in 2023. China’s public EV chargers alone will dispense 52 TWh in 2024, as much electricity as Greece consumes in a year.

- See the full note for predictions on battery prices, the impact of California’s Advanced Clean Truck rule, why the center of gravity for the global auto industry is shifting south, and how shipping and aviation companies are competing for supply of clean fuels.

- Our 2023 predictions came out looking good: we got the total number of EVs sold almost exactly right, BYD overtook Tesla as we predicted, and the cumulative number of EV chargers hit almost 4 million. Our biggest miss was on battery prices.

BNEF clients can access the full report here.