By Vandana Gombar, Senior Editor, BloombergNEF

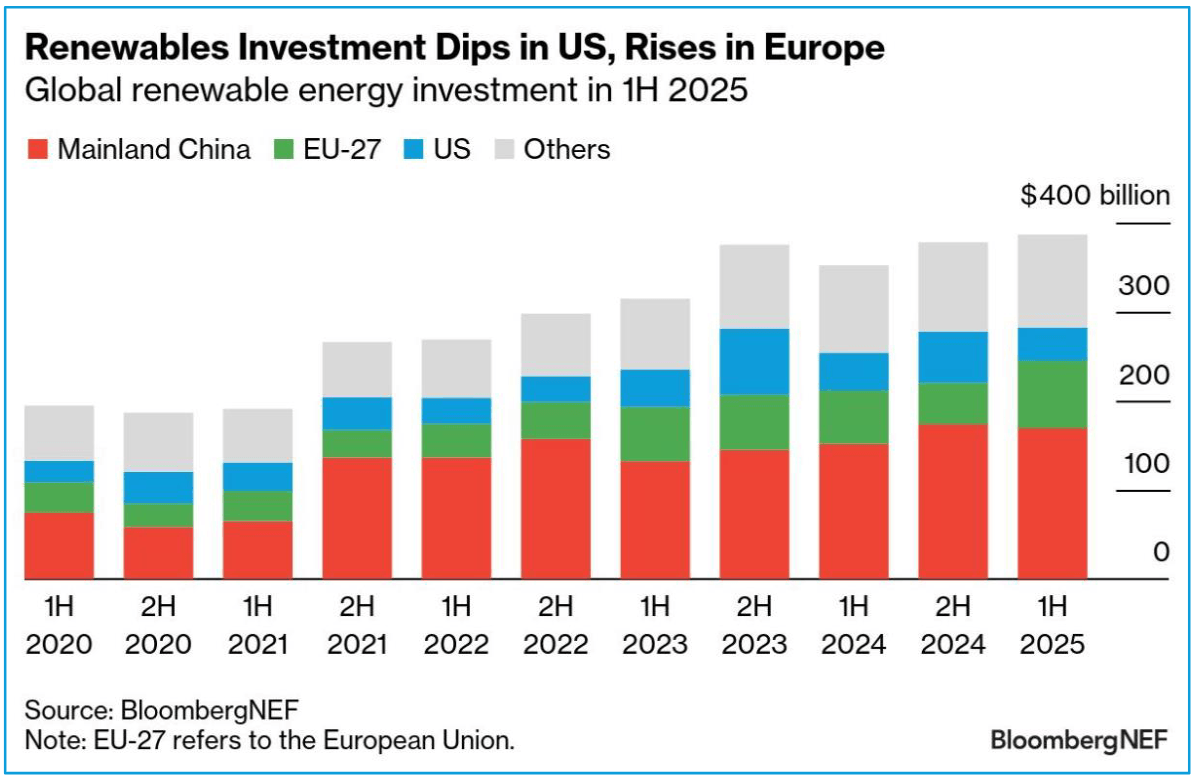

- Signs of some capital reallocation from US to Europe emerging

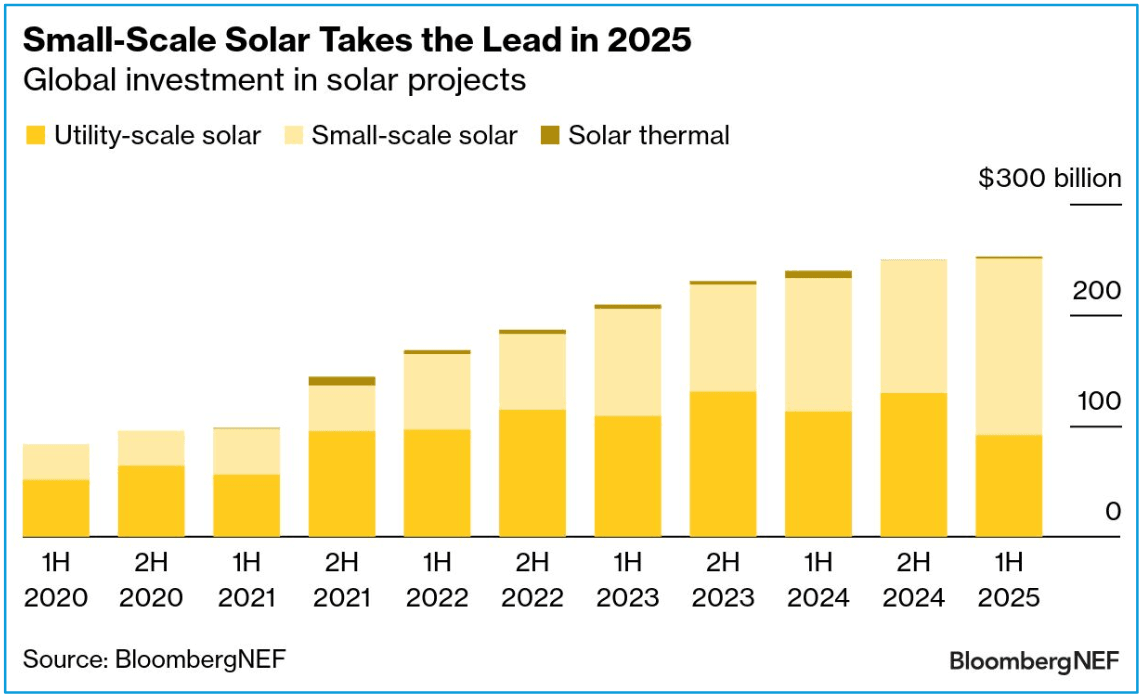

- Small-scale solar was surprise winner of 1H 2025 investments

Renewable energy investments set another record in the first half of 2025, rising 10% from the same period of last year to reach $386 billion. However, asset finance for utility-scale solar and onshore wind was down 13%, reflecting an adverse policy environment in some, key markets.

“Investors are rethinking capital allocation and putting their money where project returns are strongest,” said Meredith Annex, BloombergNEF’s head of clean power. “Project pipelines are also taking a hit.”

Signs of capital movement

That rethink seems to be happening in some specific sectors, including offshore wind. TotalEnergies and RWE said they were reducing US activity while expanding in the North Sea in annual shareholder calls. In May, the Financial Times newspaper reported that Canadian pension fund Caisse de Depot et Placement du Quebec (CDPQ) would “rebalance investment” to Europe from the US.

US investment in renewables was down 36% in the first half of the year compared to the second half of last year, while, EU-27 investment was up 63%.

President Donald Trump’s recent stop-work order on Orsted’s Revolution Wind farm — which is 80% complete is the latest federal effort to reduce investment in renewables, especially offshore wind.

Small-scale solar shines

Global solar investment in the first half of the year reached $252 billion, while wind was exactly half of that total, at $126 billion, with offshore wind accounting for most of the increase over last year. Small-scale solar captured most of the financing in this period, with asset finance for larger utility-scale projects shrinking 22% compared to the same period last year.

Markets that saw the largest year-on-year declines in utility-scale solar investment – including mainland China, Spain, Greece and Brazil — have rising curtailment of power generated or greater exposure to negative power prices.

Regions to watch

There are five markets that are in the spotlight for us at the moment:

- Saudi Arabia signed the-largest deal within Europe, Middle-East and Africa, or EMEA, region — the 2.6 gigawatts Masdar KEPCO and GD Power Al Sadawi PV Plant.

- Germany was the largest market for wind investments after China, and also has a strong solar portfolio building.

- India’s renewable energy investments reached $11.8 billion in the first half of the year, with auctions of projects that combine solar, wind and storage being the main driver of new capacity.

- Turkey saw solar investment rise 12% in the first half of 2025.

- Indonesian investment rose nearly fivefold over the-same period, with the government’s latest power development plan creating a $96 billion investment opportunity over the next 10 years.