Banks play an important role in the energy transition through helping companies and projects access capital. A bank’s lending and underwriting for both low-carbon solutions and conventional fossil fuels demonstrates its own preparedness for the transition. This financing activity also reflects the broader economy’s progress toward decarbonization.

BloombergNEF has assessed how much money global banks are channelling into the energy transition. The fourth Energy Supply Banking Ratio report finds that some 2,000 banks collectively made little progress last year to finance more low-carbon solutions compared to activities that support fossil fuels. As a result, the banking industry is not yet delivering the money needed to limit climate change.

Banks financed 89 cents low-carbon energy for every dollar to fossil fuels

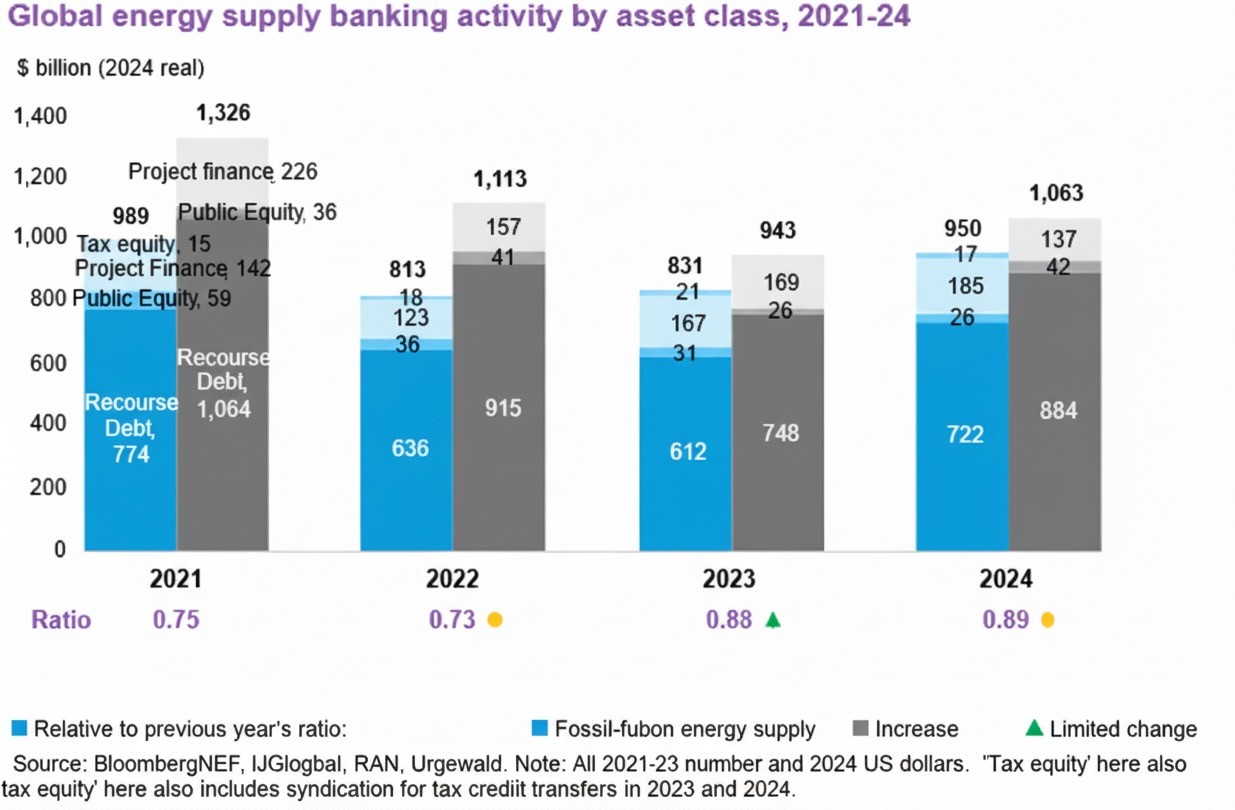

For every $1 of bank financing in 2024 that went to oil, natural gas or coal, the world’s leading banks put almost 89 cents into low-carbon energy companies and projects, including wind, solar and grids. That made an Energy Supply Banking Ratio (ESBR) of 0.89:1 in last year. That figure edged up by just a penny in each dollar financed in 2023. The figures highlight inertia both in the energy industry and with institutional financing strategies.

The ESBR is BNEF’s estimate of the facilitation that global banks do for the energy sector. This means what institutions lend directly and the value of equity and debt instruments they underwrite for companies active in supplying energy of all forms. It also includes asset finance loans and tax equity, where banks channel funding directly to projects.

Financing volumes have rebounded

The amount of bank financing for energy supply companies and projects rebounded to just over $2 trillion in 2024. This reversed declines in the previous two years and may reflect lower borrowing costs in major economies. Debt issuance rose for both low-carbon and fossil-fuel issuers by about 18%, almost returning to 2021 levels. Most major markets experienced this surge, including the United States, China and much of Europe.

Equity issuance depended on the type of energy involved. While issuance grew by 62% for fossil fuel companies last year, it fell 15% for clean energy. With project finance, that relationship was reversed: renewables reaped 11% more than a year ago and fossil fuels 19% less.

The ratio has barely improved

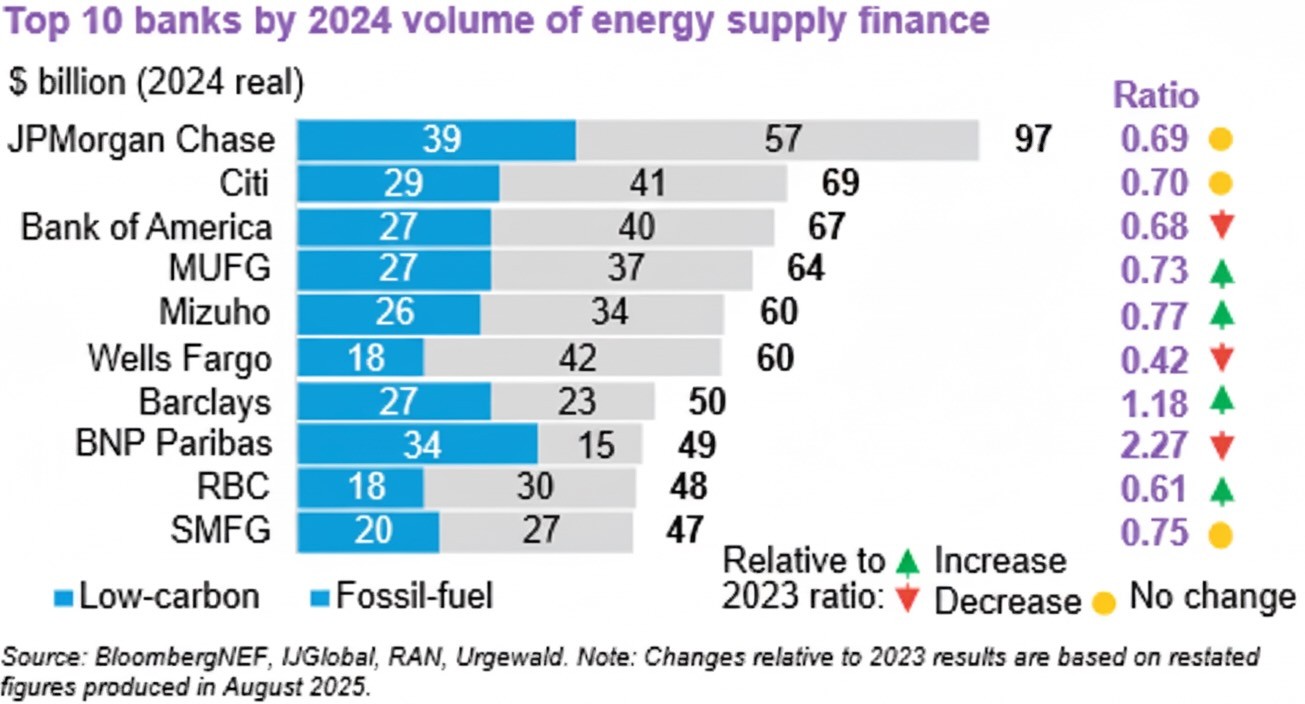

The global ESBR remains consistently below 1:1, which means money going into the industry continues to tilt toward fossil fuels instead of low-carbon solutions. It is a sticky metric not just for the total measure over the past few years, but also for most individual institutions. Fluctuations in ESBRs for almost all of the top 10 banks by volume have been limited to 0.5 points or less since 2021.

JPMorgan Chase, the largest facilitator of finance for energy supply, has had an ESBR of around 0.7:1 for every year from 2021 to 2024. Several factors contribute to this inertia for large banks. They include longstanding client relationships and those the mostly steady business models followed by those clients. There is no quick shift underway in either the energy industry or banking.

The exception is BNP Paribas. The French bank lifted its ESBR to more than 2:1 in the past two years, from below 1.4:1 in 2021. It achieved this mainly by shrinking its fossil-fuel book.

Several banks have adopted the ratio metric

JPMorgan Chase, Royal Bank of Canada, Citi and Scotiabank have adopted or committed to disclose an energy supply ratio metric over the past year. This follows a successful investor campaign for more disclosure on climate related metrics.

While each bank has made a different set of design choices in the absence of an industry standard, the overarching framework remains fairly consistent. We expect to see further consensus as more institutions adopt the metric.

Bank ratio disclosure can provide visibility to investors around how the institution’s business is tracking the broader energy transition. It also highlights how they are capitalizing on low-carbon opportunities or continuing to support conventional fossil fuels. Calculating a ratio can equally be an important internal benchmarking exercise. Bank executives can use the numbers as a strategic tool for identifying and taking advantage of growth sectors.

The magic number is 4-to-1

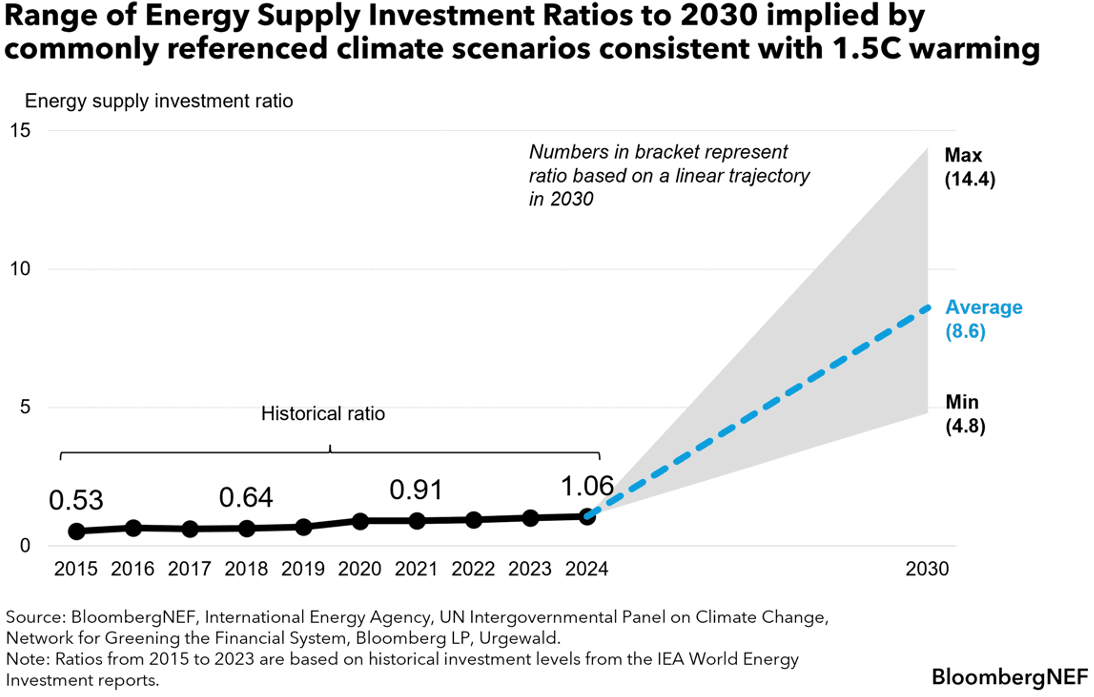

Financing a transition toward cleaner energy is a crucial part of the roadmap to limiting global warming to 1.5C.

Researchers that have set out scenarios for how those goals can be met suggest that low-carbon energy supply needs about four times the capital as fossil fuels this decade. That would require an ESBR or 4:1, far above the prevailing figures BNEF recorded.

Investment in low-carbon energy surpassed that of fossil fuels for the first time last year, with a ratio of 1.06:1. But bank financing has lagged behind, with the ESBR measuring 0.89:1.

There are a number of reasons that investment and banking ratios haven’t aligned. The measures depend on spending and finance decisions made each year by companies, and there is a time lag between raising finance and deploying capital. Sectors like residential solar also have contributed to the gap. Much of the surge in capital investment for photovoltaics came from consumer spending instead of the large corporate financings.

What is certain is that the banking ratio is not rising at the pace needed to meet global climate goals. While banks poured time and attention into the issue following the Paris talks, some have changed stance in the past year or so. Major institutions in North America, Japan and Europe have exited the Net-Zero Banking Alliance since 2024. Some have also scaled back net-zero targets.

This follows a political backlash against investment practices guided by environmental, social and governance (ESG) principles. It also reflects skepticism within banks about the industry’s ability and willingness within governments to reach the 1.5-degree goal.

Yet many banks are still pursuing opportunities in the energy transition where the fundamentals for low-carbon solutions remain strong.

BNEF clients can read the full report including institution-level volumes and ratios here.

Download the summary report

Enter your details to download the ‘Fourth Energy Supply Banking Ratios: Little Progress’ report.