Issuer innovation and regulatory support can help grow sustainable debt in emerging markets, a critical tool to address the multi-trillion-dollar climate financing gap, according to a new BloombergNEF (BNEF) report, Scaling Sustainable Debt in Emerging Markets.

The report, commissioned by the Dubai Financial Services Authority (DFSA) and the Hong Kong Monetary Authority (HKMA), finds that nearly half of all financing for low-carbon energy companies in the Middle East and North Africa (MENA) and emerging Asia Pacific (APAC) comes from labeled sustainable debt. These instruments are an important channel of capital to the energy transition and have a strong foundation for growth.

Sustainable debt issuance stagnates in key emerging markets

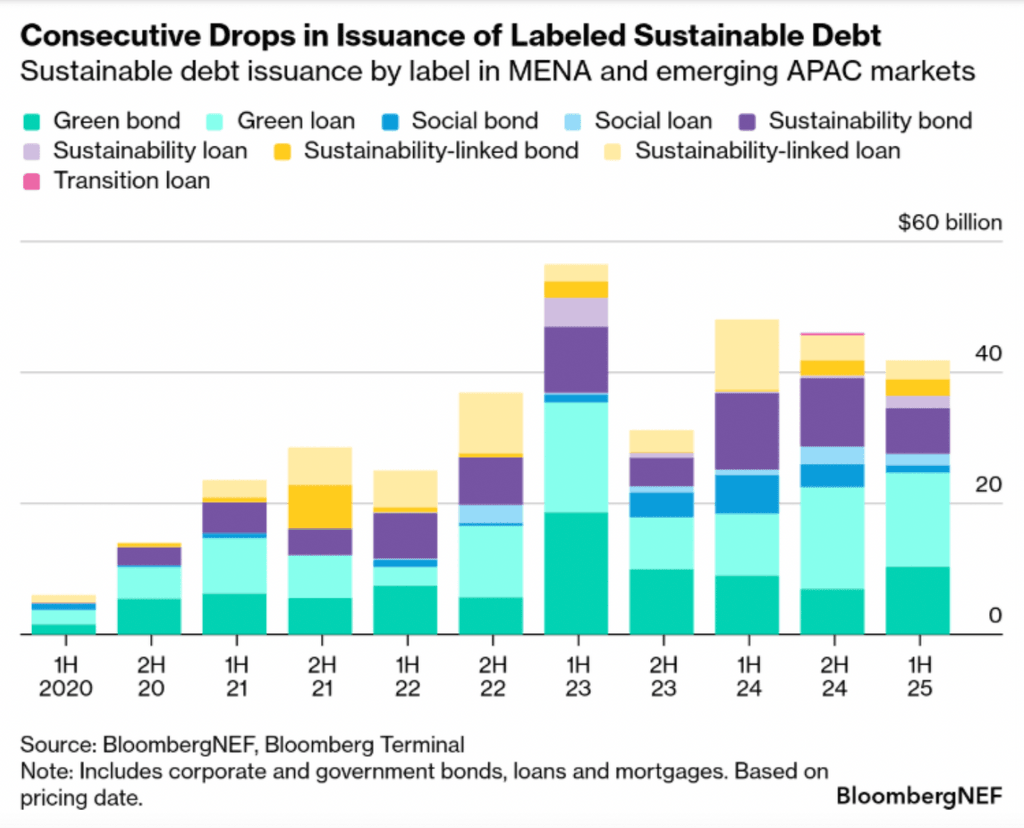

Labeled sustainable debt issuance across MENA and emerging APAC slowed in 2025, after a record 2024. Issuance globally is down amid shifting perceptions around the benefits of labeling debt instruments – including on price and reporting costs.

Reduced pricing benefits may be holding issuers back. Among the bonds sampled by BNEF, the discounts issuers were receiving for labeling debt in 2020 have faded, with some issuers paying a premium for green issuance.

Despite global headwinds, the sustainable finance market is still dynamic, with issuers experimenting with new structures and regulators exploring policy support. Labeled debt only accounts for 2.6% of the debt market in emerging economies today, highlighting clear growth opportunities.

Regulators can help lower barriers for issuers

As a key tool to drive climate finance in emerging markets, regulators and governments have a variety of solutions available to them to grow the labeled sustainable debt market and to help address climate and sustainability challenges.

Government support to offset labeling costs and provide a clear regulatory environment for labeled issuance can ease challenges when issuers go to market. The Hong Kong government provides a good example, with a scheme providing subsidies for green and social issuers. As of mid-October 2025, subsidies were granted to over 620 sustainable debt instruments worth over $170 billion issued in Hong Kong.

Regulators also can drive the market by providing guidance for issuing labeled debt, ideally encouraging issuers to label. Policy frameworks like the Association of Southeast Asian Nations’ sustainable finance taxonomy assists issuers in identifying green and transitional activities, which may help drive issuance.

Issuers can innovate beyond conventional labels, tenors and structures

Other avenues for growth include expanding past the green label and typical structures. Social debt represents a deal type with strong growth potential. Social instruments only account for 8% of total issuance since 2020 in these emerging markets. Regional neighbors like South Korea and Japan are among the largest social bond markets globally and could offer experience for success in the wider APAC region.

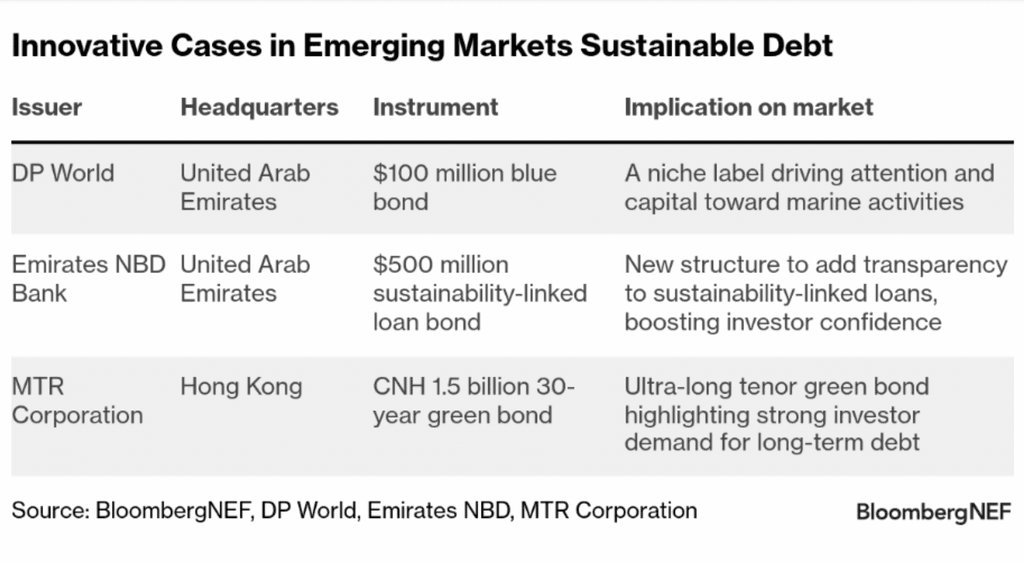

Similarly, a blue bond from DP World, a UAE-based logistics and marine port operator, highlights the benefits of specificity when applying labels to help attract capital for underserved areas of sustainability, such as marine ecosystem conservation and restoration, and sustainable marine transportation.

A sustainability-linked loan bond (SLLB) from Emirates NBD Bank also shows the added credibility that novel labeling structures can bring. Through robust selection criteria, the structure can help channel financing to the most impactful and robust sustainability-linked loans. The key to its success is transparency around the specific instruments financed by the SLLB.

A green bond and green loan from Hong Kong’s MTR Corporation, a public transportation operator, demonstrated that there is strong investor demand for ultra-long tenors. As the company’s first green ultra-long tenor issuance, the novel 30-year green bond was well received by investors, as the instrument was 5.8 times oversubscribed.

This report is part of the strategic partnership between Dubai Financial Services Authority (DFSA) and the Hong Kong Monetary Authority (HKMA) on sustainable finance.

Mark Steward, Chief Executive of the DFSA, said: “This research provides valuable insight into how sustainable debt is evolving across the MENA and emerging APAC regions. The US$94 billion issuance record in 2024 reflects growing investor confidence and the resilience of our markets. Our focus remains on supporting all forms of sustainable and transition finance to ensure that the market within the DIFC, United Arab Emirates, and across the region remains robust and credible for the long term.”

Eddie Yue, Chief Executive of the HKMA, said: “Sustainable debt is a promising tool for bridging the multi-trillion-dollar climate financing gap in emerging markets. Through this joint research, we aim to explore solutions to remove the barriers faced by issuers and identify opportunities for growth. As Asia’s leading sustainable finance hub that arranges 45% of the region’s international green bond issuances in 2024, Hong Kong is committed to leveraging our infrastructure and know-how to support emerging markets in reaching their sustainable development goals.”

Jon Moore, Chief Executive of BloombergNEF, said: “Sustainable debt helps build trust and transparency in the financial market. The effort by HKMA and DFSA to drive the development of sustainable debt markets provides valuable support to scale up finance and investment for the energy transition. We hope this report and our industry-leading insights can help regulators and market participants navigate this transition and capture opportunities that advance global sustainability objectives.”

The report is available at this link.