By Colin McKerracher, Head of Clean Transport, BloombergNEF

Death, Taxes and…

Some trends in the auto sector can be counted on year-in, year-out: Americans will keep buying big pickup trucks, SUVs will continue to take market share around the world, and Toyota will insist fuel cell vehicles are just around the corner.

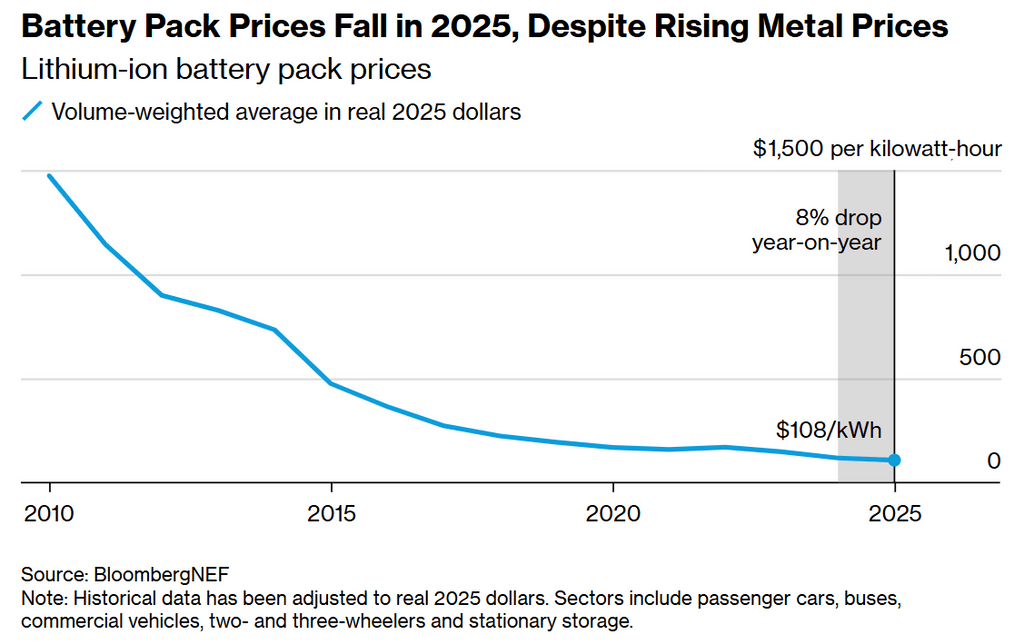

Add to that list, falling battery prices.

Lithium-ion battery prices dropped again in 2025, with average prices coming down 8% to $108 per kilowatt-hour, according to BloombergNEF’s annual price survey.

China still leads

China’s lead in low battery prices continued in 2025, with average prices in the country dropping 13% to $84/kWh. This is due to a combination of lower input costs, overcapacity, intense price competition and preference for lower-cost lithium iron phosphate (LFP) cells.

Prices in North America and Europe were 44% and 56% higher, which is a big part of why EVs in those regions still cost more than their combustion counterparts. In China, price parity has already been achieved in almost all vehicle segments.

This year, the lowest observed cell and pack prices were just $36/kWh and $50/kWh, respectively. These were for LFP batteries going into stationary storage applications. Similar lows were observed last year, which indicates these price levels are no longer extreme outliers.

BNEF has been doing this price survey for 15 years now, and each year when the top-line number lands, there’s a steady stream of commentary attributing the drop to producers slashing margins. Margins did dip slightly in the first half of this year, but that alone doesn’t fully account for the drop. There’s real innovation and efficiency improvements going on, too, and prices are now down 93% since 2010 in real terms.

Material price rise

Perhaps the most intriguing storyline from the 2025 survey is what didn’t happen.

Cobalt prices rose sharply this year after the Democratic Republic of the Congo introduced export quotas, and lithium ticked up, too. But battery prices didn’t rise. The industry absorbed these shocks through greater LFP adoption, long-term contracts and broader hedging strategies.

This is a markedly different picture from just a few years ago, when higher reliance on nickel manganese cobalt (NMC) cathodes meant a spike in metal prices led directly to batteries bucking their long-term downward trend.

It’s probably too early to celebrate — if elevated metal prices persist, the effect will eventually show up in battery figures — but even this level of resilience to underlying material price changes shows how far the battery industry has come.

The diversification trend is set to continue in the years ahead as sodium-ion battery production capacity is starting to come online, and other new cathode and anode chemistries are approaching commercialization.

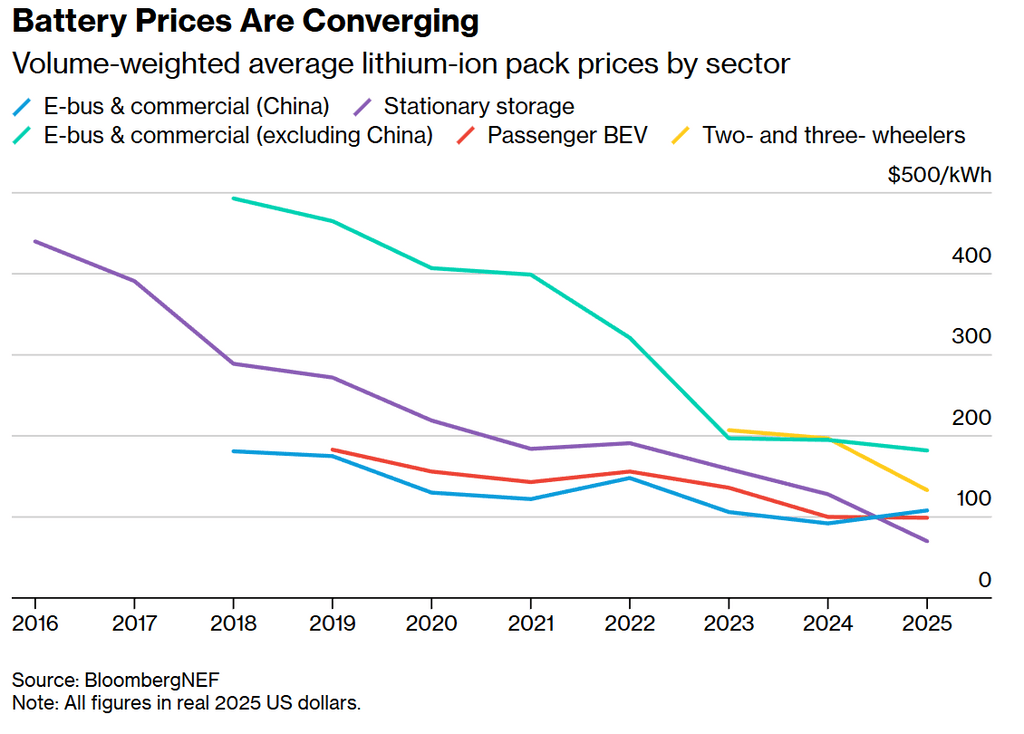

Stationary storage costs are plummeting

The average pack price for stationary storage systems dropped to $70/kWh, 45% lower than in 2024. This is the sharpest drop across all segments and makes stationary storage the lowest-priced segment for the first time.

This was largely driven by intense competition in China, where there’s immense overcapacity for battery cells specifically aimed at stationary storage applications. China’s production for stationary storage cells in 2025 is estimated at 557 GWh, over double global installations in the sector.

Those low prices will have everyone scrambling to increase their storage deployment forecasts for next year, but pinning down exactly where this will show up is tricky. China recently removed its mandate to add storage to renewables installations, which is a headwind for the battery industry overall.

My guess is that you’ll start to see a lot more on-site storage installations for everything from EV charging stations to data centers and demand management at commercial and industrial facilities. At these prices, many new applications become viable.

EV battery prices are below $100/kWh

EV battery prices came in below the $100/kWh threshold for the second year running. Average cell-only prices were $79/kWh, and much lower numbers were available in China.

Prices were down just 1% from last year, but most Western automakers have only recently started to introduce LFP cells into their new entry level EV models. As sales of those start to ramp up, global average EV pack costs should continue to come down.

The prices across battery applications continue to converge, with the gap between segments narrowing again in 2025.

Prices for two- and three-wheeled vehicles dropped sharply this year to $133/kWh, as demand picked up in markets like India and Southeast Asia.

Headline figures for the report are volume-weighted averages. BNEF clients can access the full report and breakdown by segment, geography and chemistry here, along with the outlook for prices in 2026 and beyond.