PRESS RELEASE

Battery Storage Costs Hit Record Lows as Costs of Other Clean Power Technologies Increased: BloombergNEF

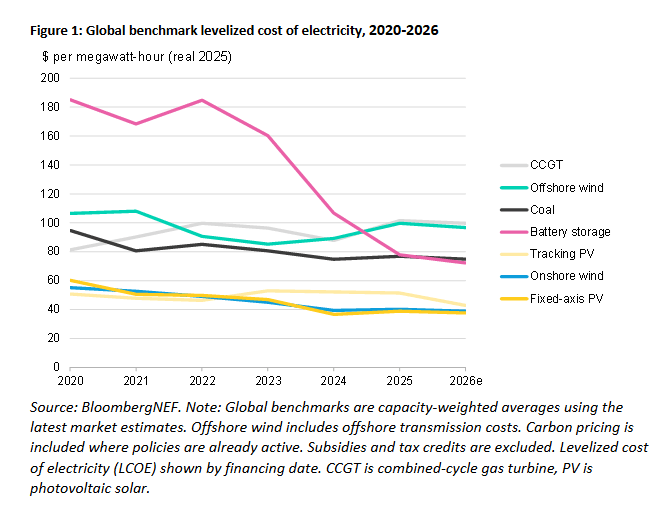

New York, February 18, 2026 – Clean power costs sent mixed signals in 2025. According to BloombergNEF’s Levelized Cost of Electricity 2026 report, the cost of battery storage projects plummeted to new lows in 2025 even as most other clean power technologies became more expensive. BNEF’s global benchmark costs for solar, onshore wind and offshore wind costs all rose in 2025, reversing the downward trend seen in recent years, due to a combination of supply chain constraints, poorer resource availability and market reforms in mainland China.

Despite global rising protectionism, supply-chain challenges and higher financing costs, BNEF expects innovation and competition will continue to lead to declining clean-energy technology costs. By 2035, BNEF forecasts LCOE reductions of 30% in solar, 25% in battery storage, 23% in onshore wind and 20% in offshore wind.

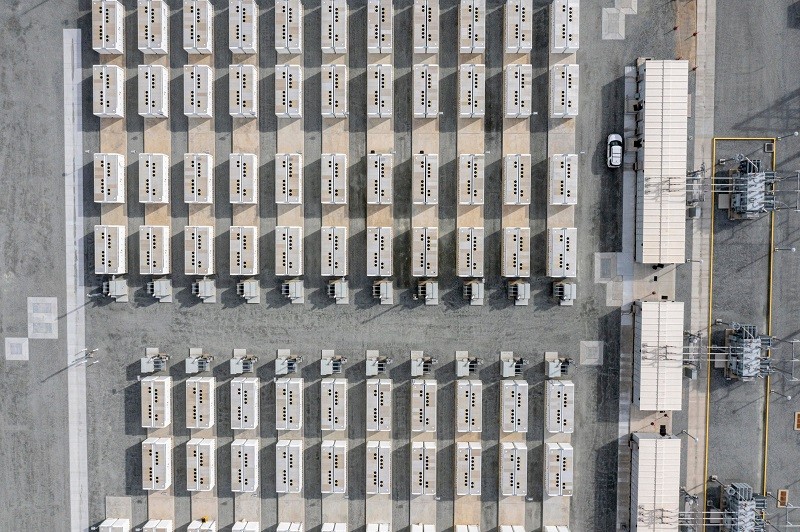

BNEF’s data shows that the global benchmark cost for a four-hour battery project fell 27% year-on-year to $78 per megawatt-hour (MWh) in 2025 – a record low since BNEF began tracking costs in 2009. Lower pack prices, increasing competition among manufacturers and improved system designs all contributed to the rapid decline. Falling battery costs are also accelerating the buildout of co-located renewable projects. In 2025, developers added 87 gigawatts of combined solar and storage, delivering power at an average of $57/MWh.

By contrast, the benchmark cost of a typical fixed axis solar farm increased 6% compared to 2025, hitting $39/MWh, while onshore wind reached $40/MWh and offshore wind climbed to $100/MWh globally.

“Cheaper costs due to manufacturing overcapacity from the electric vehicle market and better system designs are transforming the economics for large energy storage projects,” said Amar Vasdev, lead author of the report and senior energy economics associate at BloombergNEF. “The levelized cost of electricity for a four-hour system is now below $100/MWh in six markets. As costs continue to drop, we expect battery storage to strengthen solar project revenues, support broader renewable deployment and accelerate the shift toward storage‑led system balancing over fossil-fuel‑based peaking capacity.”

Thermal power generation, too, saw cost increases in 2025. New-build gas and coal plants saw rising equipment prices, which pushed the global levelized cost of electricity for combined‑cycle gas turbines (CCGTs) up 16% to $102/MWh, the highest level on record. An increase in data center development has kept gas turbine demand elevated, with BNEF expecting gas‑plant costs to remain expensive for the foreseeable future.

Wind project costs continue to diverge regionally, with mainland China retaining a cost advantage. Onshore wind projects outside mainland China saw a 4% cost decline in 2025. Yet the global benchmark rose by 2%, pushed up by recent Chinese projects built in areas with lower wind speeds, which lifts costs. Tight offshore-wind supply chains pushed costs higher in nearly all major markets and up 12% globally. In the UK in particular, the cost of recently financed offshore wind projects now sits 69% higher than five years ago, with BNEF expecting costs to remain elevated until at least 2030.

In the US, wind power has regained its position as the cheapest option for new electricity generation, overtaking gas-fired power generation for the first time since 2023. Recent surges in gas turbine demand, driven heavily by data‑center expansion, have doubled US turbine capex in just two years and pushed combined‑cycle gas turbine costs to record levels, far above global averages.

Challenges in gas turbine supply chains and grid queues may also provide opportunities for quick-to-deploy clean power technologies. Co‑located solar and four‑hour battery systems can meet a substantial share of data‑center electricity demand at a lower cost than gas, with competitiveness improving in regions like California and parts of Texas as solar output expands and storage prices fall. Together, these shifts underscore how rising gas costs and rapid advances in clean energy technologies are helping make renewables the most cost‑effective sources of firm and flexible power.

“We are in the middle of a race for electrons to meet power demand growth from electrification and data centers. Renewables are already outcompeting the operating costs of existing fossil-fuel plants in key markets, and not just for new-build projects,” said Vasdev. “New solar farms already undercut new coal or gas generation in almost all Asia-Pacific markets, while wind has displaced gas as the cheapest source of new-build generation in the US and Canada. Solar consistently beats fossil-fuel alternatives in Southern Europe and wind in Northern Europe.”

Now in its 17th year, BNEF’s annual Levelized Cost of Electricity report remains the industry benchmark for the cost of electricity generation. Based on BNEF’s proprietary cost data and powered by BNEF’s global network of regional analysts and sector experts, the analysis covers more than 800 recently financed projects, and models levelized cost of electricity (LCOE) forecasts across 28 technologies data for more than 50 markets. This year’s report includes expanded coverage of the Middle East and Africa, deeper analysis of battery storage economics and renewables-plus-storage assets, and a full data update across all mature and nascent technology classes.

Media Contact(s)

For further information, please contact our media team.

Oktavia Catsaros

BloombergNEF

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.