This Insight is part of the Energy Storage Market Outlook series.

Energy storage hit another record year in 2022, adding 16 gigawatts/35 gigawatt-hours of capacity, up 68% from 2021. Beyond record additions, several markets announced ambitious energy storage targets totaling more than 130GW by 2030, although BloombergNEF remains cautious on its impact on forecast demand given the lack of policy clarity and reforms that address fundamental deployment barriers. Government entities have shelled out millions in subsidies which boost deployment but highlight the underlying problem that batteries are not yet economically attractive in most parts of the world.

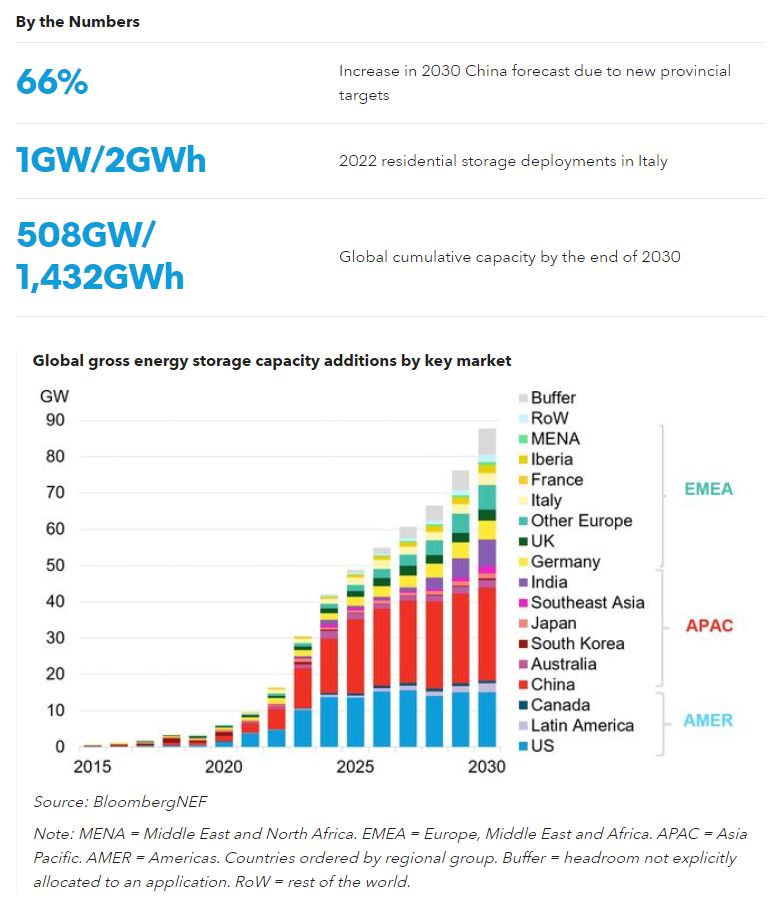

- Global energy storage’s record additions in 2022 will be followed by a 23% compound annual growth rate to 2030, with annual additions reaching 88GW/278GWh, or 5.3 times expected 2022 gigawatt installations.

- China overtakes the US as the largest energy storage market in megawatt terms by 2030. We increased our China forecast by 66% to account for new provincial energy storage targets, power market reforms and industry expectations supporting significant new capacity. In contrast, project delays continue to slow US deployments, with 7.2GW/18.4GWh of utility-scale storage projects delayed in 2022. Despite delays, utilities continue to procure more solar and storage to displace thermal assets and meet system capacity needs.

- Europe, Middle East and Africa (EMEA) added 4.5GW/7.1GWh in 2022. Residential batteries led installations in the region, a trend that will remain until 2025, as high retail electricity prices and government incentive programs support household deployments.

- High energy storage system costs have incentivized companies to accelerate the move toward lower-cost chemistries such as lithium iron phosphate (LFP). More Chinese battery makers are expanding LFP products overseas, and we expect its share to continue growing globally until 2026 due to its lower cost, longer cycle life, and manufacturing scale. After 2027, sodium-ion batteries may become more popular for energy storage system demand growth.

- Asia Pacific (APAC) maintains its lead in build on a power capacity (gigawatt) basis, representing 44% of additions in 2030. China leads in deployments in the region, driven by local targets and compulsory renewable integration policies. To keep up, other markets such as Japan, South Korea, and India are also setting ambitious targets and allocating subsidies for energy storage. Japan’s federal and local governments announced annual subsidy programs for utility-scale batteries, while South Korea set a 25GW/127GWh storage target by 2036. India is taking steps to promote energy storage by providing funding for 4GWh of grid-scale batteries in its 2023-2024 annual expenditure budget. BloombergNEF increased its cumulative deployment for APAC by 42% in gigawatt terms to 39GW/105GWh in 2030.

- EMEA scales up rapidly through the end of the decade, representing 24% of gigawatts deployed in 2030. The region added 4.5GW/7.1GWh in 2022, with residential battery installations in Germany and Italy outpacing BNEF’s expectations. The residential segment is now the largest in the region and will remain so until 2025. Over €1 billion ($1.06 billion) has been allocated to storage projects in the past year, supporting a fresh pipeline of projects in Greece, Romania, Spain, Croatia, Finland and Lithuania. EMEA is expected to reach 114GW/285GWh cumulatively by the end of 2030, a tenfold growth in gigawatt terms, with the UK, Germany, Italy, Greece, and Turkey leading additions.

- The Americas region represents 21% of annual energy storage capacity on a gigawatt basis by 2030. The US is by far the largest market, led by a pipeline of large-scale projects in California, the Southwest and Texas. The US has a seen a wave of project delays due to rising battery costs. Despite this, US utilities continue to procure energy storage paired with solar for system reliability. Meanwhile, a handful of long duration storage projects gain traction. Market reforms in Chile could pave the way for larger energy storage additions in Latin America’s nascent energy storage market. Rapidly increasing volumes of solar and wind across Chile and Brazil and underinvestment in the grid in Mexico could provide opportunities for storage.

BNEF clients can view the full report here.