By Martin Tengler, Head of Research, Hydrogen, BloombergNEF

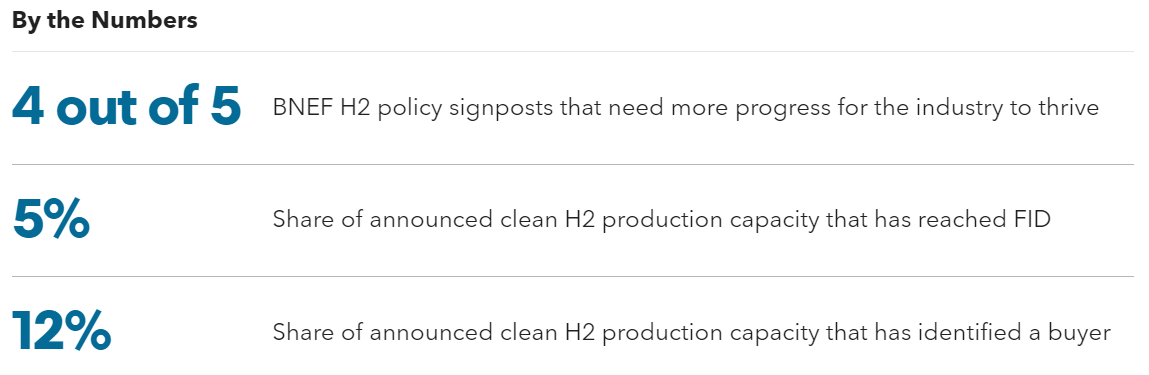

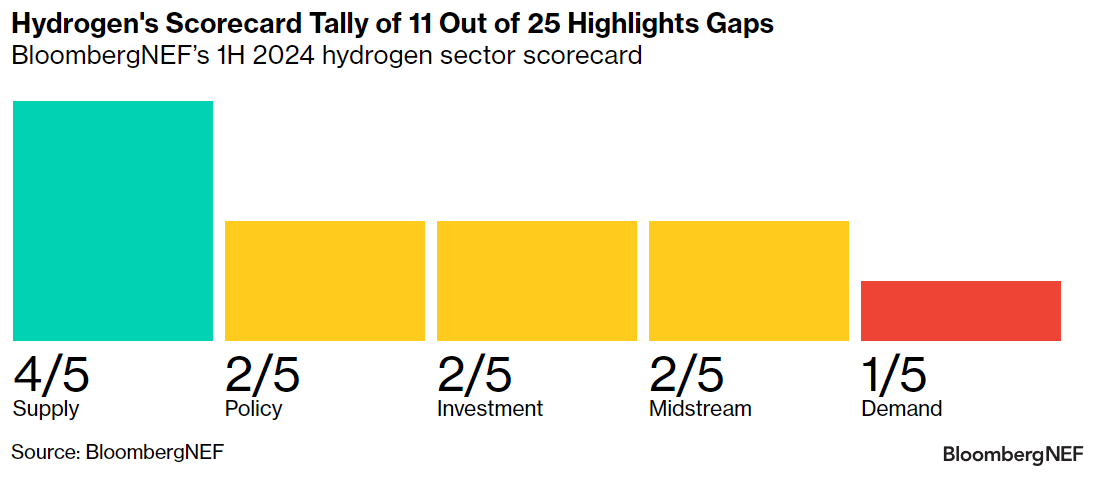

Clean hydrogen (H2) production could as much as triple in 2024 and rise 30-fold by 2030. That is impressive but a far cry from what most governments have envisioned in their strategies. Few producers have found a buyer, making final investment decisions elusive. More hydrogen midstream development is needed.

- Most governments are on course to miss policy targets. To meet them, governments would need stronger demand incentives, higher carbon prices and support for hydrogen midstream.

- Supply is rising. Electrolyzer shipments should grow 2-3 fold in 2024, with manufacturing in overcapacity. Clean H2 supply is set to rise 30-fold by 2030 – not fast enough to meet most policy goals.

- Demand remains low. Just 12% of clean H2 production capacity planned for commissioning by 2030 has identified an offtaker, up from 11% in October. Only a tenth of contracted volume is binding.

- Midstream is the missing middle. The first large salt caverns to store clean H2 are being built in the US and Europe, while Europe is developing H2 pipelines, but quantities are insufficient.

- Investment is low but growing. Only 5% of capacity announced to come online by 2030 has reached a final investment decision (FID). That is low, but more than the 3% in 2023 and 1% in 2022.

BNEF clients can access the full report here.