By Chelsea Jean-Michel, Wind, BloombergNEF

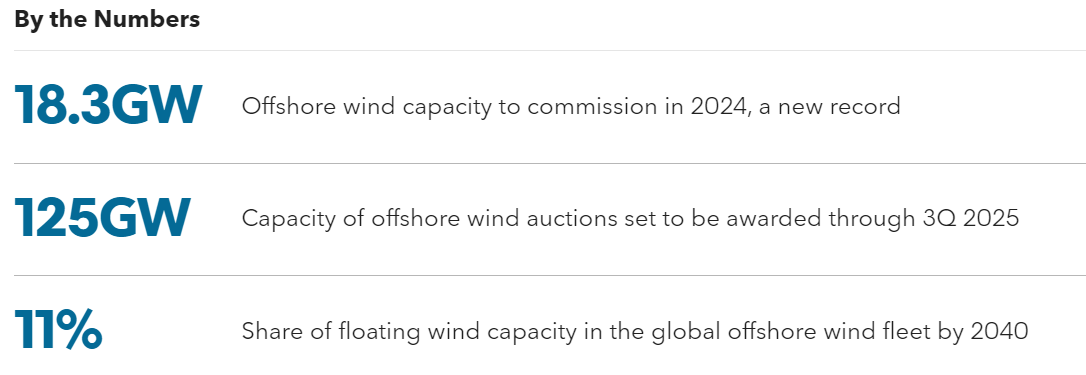

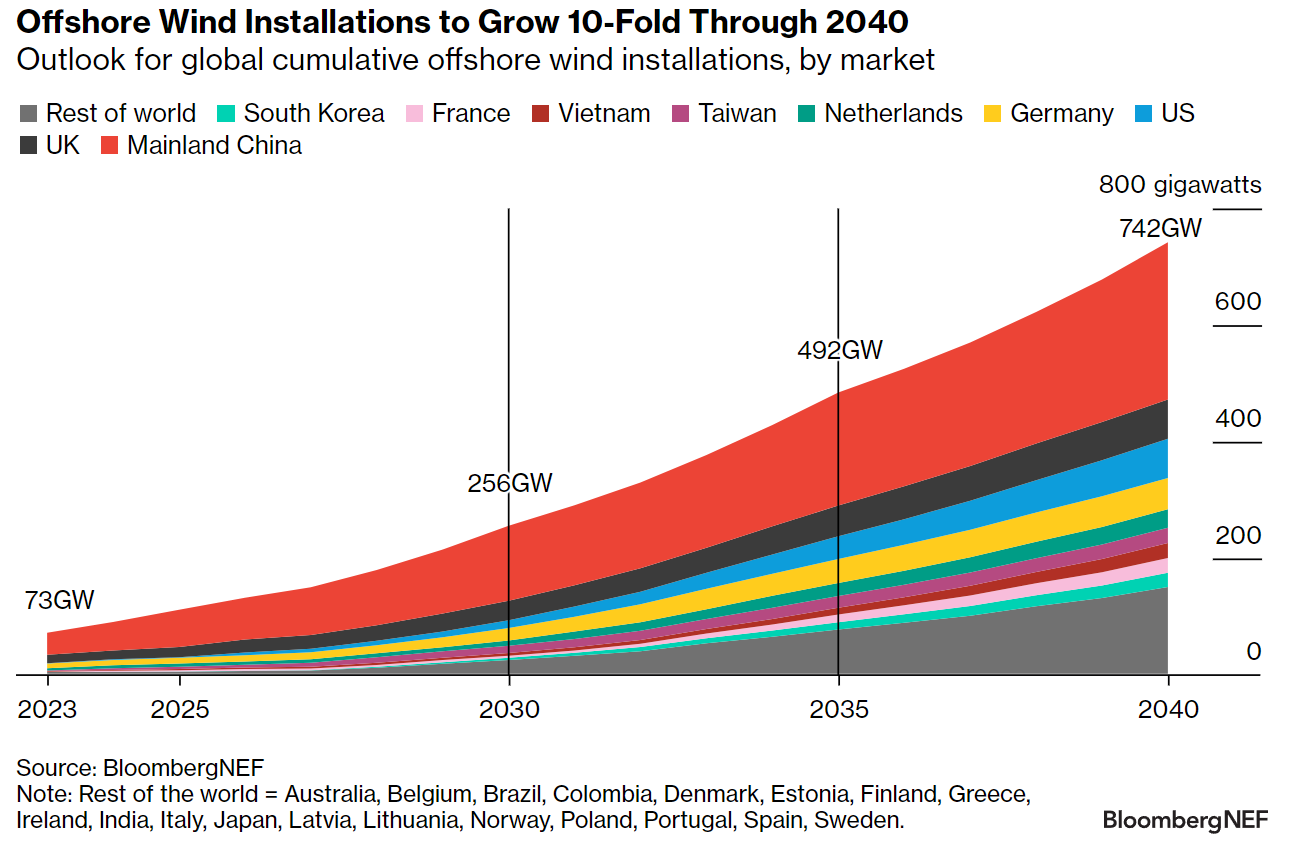

Offshore wind additions are set to hit a new high in 2024, as several newer markets including the US, France and Taiwan ramp up build. Recent cost inflation and supply chain constraints have led many developers to refocus portfolios and slow their entry into new markets. This has led to mixed results in recent auctions, despite some governments sweetening contract terms. Offshore wind auctions are set to boom, supporting a strong growth trajectory, and capacity is on track to rise 10-fold by 2040, reaching 742 gigawatts (GW).

- BNEF expects 18.3GW of offshore wind to achieve commercial operation in 2024, much of it in mainland China, Taiwan, the Netherlands and France. This is a rise from 10.7GW in 2023. Build is on track for 10-fold cumulative growth to 2040, the first time BNEF has extended its offshore wind forecast to this horizon. Mainland China, the UK and the US lead installations.

- While markets like France, Japan and South Korea awarded offshore wind contracts at record-low prices in the last six months, auctions in the US yielded more expensive projects. As much as 125GW of offshore wind seabed leases and contracts are set to be awarded through the end of 3Q 2025, driving build through the 2030s.

- After record financing activity last year, new-build deals have stalled so far in 2024. Acquisitions are on track to reach a new record this year, however, as the exchange of projects in earlier development stages boosts purchased capacity.

- Winning developers in France’s floating tender plan to use 24.5-megawatt machines, despite US and European manufacturers scaling back plans for larger turbines. GE’s abandonment of an 18GW model was a key factor in 4GW of US contract cancellations. Chinese players have continued to push outside their home market, securing orders in South Korea.

BNEF clients can access the full report here.