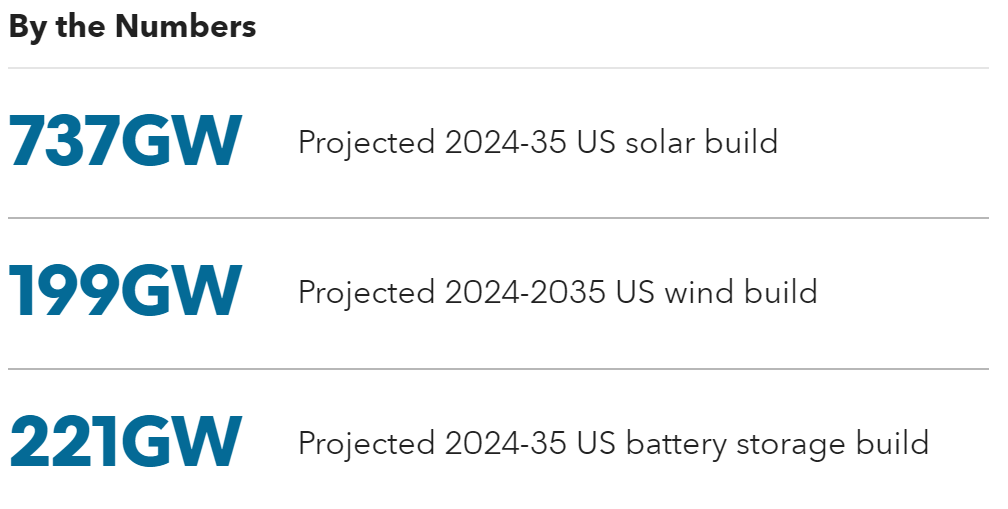

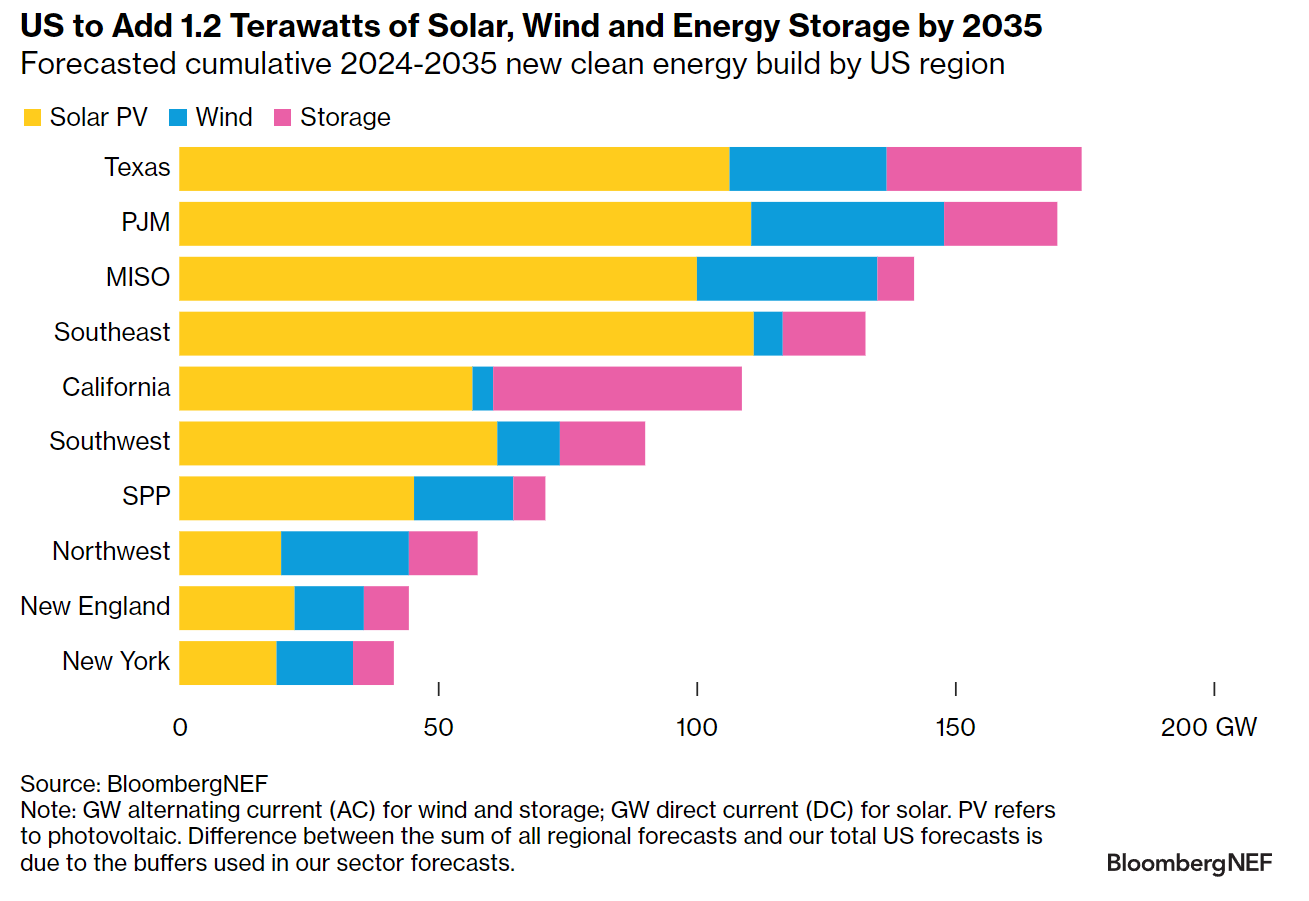

Almost 1 terawatt of new solar and wind capacity will connect to the US power grid between 2024 and 2035, BNEF forecasts. Even accounting for planned power plant retirements, this will drive an 80% increase in the nameplate power generation capacity of the US by 2035. The rise in renewables will be complemented by 221 gigawatts of battery storage between 2024 and 2035, as state-level targets lead to a flurry of utility integrated resource plans that include energy storage.

- About 2.7 times more solar than wind will come online from 2024-2035. Solar can be built cheaply in most of the US and the sector has been less hindered than wind by permitting and grid bottlenecks, supply chain constraints and high interest rates. Annual utility-scale solar build starts to fall before 2030 in Texas and California as these markets reach saturation, but this is more than offset by growth in other states.

- Both the timelines and cost of US wind and solar development are rising. Transformer and switchgear availability has become a particular chokepoint. Meanwhile, potential new import tariffs on solar cells from Southeast Asia and batteries from China may keep US equipment costs high even as global prices plummet due to oversupply.

- The rising penetration of intermittent wind and solar poses challenges to power markets and grid operators. Negative prices and curtailment of solar and wind output during hours of high production are already a feature of most big power markets and will have an increasing impact on project economics toward the end of this decade. Meanwhile, US grid operators are concerned about the potential for rising electricity demand from data centers and manufacturing, leading many to propose new gas power plants to maintain reliability.

- A major expansion of US grid infrastructure is needed to enable new supply and demand connections and to reduce congestion on power lines during hours of high wind and solar generation. Proposed federal reforms to increase interregional grid planning and establish centralized permitting of critical transmission are encouraging but will take time to implement.

BNEF clients can access the full report here.