By Jenny Chase, Solar, BloombergNEF

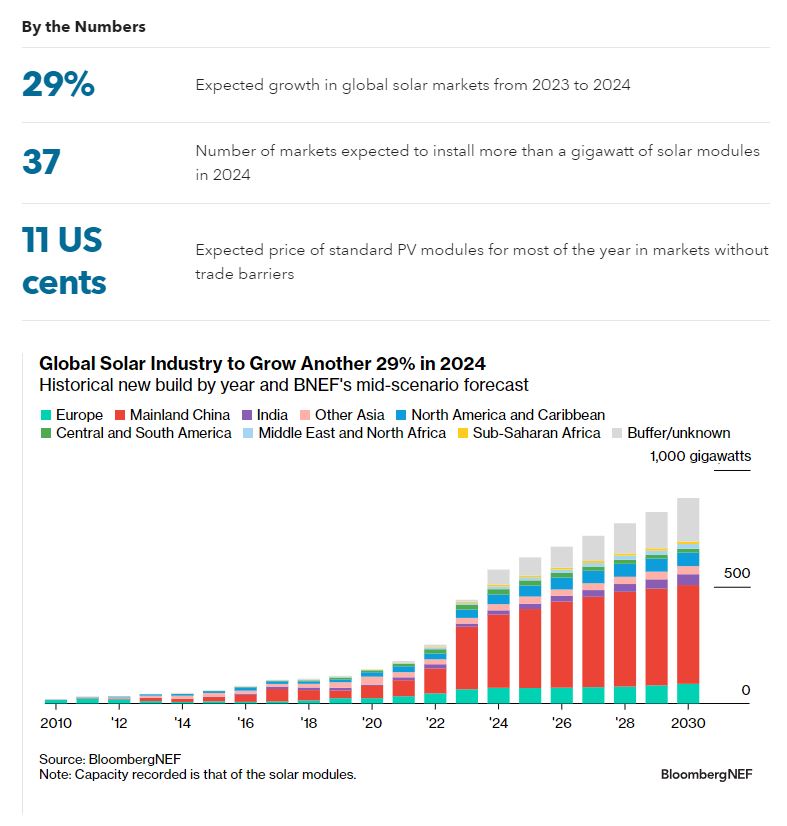

The photovoltaic industry added about 444 gigawatts of new capacity in 2023, a 76% growth on 2022 build. Prices of solar modules are at record lows, and supply of components is plentiful. End-user markets are booming while manufacturers struggle to make a profit. Installations this year will top 520GW.

- Yet again, forecasts for solar build have proven too conservative. China alone added 216.9GW(AC) or 268GW(DC) in 2023, 60% of the world market, and we do not expect it to fall. New markets are picking up around the world as well. We only see about 574GW(DC) of module build in 2024, mainly limited by local factors such as access to grid, land and labor.

- Enough polysilicon could be produced by major suppliers to make 1.1 terawatts of modules this year. Some polysilicon makers have already halted production on low prices; others are likely to follow.

- We have tightened the criteria for tier 1 manufacturers and hence the tier 1 lists have been shortened, but there is still enough module assembly capacity belonging to the tier 1 players to make 783GW of modules per year.

- Governments continue to plan to support local manufacturers and build local solar industries, but the intense cost pressure will make companies wary of investing unless incentives are extremely generous. Many announced plans for factories in Europe, the US and other countries will be canceled.

BNEF clients can access the full report here.