Sustainable aviation fuels (SAFs) are one of few low-carbon technologies with the potential to help decarbonize the aviation sector and are the only feasible option in the near term.

For the nascent SAF industry, 2022 has been a pivotal year as growth in the market picks up pace. Key policies to boost adoption are progressing through their respective legislatures. The number of forward purchase agreements have surged as airlines demonstrate their commitment to the clean fuel, and new projects boost anticipated production capacity.

But hurdles remain, namely scarcity of supply, competition with renewable diesel for resources and lack of technological diversification. If unaddressed, these will lead to substantial bottlenecks and could cause the aviation industry to fall short of its ambitious goals. This research note presents the key themes shaping the sector and its outlook to 2030.

- Thirty-eight of the world’s top airlines have committed to net-zero emissions, either by 2050 or earlier. Furthermore, almost 30 have set some form of SAF adoption target, like 10% of fuel consumption by 2030. While the US and Europe continue to lead the market, other nations are beginning to set out policies, roadmaps and targets to support domestic SAF adoption, including Canada, China and Japan.

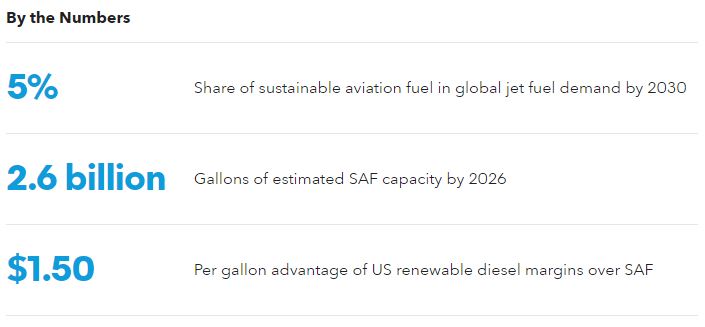

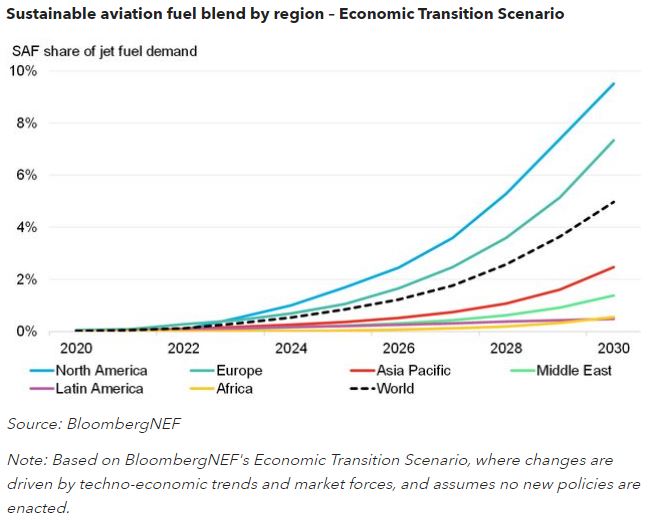

- Demand for SAF will reach 7 billion gallons, or 5% of global jet fuel demand by 2030 in BloombergNEF’s Economic Transition Scenario, where changes are driven by techno-economic trends and market forces, and assumes no new policies are enacted. In BNEF’s Accelerated Policy Scenario, demand reaches 10.6 billion gallons, or 7.5% of jet fuel use.

- Despite growing interest and targets from the aviation industry, SAF supply remains scarce and highly concentrated among a few producers. A multitude of projects to bring new capacity online are planned for the next five years.

- If all come to fruition, SAF capacity could exceed 2.5 billion gallons by 2026. If these plants maximize their SAF yields instead of renewable diesel, this figure could reach 4 billion gallons. Finally, if all planned renewable diesel projects were adapted to maximize SAF production instead, annual capacity could reach 7.6 billion gallons.