The Levelized Cost of Electricity (LCOE) analysis is our assessment of the cost competitiveness of different power-generating and energy storage technologies across the world. BNEF has been analyzing these technologies since 2009, based on our project financings database and our study of the cost dynamics in different sectors.

Global supply chain pressures have started to ease and key commodity prices are cooling off after a tumultuous 18 months. However, the inflationary effects are still catching up with renewables projects financed in 2H 2022 and some key commodities remain stubbornly high. In addition, new macroeconomic challenges have emerged. Inflation is at multi-decade highs and central bank interest rate rises are hitting capital-intensive renewables and storage projects hard. A strong US dollar has further weakened the purchasing power of equipment importers, leading to cost rises in several markets.

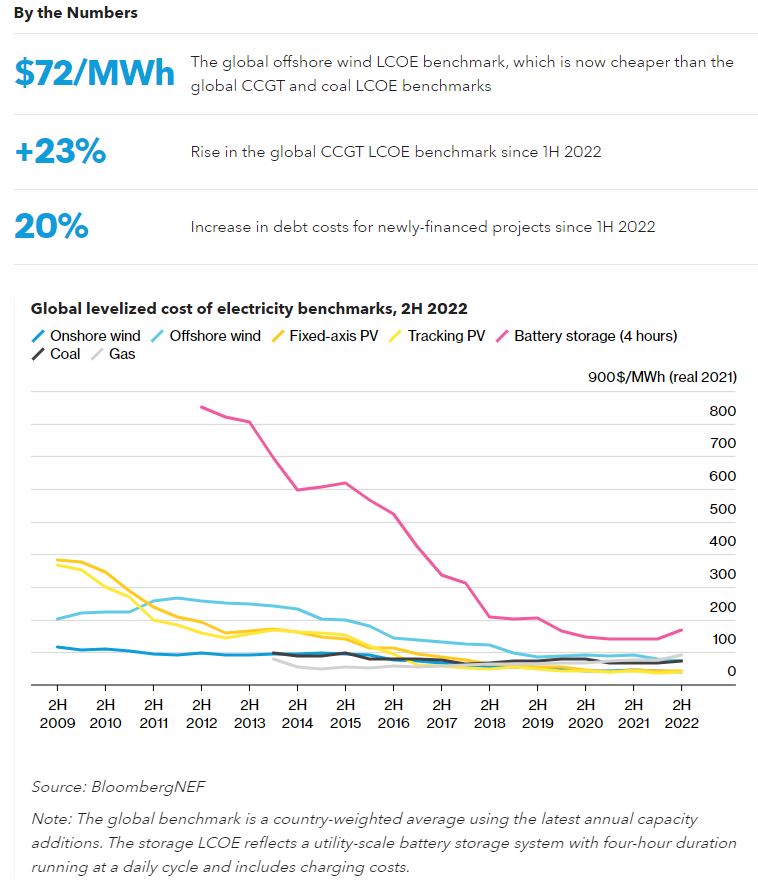

- Higher fuel and carbon prices, elevated material prices and higher debt costs have pushed up LCOEs for coal, gas and standalone battery storage projects.

- The global offshore wind benchmark is now $3/MWh below that of coal and $18/MWh below that of gas. This is the first time that the benchmark undercuts fossil fuels in our analysis.

- High commodity prices continue to make coal and gas projects more expensive. At $93/MWh globally, our benchmark gas LCOE is now more than double solar and onshore wind. BNEF expects fossil fuel prices to remain high in the short- to mid-term.

- Central bank rate hikes in 2H 2022 have increased debt cost by 20%, compared to 1H. Rising debt costs affect renewables more than fossil fuel plants due to the higher upfront investment needs.

- A strong dollar has weakened the purchasing power of developers who rely on equipment imports and increased capex. In the case of Turkey, this has increased the capex for solar equipment by up to 40%.