By Helen Kou, Energy Storage, BloombergNEF

Three years into the decade of energy storage, deployments are on track to hit 42GW/99GWh, up 34% in gigawatt hours from our previous forecast. China is solidifying its position as the largest energy storage market in the world for the rest of the decade. Government investments and policies are starting to bear fruit as project pipelines grow larger due to new capacity auctions and utility proposals. Yet, there are still uncertainties within the market. The case for long-duration energy storage remains unclear despite a flurry of new project announcements across the US and China.

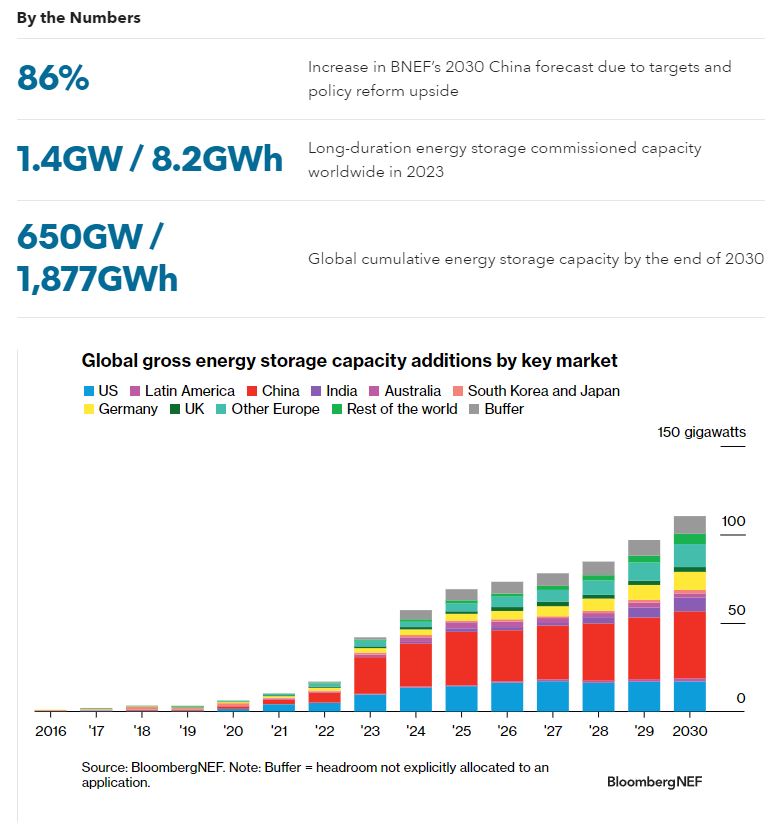

- Global energy storage’s record additions in 2023 will be followed by a 27% compound annual growth rate to 2030, with annual additions reaching 110GW/372GWh, or 2.6 times expected 2023 gigawatt installations.

- Targets and subsidies are translating into project development and power market reforms that favor energy storage. Our increase in deployments is driven by a wave of new projects prompted by energy shifting needs. Markets are increasingly seeking energy storage for capacity services (including through capacity markets). Japan, Poland, the UK, Chile, the US Southwest, New York and Australia are new markets opening up these opportunities.

- On the technology front, lithium-ion batteries using nickel manganese cobalt (NMC) chemistries are losing market share due to their relatively higher cost when compared to lithium iron phosphate (LFP) batteries. Beyond lithium-ion batteries, alternative technologies focused primarily on long-duration energy storage (LDES) needs remain limited, with 1.4GW/8.2GWh of commissioned capacity worldwide. The Asia Pacific (APAC) region has accounted for 85% of new installations since 2020.

- Asia Pacific (APAC) maintains its lead in build on a gigawatt basis, representing almost half (47%) of the additions in 2030. China leads largely due to top-down compulsory requirements to pair storage with utility-scale wind and solar. Other markets have also set new policies to promote storage. South Korea will hold an auction for storage to reduce renewable curtailment and published a new policy to revive its commercial storage sector. Australia and Japan are both executing new capacity auctions for clean firm capacity which benefit energy storage installation by providing long-term capacity payments. India’s new ancillary service product may provide opportunities for stationary storage in wholesale markets. We increased our cumulative deployment for APAC by 36% in gigawatt terms to 317GW/885GWh in 2030, largely due to China’s forecast outlook and methodology updates.

- Europe, Middle East and Africa (EMEA) represents 24% of annual energy storage deployments on a gigawatt basis by 2030. The region added 4.5GW/7.1GWh in 2022, with residential battery installations in Germany and Italy outpacing our previous expectations. Residential batteries are now the largest source of storage demand in the region and will remain so until 2025. Separately, over €1 billion ($1.1 billion) of subsidies have been allocated to storage projects in 2023, supporting a fresh pipeline of projects in Greece, Romania, Spain, Croatia, Finland and Lithuania. EMEA is expected to reach 114GW/285GWh cumulatively by the end of 2030, a 10-fold growth in gigawatt terms, with the UK, Germany, Italy, Greece, and Turkey leading additions.

- Americas lags behind the other regions, representing 18% of gigawatts deployed in 2030. The geographical spread and broadening scope in activity across the US indicates it has become a mainstream resource for various US utilities’ decarbonization strategy. Projects delayed due to higher-than-expected storage costs are finally coming online in California and the Southwest. Market reforms in Chile’s capacity market could pave the way for larger energy storage additions in Latin America’s nascent energy storage market.

- We added 9% of energy storage capacity (in GW terms) by 2030 globally as a buffer. The buffer addresses uncertainties, such as markets where we lack visibility and where more ambitious policies may develop that we haven’t predicted. We revised our buffer calculation methodology in this market outlook. In this iteration, we based the buffer on battery shipment analysis, where we identified gaps in historical and near-term battery demand and applied that forward. Based on our analysis, we added a buffer of 485MW/1.9 GWh in 2022 and 1.9GW/5.1GWh in 2023. We added a 10% buffer each year from 2024 to 2030. Historically, our buffer was based on previous outlook forecast accuracy.

- (Chart above corrected to present latest data on October 4, 2023.)

BNEF clients can access the full report here.