The need for deep decarbonization is accelerating the development of clean hydrogen (H2). Governments have promised more than $300 billion of funding. Electrolyzer shipments have been doubling every year since 2020 and the trend will continue into 2024. The main pain point is demand. Producers need buyers. To raise H2 demand, more incentives – both carrots and sticks – will be needed.

- Public money available for clean H2 has climbed to $308 billion, led by the US and Europe. But most funding programs support clean hydrogen producers rather than users, which will need to change if governments are to meet their hydrogen demand targets.

- Governments are starting to incentivize H2 uptake, but more will be needed. The EU has set quotas for the use of renewable H2 in industry and transport. Germany is launching carbon contracts for difference and plans building power plants burning H2 or derived fuels. The US has announced a $1 billion plan to support clean H2 demand.

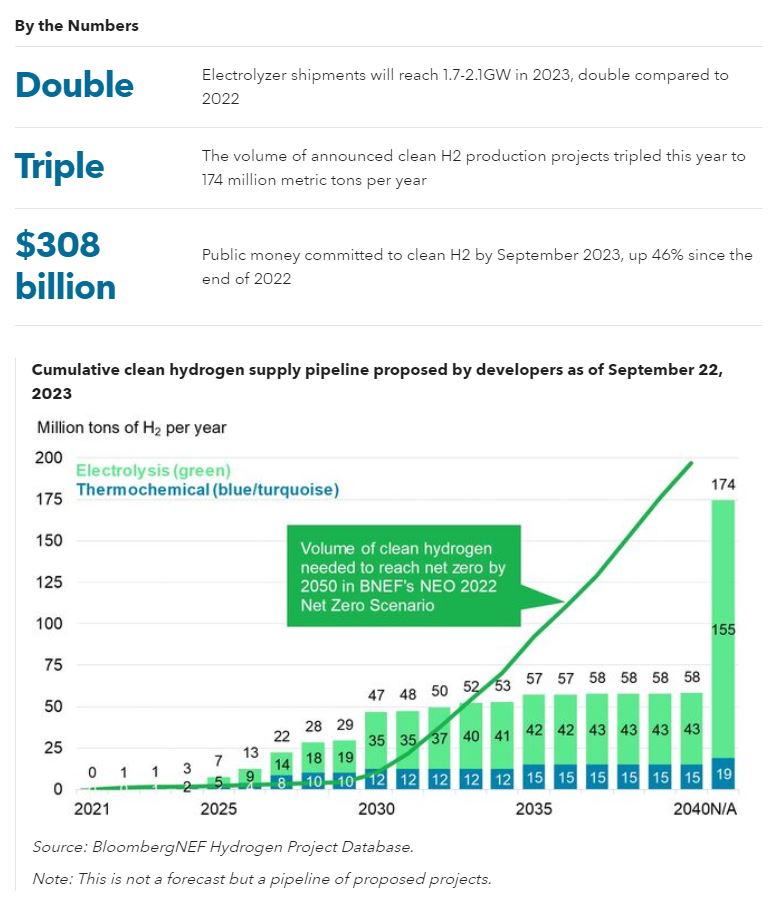

- The pipeline of proposed clean H2 projects has more than tripled since January to 174 million metric tons per year, close to the volume needed by 2040 in BNEF’s net-zero scenario at 197 million metric tons.

- Green H2 projects are being built at an exponential rate. Equipment suppliers could ship 1.7-2.1GW of electrolyzers in 2023, twice as much as in 2022. Blue H2 projects are taking longer to develop due to their larger size and technological complexity.

- The announced supply of clean H2 far exceeds demand, but pockets of demand are emerging in oil refining, steel making and maritime transport in Europe, where incentives to adopt cleaner technologies have been strongest.

- Almost 10,000 km of H2 pipelines have been proposed, 1% the length of global natural gas transmission pipelines. Around 80% are in Europe and some are starting construction.

BNEF clients can access the full report here.