By Jenny Chase, Lead Analyst, Solar, BloombergNEF

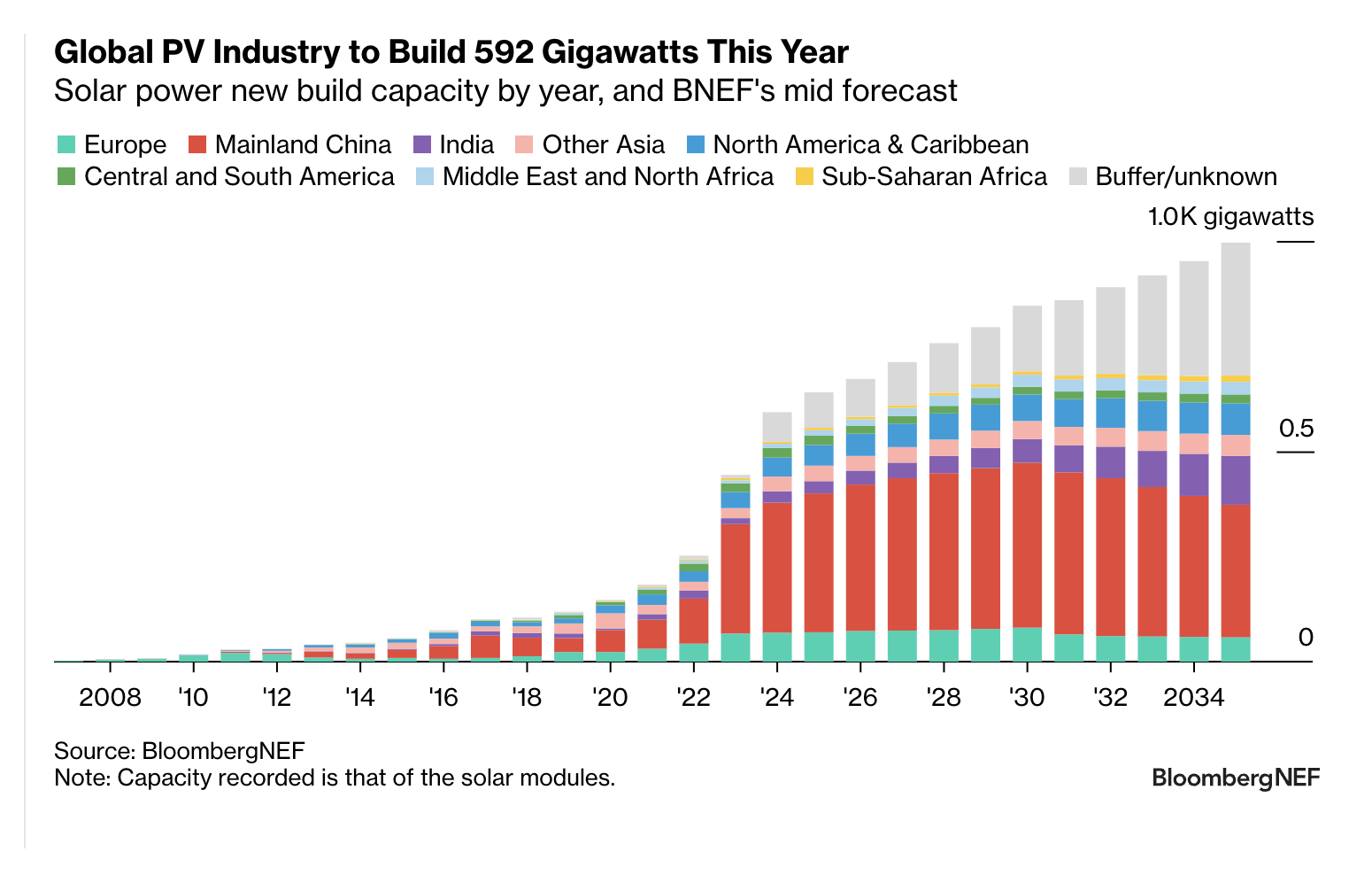

The global PV industry is expected to install 592 gigawatts of modules this year, up 33% from the boom year of 2023. Low prices for modules are stimulating demand in new markets, but hurting manufacturers, who are competing intensely to maintain market share.

- The global PV build forecast is up 1% quarter-on-quarter, largely due to developments in India and Pakistan, with installations slower than previously expected in Japan and South Africa. Most of the established solar markets continue to build steadily.

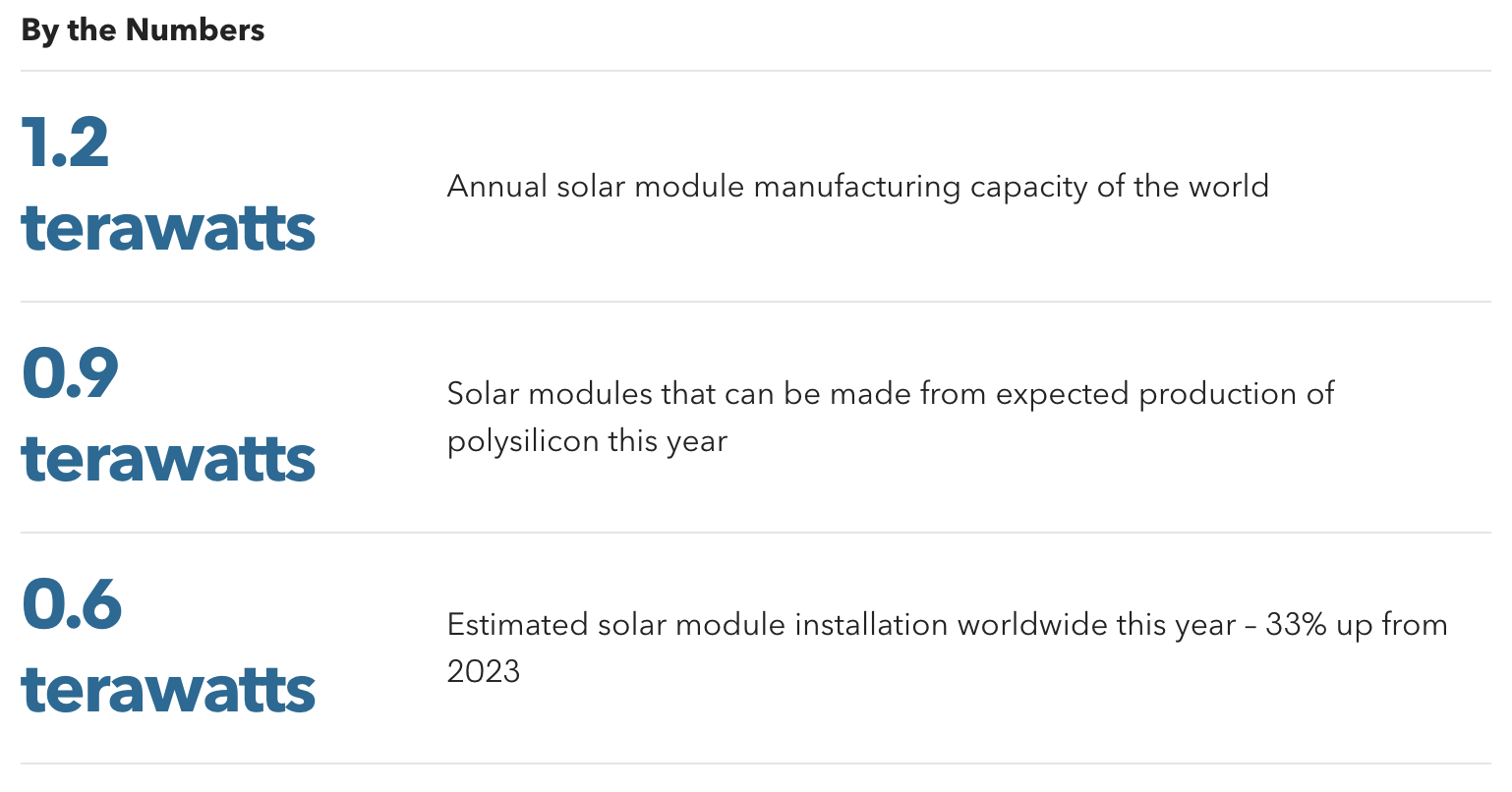

- Polysilicon prices have fallen to $4.7/kg. That is below production cost for nearly all manufacturers. Firms are shutting down factories for maintenance, and we have reduced our estimate of 2024 polysilicon production to 1.96 million metric tons – still enough to make 900GW of modules.

- Module prices have dipped to $0.096 per Watt, the lowest level ever, while polysilicon at $4.7 per kilogram is below production cost. Most solar manufacturers are expected to report losses this year, their convertible bonds are showing signs of weakness, and some will not survive this cycle.

BNEF clients can access the full report here.