By Sunny Park, BloombergNEF

Climate change wasn’t the only thing top of mind at New York Climate Week. Nature was also on the agenda, with the Taskforce on Nature-related Financial Disclosures unveiling its final recommendations for corporate disclosure.

Economic activity cannot be decoupled from nature. Some 55% of global GDP – equivalent to roughly $58 trillion – is moderately or highly dependent on nature, according to research from PwC, though it is also correct to say that all economic activity depends on nature to some extent.

Studies show that companies are systematically underestimating their nature-related risk, as reflected in the recent finding of environmental disclosure platform CDP that only 20% of financial institutions measure exposure to nature-related risk. This is far behind the 85% that calculate potential vulnerability to climate impacts.

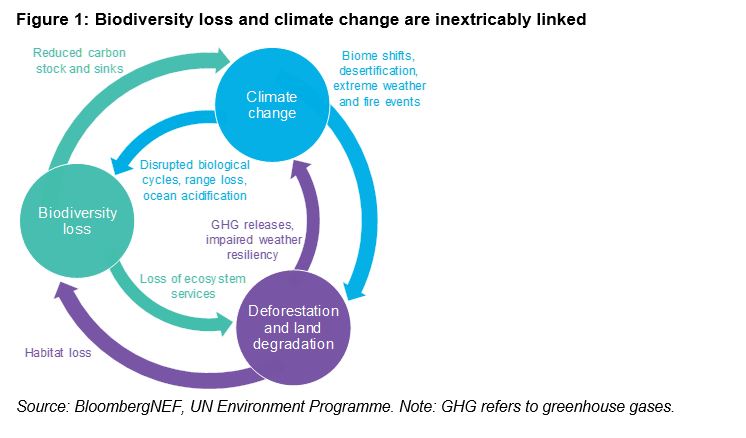

This exposes commercial vulnerabilities given the inextricable link between the climate and nature crises. Climate change is disrupting the biological cycles and diversity of plants and animals, and cannot be averted without addressing deforestation. Biodiversity loss, meanwhile, threatens the ecosystem services that underpin the economy.

Take Spain, for example, the world’s second-largest producer of almonds. Recent mild winters and warm springs have put the biological cycles of almond trees and pollinators out of sync, such that the trees are flowering before the bees reappear for the season. Without cross-pollination, the almond tree won’t produce fruit that year.

All sectors depend on nature and biodiversity to varying degrees. The three most reliant – the construction, agriculture, and food and beverage industries – generate nearly $8 trillion in combined value, according to the World Economic Forum.

Many other sectors are less obviously dependent on nature, including power and water utilities, miners and metal refiners, and consumer goods companies. Their reliance can stem from the direct extraction of natural capital to climate protection, flood and storm protection, and pest control provided by nature – among other things.

Many supposed climate solutions also have unintended negative impacts on biodiversity. A recent study published in the journal Proceedings of the Royal Society B has linked booming electric vehicle sales to declining populations of two threatened flamingo species in Chile. The concentrated salt brine ponds used to extract lithium can kill the aquatic organisms that flamingos eat, such as shrimp and algae. Without this food source, the flamingos can starve, migrate elsewhere, and are less likely to reproduce.

Initiatives are emerging that encourage companies to manage the economic and commercial risks and opportunities that result from interactions with nature. Prominent among these initiatives is the Taskforce on Nature-related Financial Disclosures, or TNFD. It is the sister initiative of the Taskforce on Climate-related Financial Disclosures, better known as TCFD, which was the catalyst for companies to disclose and report their climate impacts.

A nature-related disclosure framework

Formed in 2021, the TNFD is a market-led initiative responding to the growing need to factor nature into financial and business decisions, ultimately supporting a shift of financial flows away from harmful practices. It consists of 40 individual Taskforce members drawn from corporates, financial institutions and market service providers, who together control over $20 trillion in assets.

Over the past two years, the TNFD has iterated and refined a voluntary framework for corporates and financial institutions to disclose and report their dependencies and impacts on nature. The completed framework was officially released on September 18, 2023.

The core of the TNFD’s recommendations is a four-pillar approach to disclosure, requiring companies to report how they consider nature-related risks and opportunities in their governance, strategy, risk and impact management, along with any metrics and targets that have been established. This applies to businesses of all sizes and across all sectors.

An additional component, entitled the “LEAP” approach, is an integrated assessment process for nature-related risk and opportunity management:

-

Locate

your interface with nature.

-

Evaluate

your dependencies and impacts on nature.

-

Assess

your nature-related risks and opportunities.

-

Prepare

to respond to nature-related risks and opportunities and to report on your material nature-related issues.

This guides companies in conducting thorough checks to identify and evaluate how nature-related factors affect them, including risks and opportunities. Firms do not have to report their findings under this approach to be considered compliant.

Public and private support growing rapidly

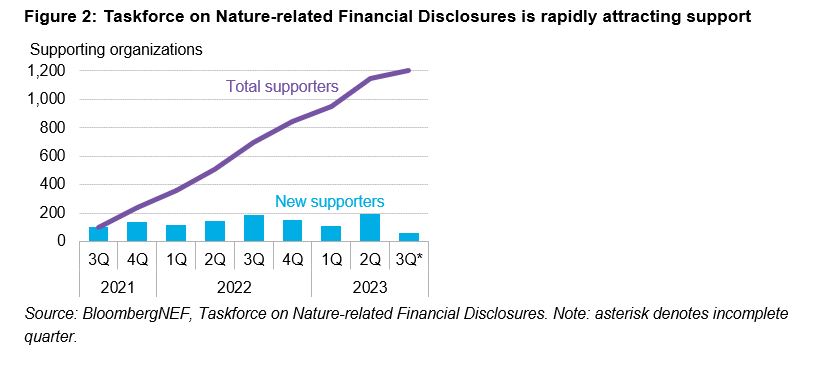

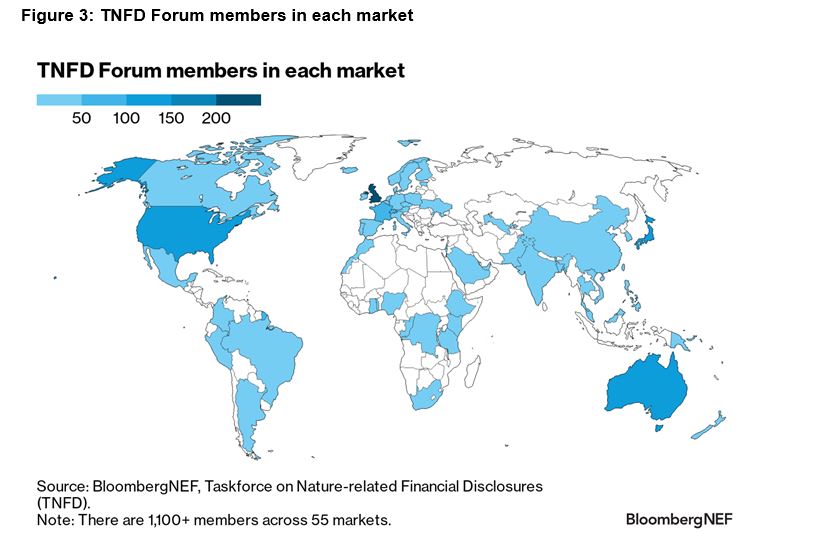

More than 1,200 businesses have joined the TNFD Forum in support of the initiative. It has also been endorsed by the G-7, G-20 and a wide range of international organizations including the Network for Greening the Financial System (a group of central banks).

Since the TNFD was created in late 2021, support has risen at almost twice the pace that TCFD scaled over its development period. BloombergNEF expects a further uptick in the quarter following the release of the completed framework.

The rapid growth in membership reflects both rising awareness of the importance of nature, and a recognition that participation in voluntary initiatives puts businesses in a stronger position to manage the regulatory intervention that is likely to follow.

Another framework in a crowded landscape

The TNFD is one of many financial and non-financial reporting frameworks, including CDP, TCFD, the Global Reporting Initiative (GRI), and the International Sustainability Standards Board (ISSB) – each of which provides guidance and standards for companies looking to disclose their impact on climate and nature.

These frameworks are dynamic, sometimes competing and sometimes complementary. The TCFD has been absorbed back into the ISSB as part of the International Financial Reporting Standards’ all-encompassing “S2” guidance. The TNFD will progress over the next two years: attracting more support, and refining and updating its guidance based on feedback until eventual integration into the ISSB as a means to inform regulated nature-related disclosure. Indeed, the TNFD guidelines were designed with this end point in mind.

The TNFD guidelines are anticipated to become a standard part of many companies’ disclosure practices and decision-making processes. According to sample responses gathered by TNFD in the summer of 2023, a significant majority of Forum members, averaging 75%, plan to begin disclosing using 2024 data by the financial year 2025. Furthermore, several markets are already exploring the inclusion of TNFD guidance in their reporting regulations and offering support. As a result, BNEF expects sector-specific guidance to continue to evolve as more companies actively use this framework for reporting.

Complex and burdensome disclosure

The complexity of measuring and quantifying nature creates a hurdle for firms looking to report and disclose. Unlike climate reporting – which is based around a universal metric for emissions, carbon dioxide equivalent – nature is inherently multifaceted, requiring the consideration of different biomes, species, natural resources and human rights, and the interplay between each.

The Taskforce endeavored to strike a balance between academic rigor – which encompassed numerous intricate biodiversity indicators – and businesses’ preference for a limited set of simple metrics. Its flexible approach allows disclosing firms to select metrics appropriate for their sector and location, but in doing so has drawn criticism from both sides of the debate.

Disparate metrics and publication channels will pose a challenge for standardization, potentially making comparison between companies difficult – to the detriment of investors, regulators and the disclosing companies.

Those inconsistencies provide ammunition for parties warning of disclosure fatigue, given many companies will likely struggle to find the time and resources to understand and implement another acronymic framework. Similar claims were made as the TCFD gained prominence, though it became plain that the costs of inaction outweigh those of disclosure.

Voluntary nature reporting to probe business relationships

As with climate, understanding the risks and potential opportunities of an organization’s dependencies and impacts on nature is a stepping stone to taking action.

Businesses operating in highly nature-exposed sectors are part of complex value chains, with a myriad of nature touch points inherited from their suppliers and customers. In addition to helping companies understand their direct dependency on nature, reporting will place greater focus on supply chain traceability.

For example, nature reporting will empower corporations, investors and lenders growing wary of their supply chain and portfolio exposure to deforestation. More forward-looking institutions are also considering the transitional and physical nature risks inherited from partners exposed to biodiversity damage caused by pesticides and over-exploitation of water resources, and within high conservation value areas.

However, few firms have set rules and targets to manage nature risks. Only 5% of Fortune Global 500 companies have set quantified targets on nature, according to McKinsey, compared to 83% for climate. The TNFD reporting framework promises to remove the opacity that has supported inaction.

TNFD co-chair David Craig will be speaking at the BNEF Summit London, which be held on October 10-11, 2023. For more analysis of developments across climate and nature-related financial disclosure, BNEF clients can read:

TNFD: Nature-Related Reporting Following Climate Cousin