By Kyle Harrison, Head of Sustainability Research, BloombergNEF

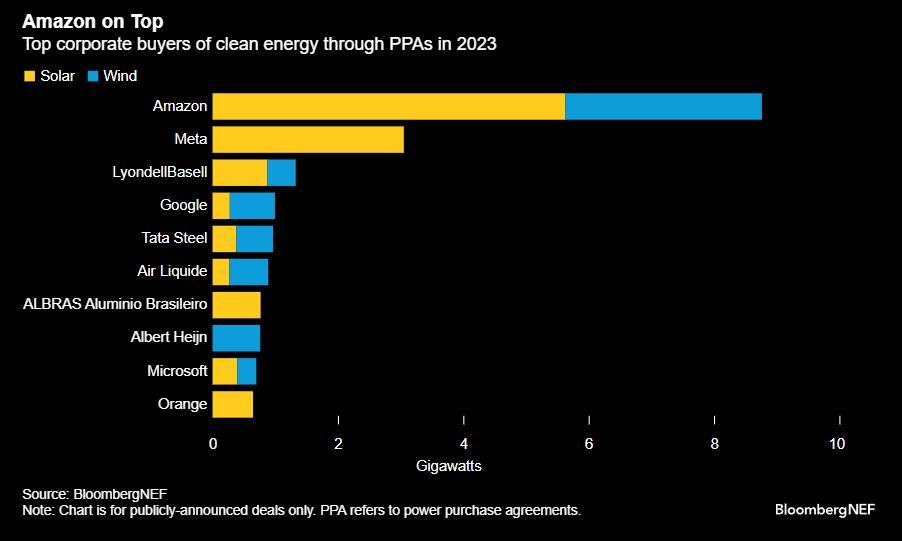

Corporations ratcheting up their consumption of green power led to a record number of purchase deals in 2023. Tech giant Amazon took the top slot, buying more solar and wind power than the next three companies combined. This market is well-positioned for more growth with improving economics in key regions.

Amazon announced 74 individual power purchase agreements or PPAs across 16 different markets in 2023, totaling 8.8 gigawatts of capacity. Over 60% of these deals were for buying solar power, while the rest were for wind. The banner year brings Amazon’s announced corporate PPA portfolio to 33.6GW. This is the eighth largest clean energy portfolio globally, just behind NextEra at 34.6GW, though Amazon doesn’t own its projects.

Trailing Amazon in 2023 was Meta, that announced 3GW of PPAs, followed by LyondellBasell Industries at 1.3GW and Google at 1GW. Notable newcomers to the top buyers list in 2023 included Tata Steel and supermarket chain Albert Heijn.

In total, over 200 corporations announced PPAs in 2023, showcasing the popularity of clean energy buying as a decarbonization tool for the private sector. These PPAs were signed with over 150 project developers, who are the counterparties on deals. None were more active than Engie, that publicly revealed 2.4GW of deals — the most for any developer. The company sealed 34 individual deals across six different markets, 61% of which were for solar power and the remaining for wind. Being part of a larger utility business with a power trading arm allows Engie to structure customized clean power deals with corporate buyers, which gives it an advantage over many developers.

The next largest sellers to corporations were AES (1.9GW), Tata Power (1.2GW) and Lightsource BP (1GW), with AES also announcing nearly 1.1GW of transacted storage capacity in 2023, which doesn’t factor into these rankings.

Another record

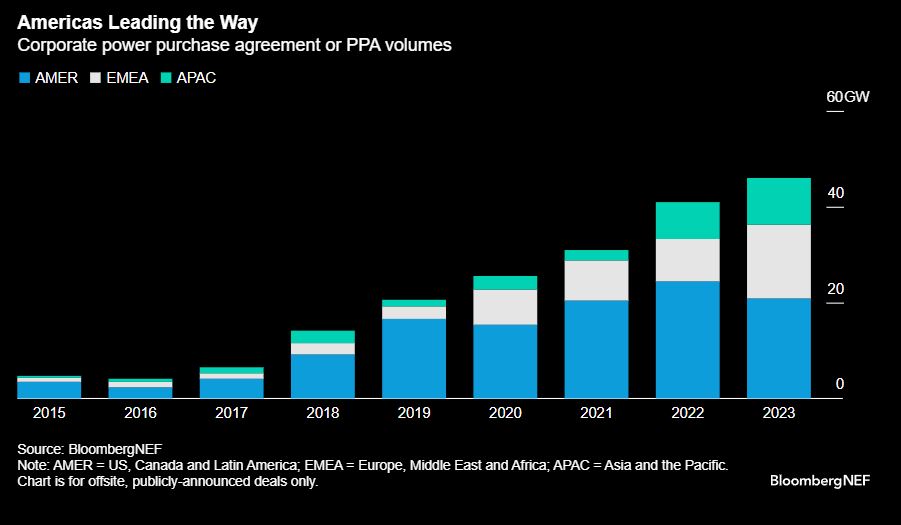

The deals from Amazon and others brought the annual corporate PPA total to a record 46GW in 2023. This is up from 41GW in 2022 and is the seventh consecutive year of growth in the corporate PPA market.

Companies have signed nearly 200GW of corporate PPAs in total since 2008, which is greater than the power generation fleets of countries like France, the UK and South Korea.

The Americas remained the largest region for activity in 2023, again, with almost 21GW of deals announced, most of which (17.3GW) came from the US. The region includes Canada and Latin America.

The Europe, Middle East and Africa (EMEA) region was the second largest, with deals announced up 74%. Elevated power prices in the area meant that companies could save money by locking in comparatively cheaper clean energy deals in key markets like Spain and Germany.

The Asia Pacific (APAC) region also saw record activity, with 9.7GW of deals announced. While this is small relative to the Americas and EMEA, APAC has seen a flurry of supportive policy developments in key markets like Japan, South Korea and China. All these have made it easier for corporations to buy clean energy, positioning the zone well for more growth.

Green commitments boost

The biggest indicators of future growth are clean energy targets set by corporations. Over 450 companies have joined the RE100 Initiative, pledging to fully offset their electricity consumption with clean power deals. BloombergNEF estimates these companies have purchased enough clean energy — at 256 terawatt hours — to offset 50% of their electricity consumption. They will need to purchase an additional 301TWh in 2030 to meet or maintain their RE100 goals, meaning they must double their activity from current levels. If this 301TWh shortfall is fulfilled entirely through PPAs, it could drive an additional 105GW of solar and wind build. This paints a bullish outlook for corporate PPA volumes for the next few years.

More attractive policies for clean energy buying being rolled out globally will enable a bigger jump, as will the falling costs for clean energy projects. Increasingly volatile energy markets will also drive more activity, as buyers can hedge against this volatility with a long-term PPA.