By Vandana Gombar, Senior Editor, BloombergNEF

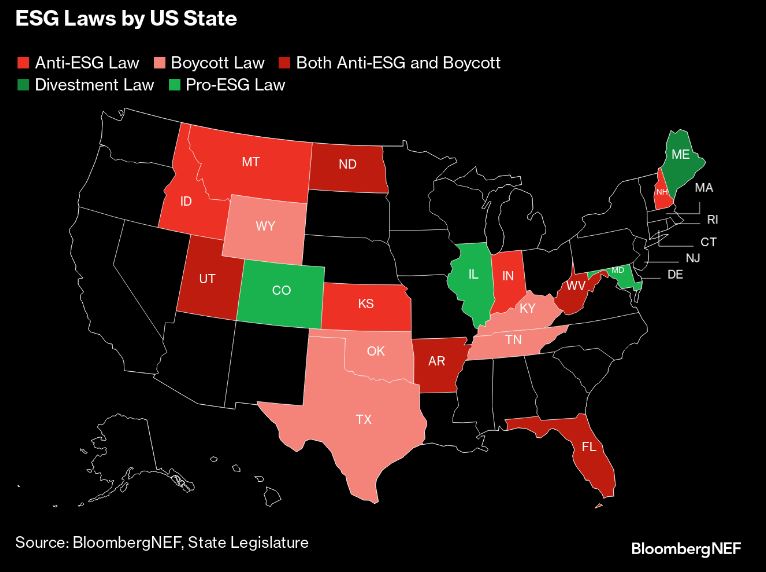

Investing while keeping in mind environmental, social and governance factors is becoming increasingly challenging in the US, with as many as 15 states enacting anti-ESG laws and over a dozen planning similar moves.

California is the only state planning pro-ESG legislation for now and would join the four others that currently have laws in place that favor ESG-weighted investing.

“Things can get very tricky for global financial institutions active in these states, and for the states pursuing an anti-ESG agenda,” said Jameson McLennan, BloombergNEF’s US sustainable finance analyst. “The costs of these actions are just starting to become evident.”

Oklahoma released its initial list of 13 financial institutions that it has determined boycott oil and gas companies and “may be excluded from doing business with the state” last month. BlackRock, Wells Fargo, JPMorgan Chase and Bank of America were among those named.

Emily Piech, a spokesperson for JPMorgan, described the Treasurer’s decision to include the bank on the list as “baseless” in an emailed statement to Bloomberg News. “[A]s the nation’s largest bank, we are among the top financers across the energy sector, including traditional energy sources.”

Bank of America spokesperson Bill Halldin said the firm looks forward “to continued discussion with the Oklahoma Treasurer about the many ways we serve clients and communities in Oklahoma, including in the energy sector.”

The office of Texas Comptroller Glenn Hegar maintains a similar list to neighboring Oklahoma. HSBC was added in March, with Hegar asserting at the time that the bank’s policies “threaten Texas jobs, our state economy and our national security.”

HSBC contends that it doesn’t boycott the oil and gas industry and “seeks a balanced approach in the implementation of its net zero commitment, with the primary aim being to support our customers in the transition from a high-carbon to a low-carbon economy,” Matt Ward, head of communications for HSBC USA, said in an emailed comment to Bloomberg News at the time.

Others on Texas’ blacklist include BlackRock, UBS Group and BNP Paribas.

Pro- and anti-ESG groups floated competing shareholder proposals at a BlackRock shareholder meeting last week. Both failed, but provided a glimpse of how things could evolve as the battle between the two sides heats up.

“Some of these states could see the cost of funds rise,” said McLennan. “Additionally, financial institutions could face legal risks if they continue to to utilize ESG factors.”

UBS agreed to pay a Texas school district $850,000 earlier this month after the bank was dropped from underwriting a bond sale. The settlement reflects the costs for the Normangee Independent School District to redo the sale without UBS.

The increased scrutiny of ESG isn’t just a US issue. Across the Atlantic, the European Commission is planning to regulate companies providing ESG ratings, according to a draft proposal seen by Bloomberg News.