By Yuchen Tang and Julia Attwood, Sustainable Materials, BloombergNEF

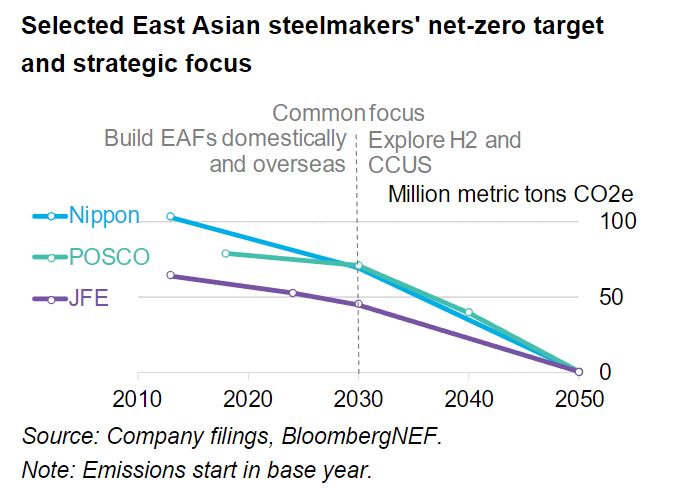

The largest steelmakers in Japan and Korea are aligned on reaching net zero by 2050, but they are plotting very different courses to get there.

Japan’s Nippon Steel and JFE Steel, along with South Korea’s POSCO, are East Asian steelmaking leaders with similar production sizes and structures. They have comparable starting points and face the same resource constraints. But while Nippon and JFE still see a role for blast furnaces in 2050, POSCO is all in on hydrogen (H2).

Split by H2, united by EAF

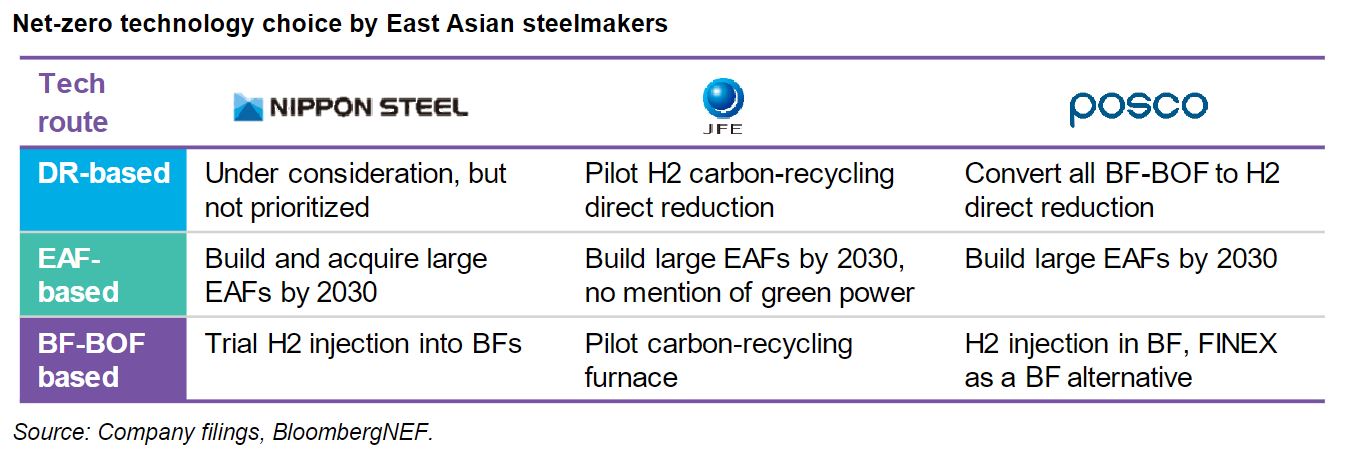

The three steel giants are split on how big of a role hydrogen will play in the long run, but share a common focus on ramping up electric arc furnaces (EAF) by 2030.

Since 2013, the Japanese companies have been refining technologies based on blast furnaces (BF), hoping to extend a lifeline to coal–reliant fleets and make use of their deep expertise with this complex equipment. However, recent moves show diversification into hydrogen may be underway.

South Korea’s POSCO has committed to converting its domestic steelmaking capacity to fully hydrogen. It will leverage its existing expertise in fuel cells, developing proprietary H2–based direct reduction to make sponge iron and is actively seeking overseas partners with the right resource mix, such as low–cost low–carbon energy and high–quality iron ore, to bolster its hydrogen ambition.

Today, all three companies’ fleets are dominated by BF production. However, there is consensus that increasing use of EAFs is the best first step to decarbonization. To kick off the transition and achieve 2030 interim targets, players are building advanced EAFs capable of large–scale and high–quality production, while investing in new and acquiring existing EAF capacity in emerging markets overseas.

Overseas expansion gives access to clean power, electrified production

All three East Asian steelmakers have rolled out plants to expand their presence overseas, preparing for a more diverse value chain in a net–zero future.

Securing metallic feedstocks and clean power is a key motive in overseas expansion. This makes the Middle East, Australia, Brazil and Canada popular destinations, with excellent renewable resources and rich iron ore reserves.

JFE Steel has agreed with Emirates Steel Arkan to explore producing direct–reduced iron (DRI) or hot briquetted iron (HBI) in Abu Dhabi. Production will use the low–cost and abundant local natural gas as a reducing agent to replace coal, and the high–grade iron ore supplied by Itochu.

Nippon Steel recently started considering a $700 million investment in a hydrogen–based steel project, potentially in Australia and Brazil.

In 2022, POSCO announced plans to invest heavily in Australia, committing $28 billion to renewables development and green hydrogen production to be used for HBI production. Another $12 billion goes to modernizing steel equipment, bringing the total investment in the country to $40 billion by 2040.

The other focus area is optimizing existing production and integrating more EAFs.

All three steelmakers have either invested in or acquired electric arc furnaces overseas, particularly in Southeast Asia and North America.

In 2022, Nippon steel bought majority stakes of two EAF steelmakers in Thailand, acquiring a 1.5 million– metric–ton(Mt) EAF in Chonburi at GJ Steel and a 1.8Mt EAF in Rayong at G Steel. Both produce hot–

rolled steel sheets to satisfy local markets.

Nippon Steel expanded to the US, through its flagship joint venture with ArcelorMittal. The company, known as AM/NS Calvert, invested $775 million in a 1.5Mt plant in Alabama, and production aims to come online in 2H 2023. In 2022, POSCO began building a 1.5Mt EAF in Mexico, with $43 million already invested.

In addition to emissions reduction, these companies are attempting to nearshore steel capacity, building it closer to its end–use market. This is to capture growing demand from emerging markets, particularly in lower– end construction steel. Their operations in their home markets will also become leaner as a result, making their future not only lower carbon, but more diversified.

Japan’s blast–furnace supremacy may be waning

Japanese steelmakers have been favoring blast furnace–based emissions reductions for two reasons:

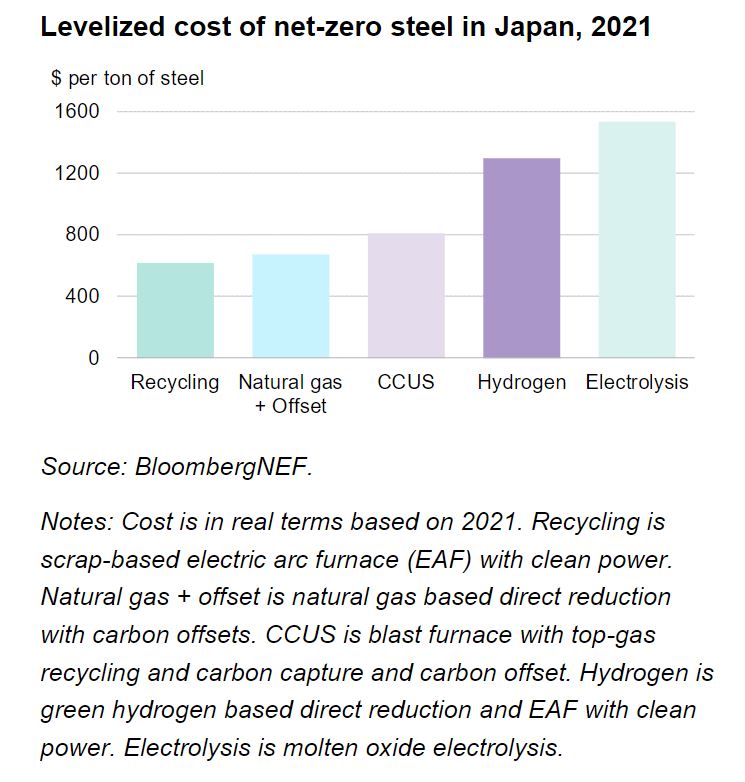

- Japan already has superior blast furnace expertise. Blast furnaces are also the most efficient way to make the iron needed for large-scale and high- quality steel production. As a result, the industry ruled out scrap based EAFs due to their smaller scale, lower production efficiency and poorer performance in removing impurities.

- Japan lacks renewables resources. Access to cheap green power, and therefore low-cost H2, are key for hydrogen-based direct reduction. As a result, switching to production routes hinging on clean energy as the main fuel source will bear a significant cost increase. By contrast, keeping blast furnaces and retrofitting with CCUS is a cheaper option.

The combination of these two factors makes it hard for Japanese players to relinquish their competitive edge in blast furnaces and move to a hydrogen direct-reduction route that will put them at a disadvantage for domestic production.

However, a net-zero imperative is changing these plans. Both Japanese players have now realized that to be on track for 2050, EAFs must be scaled up, upgraded and deployed immediately as other net-zero options reach maturity. To avoid domestics resource constraints on hydrogen in Japan, steelmakers are looking overseas for supply.

The steel industry is at a tipping point where it needs to make meaningful breakthroughs in technology, before deciding which one to deploy at commercial scale. The decision will be based on the most economic combination of resources, infrastructure, market, and policy.