By Vandana Gombar, Senior Editor, BloombergNEF

There is one key question that decides where the Bezos Earth Fund’s $10 billion is deployed in the energy sector: will the proposal significantly accelerate the global energy transition?

“My task is to find innovative ways to accelerate decarbonization,”

Nicole Iseppi

, the director of global energy innovation at the fund, told BloombergNEF. “We are looking at what we can do now in this decade – which we call the “decisive decade” – to enable transformational changes that can drive the global energy transition.”

Set up by Amazon founder Jeff Bezos in 2020, the fund is focused on nature and climate challenges, and aims to give out all the $10 billion as grants by the end of the decade. Projects it is backing include the electrification of the entire US fleet of 480,000 school buses and bulk procurement of solar panels and batteries in Africa – both with partners.

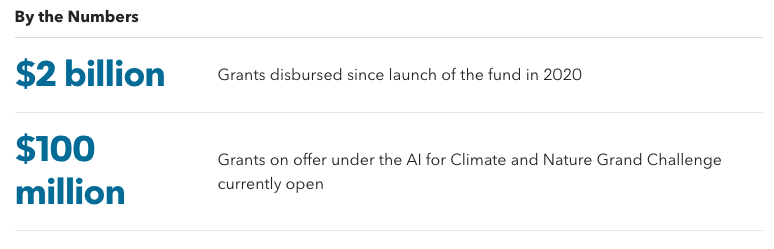

Of the $2 billion disbursed since launching, about a quarter has gone to energy and decarbonization projects. Iseppi said the ambition is to “phase out fossil fuels – coal and gas – in electricity generation, rapidly scale up zero-carbon power, modernize the power grid, grow energy storage and digitalize the energy system so it becomes more efficient and resilient.”

The fund’s latest ‘AI for Climate and Nature Grand Challenge’ offers $100 million in grants. The three initial focus areas are sustainable proteins, biodiversity conservation and power grid optimization. There is also a “wild card” entry option. The application window is open until August 13.

“We believe small-scale changes won’t deliver. The economy of the 2030s and 2040s will be quite different from today’s. Major changes will be needed in the way we live, work, travel, farm and consume,” Iseppi said.

The fund tracks 70 transitions and the tipping points that need to be reached through its Systems Change Lab. “We then identify the transitions where we believe the Bezos Earth Fund could potentially help play a transformative role,” she explained.

Iseppi also wants the fund to have a role in emissions removal solutions: “Renewables are brilliant but at the end of the day, we still need to see how to create negative emissions.”

The following transcript has been lightly edited.

What is your brief as director of global energy innovation? What is the span of what you look at?

The Bezos Earth Fund is a new philanthropy. It stands out as the world’s only philanthropy that is exclusively dedicated to addressing climate and nature challenges. Another distinguishing factor is that we are focused on systems change. We are looking at what we can do now in this decade – which we call the “decisive decade” – to enable transformational changes that can drive the global energy transition. I am one of the five core program directors at the fund and my task is to oversee global energy activities and find innovative ways to accelerate decarbonization.

We work globally, with a special focus on the US. We want to be really catalytic with our funds and focus on the major shifts needed in the global power sector to decarbonize. We are looking at how we can phase out fossil fuels – coal and gas – in electricity generation, rapidly scale up zero-carbon power, modernize the power grid, grow energy storage and digitalize our energy system so it becomes more efficient and resilient. We want to ensure universal clean energy access and a just and equitable transition. We actually have a dedicated climate justice team.

As a philanthropy, our capital is extra special – our funding is 100% grant-based.

One of your popular projects is US school bus electrification. How did you zero in on that? How are you choosing projects?

We are looking to make some big bets, and we want to be exceptionally catalytic in our approach. Our first endowment is for $10 billion. We want to use the money wisely, filling gaps where it is most relevant. The Bezos Earth Fund partnered with the World Resources Institute and multiple stakeholders to electrify the entire US fleet of 480,000 school buses by 2030. We are already over halfway through implementing this project.

How do you figure out what is the highest impact, especially in the energy space?

What is wonderful in the energy industry is the increased momentum towards accelerating the energy transition. There is a role for the private sector, a role for government and a role for civil society. In the energy portfolio of the Bezos Earth Fund, we are very focused on being strategically catalytic, and concentrating only on core gaps where, without the Bezos Earth Fund’s precious capital, things will not progress at the speed and scale needed. That is why we opted to support a program for electrifying school buses.

We are one of the partners in an entity called GEAPP – the Global Energy Alliance for People and Planet – with the founding partners being the Bezos Earth Fund, the Rockefeller Foundation and the IKEA Foundation. The aim is to enable the 3.6 billion people trapped in energy poverty to secure energy access and advance electrification using renewables.

We support GEAPP’s mandate and have provided very project-specific funding that supports the reskilling of fossil-fuel workers as part of South Africa’s Just Energy Transition Partnership. Via GEAPP, we also support the design and building of metro grids in the Democratic Republic of Congo.

Another area we have supported via GEAPP is the DART [Demand Aggregation for Renewable Technology] program. This aims to reduce the cost of distributed renewable energy solutions by aggregating equipment orders and providing short-term financing to developers. We supported the pilot project of GEAPP in Nigeria in 2022 and with a small order reduced the cost of batteries and PV for developers by 20% and 10%, respectively. The intention is to now expand the scale of this pilot project in Nigeria and also to some other countries.

Are you spoilt for choice in the projects that meet your criteria for impactful, systemic changes, or do you need to work hard to carve out ready-to-fund projects?

One of the challenges I’ve experienced is that while there are many good ideas in the industry and by various stakeholders, there are also a lot of different sources of capital available already in the market. We need to ensure that we are supporting activities and projects where grant funding is most warranted and needed. Our solutions need to address a tipping point, contribute to system change for the future and be accelerators.

How many live proposals do you have on your desk at any moment that you are exploring?

In terms of big initiatives, there are currently a handful we are co-designing with partners who share a mindset similar to ours. Additionally, we always have behind those 20+ other potential early- to mid-stage project ideas that we are analyzing and exploring.

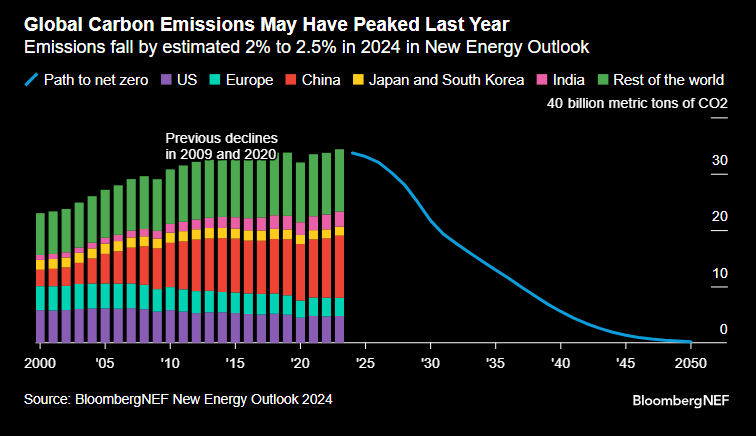

We believe small-scale changes won’t deliver. The economy of the 2030s and 2040s will be quite different from today’s. Major changes will be needed in the way we live, work, travel, farm and consume. Reaching net-zero emissions and shifting to nature-positive development will require changes across entire systems – driven by new technologies, better policies and new ways of thinking about the future.

We identify and monitor the key transitions that are required, and an important reference is our Systems Change Lab, which monitors over 70 transitions and their tipping points. We then identify the transitions where we believe the Bezos Earth Fund could potentially help play a transformative role. We tailor the level of support to the need, are willing to take risks, and obsess about results.

How many projects has the energy team at the Earth Fund supported?

The Bezos Earth Fund has dispersed just over $2 billion since its launch. About 25% of this has gone to energy and decarbonization projects. On top of that, there are also some other overlapping related projects. For example, we recently launched a global grand challenge: AI for Climate and Nature. Energy is one of the focus areas and, within that, we have chosen to zoom in on the grid. It is looking at how AI as a tool can optimize the grid to enable renewable energy integration, enhance resilience and create equitable energy systems.

I look at increasing instances of negative power prices in California as solar generation spikes and it seems like there’s an argument to be made for fundamentally restructuring price setting. What are your thoughts?

What’s important is that we are moving to a clean energy system and we are improving people and communities’ lives, but we also need to make it an economically viable system. We need new business models because most of the economics today, both for solar and energy in general, are still based on past fossil-fuel economy values. We need to rethink our pricing strategies to ensure they align with our green economy goals.

On top of that, we need to move away from looking at solar assets as individual assets and adopt more of a portfolio view. We need to think about hybrid systems like wind and solar or solar and storage. Output not being used represents wasted potential.

Do you also get involved with the manufacturing part of the energy value chain?

We are open to looking at new clean energy technologies and advancement of existing platforms to then determine how we could be a collaborator – whether it’s through early R&D [research and development] or a pilot demonstration.

We also consider the big questions in this process: how do we make sure that we have the materials needed to deploy this energy transition while maintaining sustainability? Are they the best sustainable materials that one should use, or should we actually be more innovative and think of alternatives?

New technologies must be invented, developed, and deployed with speed and at scale. The Bezos Earth Fund supports new technologies on a highly selective basis, where core gaps exist and where we can help remove barriers.

What are the key performance indicators you have set for yourself in the near term?

It’s about making sure every dollar counts. We are strategic and frugal to make sure we deploy our funds where they are most needed – so we ensure we’re not simply duplicating what others are doing or could do, but are going in where some of those more catalytic depths are, while also envisaging an exit strategy.

Our success will be when we exit from using our philanthropy funds and make a self-sufficient new industry or technology to accelerate the transition and continue to grow. We want to bring back the voice of communities in co-designing systems change. At the end of the day, the energy system is for individuals, community and society.

Do you have a target for the volume of funding that you want to push out the door? What would a good year look like for you?

Our endowment is till 2030. If I look back at the end of this decade, I would like to have nurtured innovation, in addition to accelerating clean, affordable and equitable green solutions. I also would like us to play a role in emissions removal solutions. Renewables are brilliant but at the end of the day, we still need to see how to create negative emissions. Besides, I would like us to work on projects at the community level, initiatives that ensure energy independence and energy security.

We would like to be known for a couple of big things, such as the role of digitalization in our energy system – we need to make it not only more efficient but also more effective for future demand.

Since we are the only philanthropy focused on systems change, I would really like us to also be part of thought leadership, thinking not only of the design but the operations of the future grid beyond this decade.

If you had to identify your near-term priorities, would it be correct to say: grid, grid and grid? Or maybe: grid, electrification and AI?

Our near-term priorities are electrification, integrating increased digitalization, and AI in energy and the next-generation grid. The grid plays a crucial role as the backbone of the energy system.

And to those that say “what is climate change?”, how do you respond?

We are led by the science and focused on solutions. We need to make sure that amongst all the noise and chatter in this busy global energy industry, the voices and expertise that need to be heard are raised.

Of the $500 million used up in the energy sector, what were the big bets made? What is the largest money commitment made?

The largest individual allocation that has gone to energy and decarbonization to date is the grant the Bezos Earth Fund gave directly to GEAPP. It is a single grant of $50 million that supports three specific activities – a just transition, metro grids and mini grids deployment, and demand aggregation for renewable technology.