By Michael Daly, Transition Risk, BloombergNEF

BloombergNEF’s Clean Energy Exposure Ratings (CEERs) assess the share of company revenues drawn from clean energy activities, and rates firms from A1 (high exposure) to A5 (no exposure). This includes revenues drawn from solar, wind, hydro, nuclear, power grids, electrified transport, energy storage, hydrogen, geothermal, bioenergy and carbon capture. BNEF updated the CEERs in December 2023, introducing the following improvements:

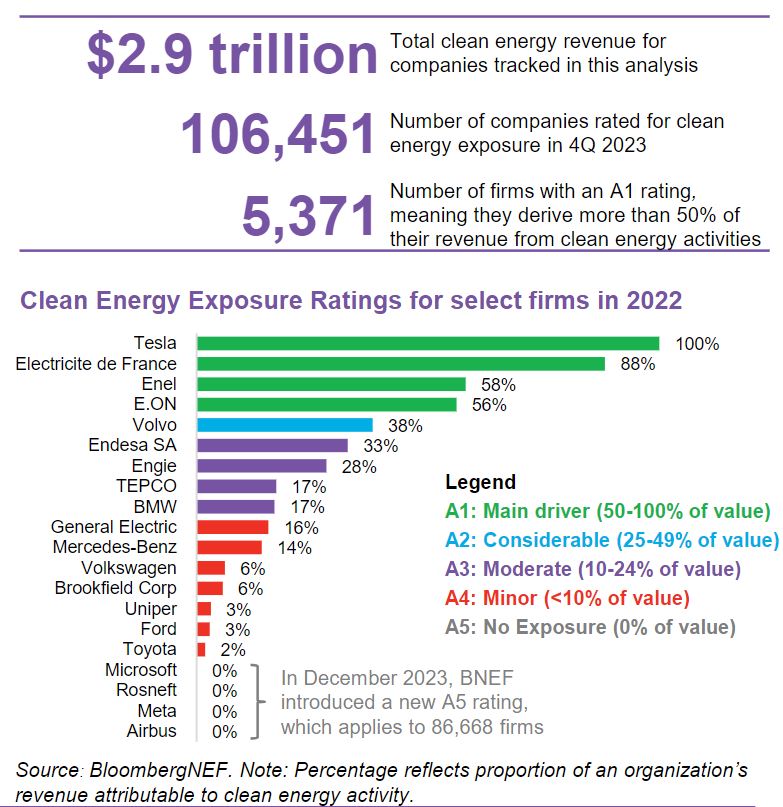

- Coverage expansion: The CEERs now assess 106,451 companies for clean energy revenue exposure. This includes 51,632 publicly traded firms (49%) and 54,819 non–listed firms (51%), and represents a doubling from our coverage in August. We estimate the total amount of clean energy revenue from companies reviewed in this analysis added up to $2.9 trillion in 2022.

- Renewable assets data: The CEERs now capture the exposure of participants to the development, financing, maintenance or ownership of renewable projects in 2022. This leverages companies and renewable assets captured in BNEF’s Renewable Energy Project database (web), one of the largest such datasets in the world. This update helps identify exposure when financial statements do not reveal it. For example, Saudi Aramco owns a 30% stake in a 750 megawatt solar plant (web), leading to an A4 rating in this analysis, while ExxonMobil is an equity sponsor to three carbon capture and storage projects (web), leading to an A4 rating. If only financial statements had been considered, both firms would have received an A5 rating (no exposure).

- New rating: The CEERs now include an A5 rating capturing companies with no clean energy exposure. BNEF now reviews an even wider array of data from financial statements, company descriptions and firm ownership structures to renewable energy assets. This enables the ratings to capture as many companies exposed to opportunities in the clean energy transition as possible.

BNEF clients can access the full report here.