By Bo Qin, Lead Analyst, Carbon, BloombergNEF

California carbon has hit its highest price since November 2021, rising to $36.14 per metric ton after supply-curbing scenarios were presented by the state’s carbon market regulators on July 27. This zenith represents a 19% increase over carbon prices at the beginning of the year.

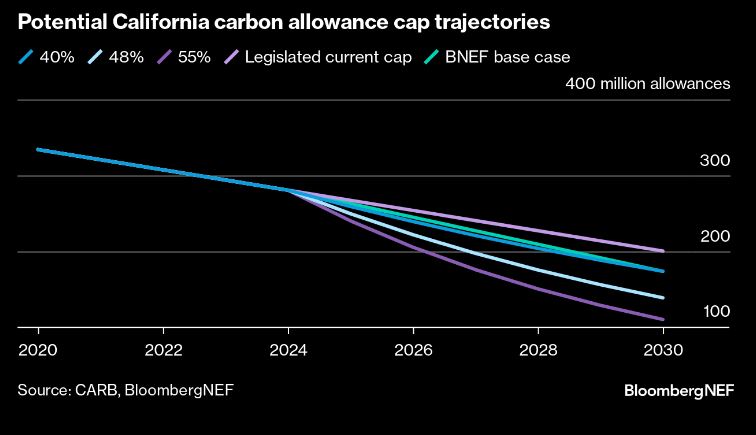

The proposed scenarios would align the state’s cap-and-trade program with the 2022 Scoping Plan, which has a new goal of reducing emissions 48% from 1990 levels, up from the previous reduction target of 40%. The carbon market scenarios explored reducing emissions 40%, 48% and 55% by 2030. The rulemaking also included an emissions inventory adjustment, as previous estimates overstated the modeled emissions. The new cap scenarios surprised the market by pushing down 2025-30 allowances to compensate for 2021-24 allowances that reflected less ambitious goals.

2030 cap trajectories

The California Air Resource Board (CARB) held a workshop discussing the different scenarios to align the carbon market with the 2022 Scoping Plan target. The identified targets included a statutory reduction target of 40%, the Scoping Plan target of 48% and an ‘upper ambition’ target of 55% from 1990 levels by 2030. The theoretical cap for 2021-30 will be determined based on the abatement targets and a linear reduction from 2021 to 2030. Then, the actual changes will be applied to 2025-30 caps using a constant percentage decline.

2021 emissions inventory adjustment

CARB recognized it had overstated 2020 emissions by 13.7 million metric tons in the latest emissions inventory, which impacted the previous Scoping Plan reference scenario. In addition, the earlier rules also overstated the cap-and-trade program’s coverage of of the state’s greenhouse gas inventory. The share should be 77% instead of 77.5%. The new scenarios update both figures.

Statutory scenario

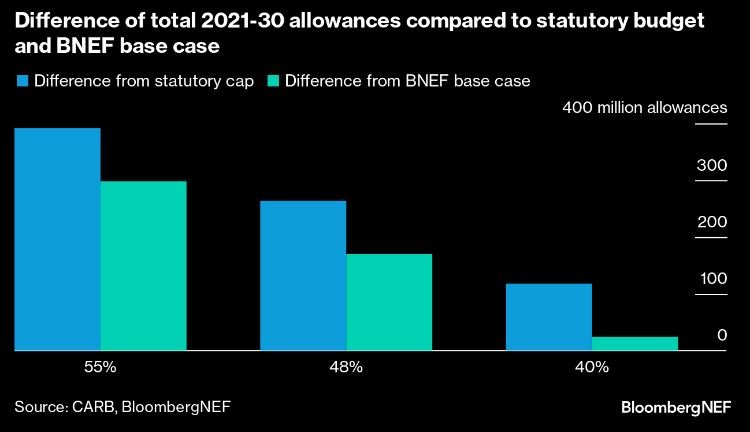

The proposed new 2030 goal for 40% emissions reduction is 199 million metric tons (Mt) of carbon equivalent. The new 2020 starting point is 310Mt, 7% below the previous value of 334Mt. The total 2021-30 estimated allowances sum to an estimate of 2,490Mt. The scenario removes an estimate of 115Mt, or 4%, from the total statutory budget for the decade. We estimate that the constant annual percentage change for the cap is 8% for 2025-30.

Scoping Plan scenario

The scenario aligned with the 48% abatement goal targets a 173Mt cap for 2030, the same as BNEF’s base case in the California-Quebec Carbon Market Outlook 2023. The total 2021-30 estimated allowances sum to an estimate of 2,340Mt. The scenario removes an estimate of 265Mt, or 10%, from the total statutory budget for the decade. The scenario is also 170Mt below BNEF’s base case, which was modeled without the emissions inventory adjustment and without adding the cap reduction backloading for the 2021-24 period during 2025-30. BNEF estimates that the constant annual percentage change for the cap is 11% for 2025-30.

Despite this scenario aligning with the Scoping Plan, CARB highlighted that all scenarios are on the table for the agency to consider.

‘Upper ambition’ scenario

The 55% emissions target aims at a 149Mt 2030 goal.

The total 2021-30 estimated allowances sum to an estimate of 2,215Mt. The scenario removes an estimate of 390Mt, or 15%, from the total statutory budget for the decade. We estimate that the constant annual percentage change for the cap is 14% for 2025-30.

Other matters

CARB will also address the use of free allocation and voluntary renewable electricity program in the rulemaking. The allowance budget extension beyond 2030 will be also a focus as the regulator aligns the carbon market with California’s legislated net-zero goal and 85% abatement goal from 1990-levels by 2045.

Rulemaking timeline

The formal CARB rulemaking could start by the end of 2023, with final votes on the changes by the end of 2024. Changes are expected to be implemented from 2025.