This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Record number of announcements in 2021, but not investment

- More than $2 billion invested in CCS in Americas and EMEA

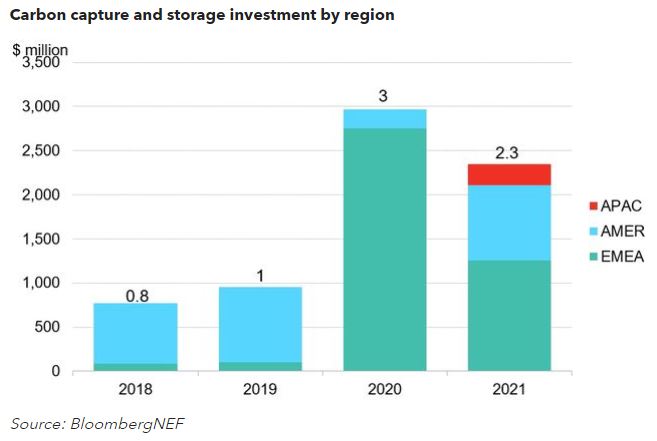

Global investment in carbon capture and storage (CCS) reached $2.3 billion in 2021, down $0.7 billion from 2020, according to BloombergNEF.

While last year saw a record number of announcements, investment fell behind as developers seek to get more for their money from falling capture costs. As the industry moves toward large-scale projects, total investment is determined by whether a few projects reach a final investment decision (FID).

The most important deals announced in 2021 included Santos’ FID on its $165 million Moomba project in Australia, and the $500 million committed by the U.K. government and industry to develop CCS clusters. Emerging industries, such as direct air capture, also made progress — startup CarbonCapture raised $35 million, putting it on track to be a future industry leader.

BNEF expects the CCS industry to return to growth in 2022. Large projects such as Porthos and Rio Grande LNG are expecting FIDs this year and, if positive, these announcements, alone, would set a new record for CCS investment in 2022.

For more detail on these findings, an abridged version of the 2022 Energy Transition Investment Trends Report can be downloaded from this page. BNEF subscribers can find the full report on the client website and on the Bloomberg Terminal.