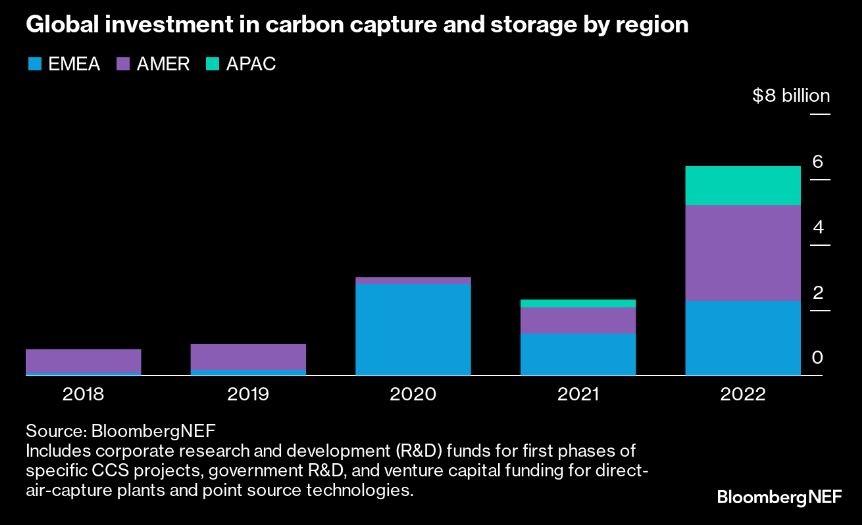

Investment in carbon capture and storage (CCS) has more than doubled since last year to hit a record high of $6.4 billion.

The US led the pack, with 45% of global investment, but the regional split is far more even than in previous years. APAC investment surged to $1.2 billion off the back of projects in Australia and Malaysia. China has commissioned a pilot project to capture 0.2 million tons of CO2 per year at a petrochemical complex, although it still lags behind its neighbors in terms of CCS development.

EU funding for CCS was mostly venture capital flowing into direct-air-capture companies like Climeworks, which secured $650 million in April. The EU put much of its funding toward industrial decarbonization, with $420 million invested in cement and steel projects.

US policy has been generous to CCS, which should lead to more investment in CCS projects in 2023. As the decarbonization of hard-to-abate sectors gains momentum and political support rises globally, BNEF expects CCS investment records to continue to be broken.

Global investment in carbon capture and storage by region (Note: Includes corporate research and development (R&D) funds for first phases of specific CCS projects, government R&D, and venture capital funding for direct-air-capture plants and point source technologies.)