By Layla Khanfar, Kyle Harrison and Emma Coker, BloombergNEF

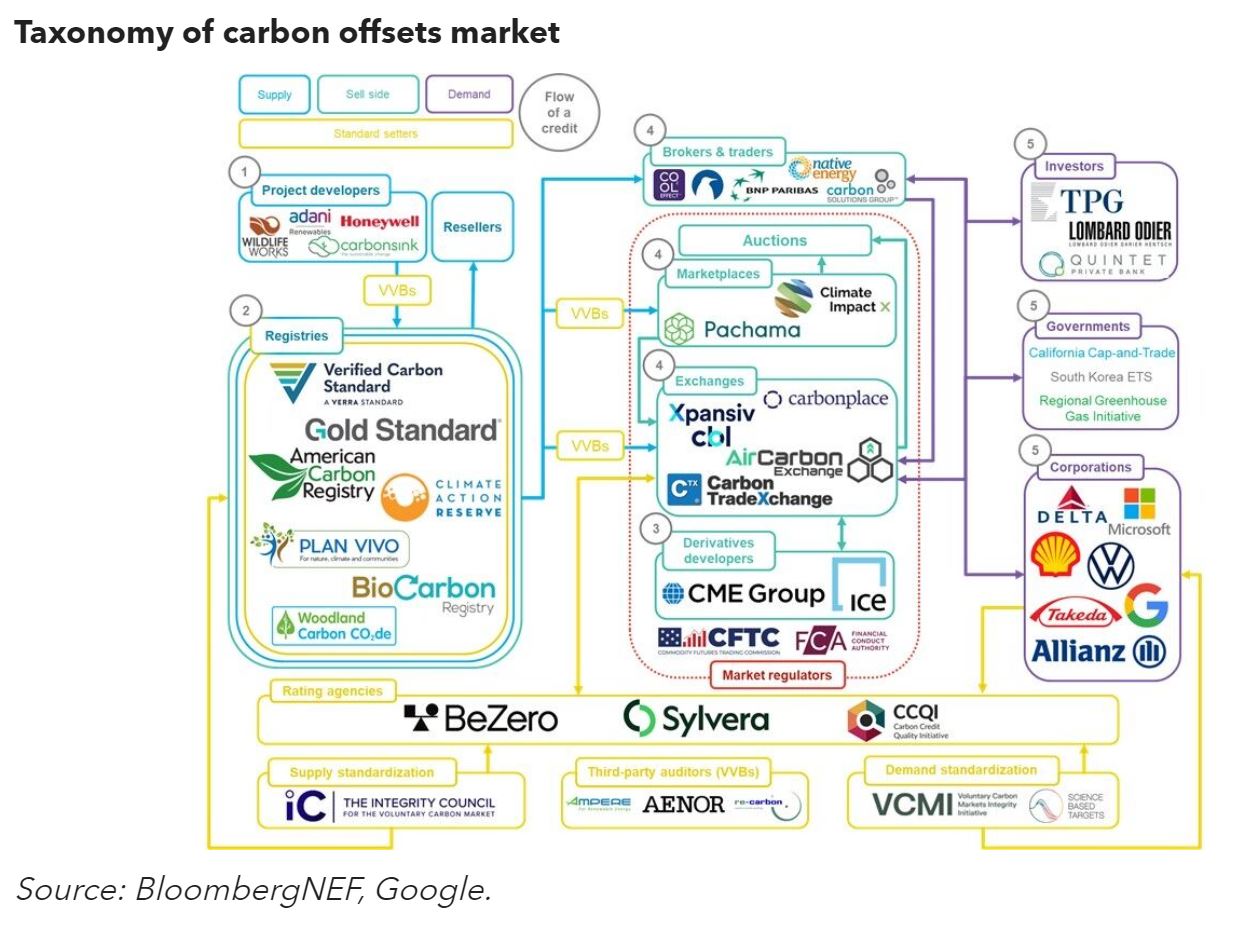

The use of carbon offsets is set to explode over the coming decades as companies and governments look to achieve their climate goals. But meeting this demand will hinge on building trust in offsets and a rapid evolution of how the market operates – from the current system of over-the-counter transactions between projects and buyers, to infrastructure that supports instantaneous and high-volume trade of credits.

BloombergNEF’s Long-Term Carbon Offsets Outlook sees demand for carbon offsets reaching 1.2 billion metric tons of carbon dioxide equivalent (GtCO2e) by the end of this decade and 5.38GtCO2e in 2050 – almost 35 times higher than today. At these levels, over-the-counter trades are an insufficient and inefficient means of transacting credits.

To scale up instantaneous and transparent transactions, the carbon offset market must address three key areas. First, regulators and integrity initiatives need to agree on quality definitions and standards. But the decentralized structure of the market today can nullify the work of such groups thus far, so financial regulators will also need to come to the table to ensure the necessary checks and balances are in place. Meanwhile, if quality and standards are not addressed fast enough, efforts to create standardized contracts and futures products will be moot.

Appetite for carbon offsets took a step back last year amid growing concerns over quality. But the market is nonetheless making progress towards becoming a commodity market – a necessary step if it is to support future demand and meets its potential of being valued at over $1 trillion annually, up from roughly $2 billion today.

BNEF clients can read the full article here: Carbon Offsets Should Start Thinking More Like a Commodity.