By Brenna Casey, Sustainable Materials, BloombergNEF

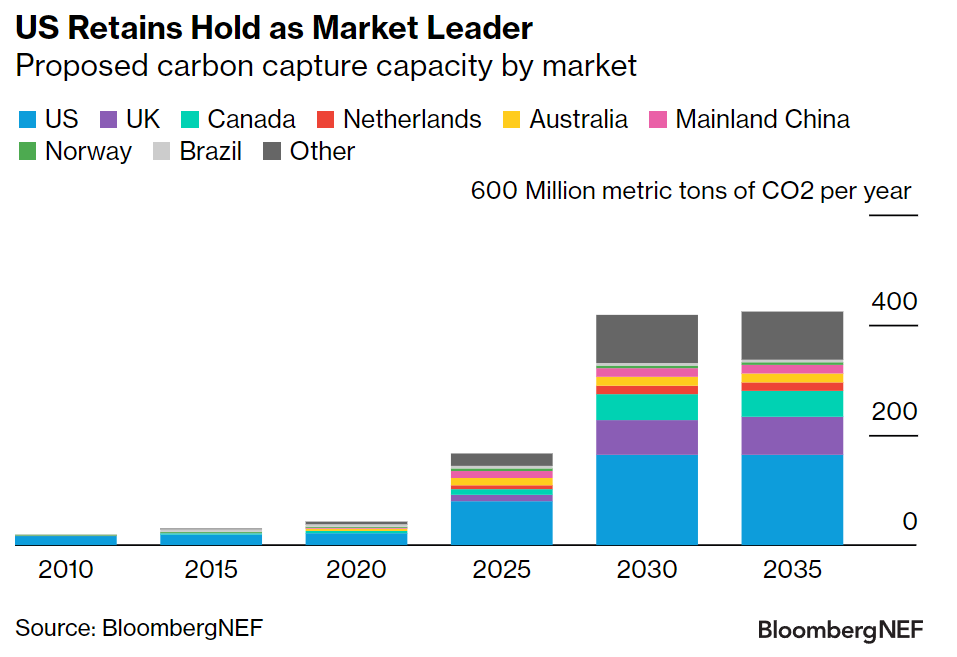

After two years of consecutive and dramatic growth, activity in the carbon capture industry is starting to slow in leading markets. The US remains the top player with a 39% market share in proposed capture capacity by 2035, but the delay in finalizing 45Q guidelines is stalling projects. The EU, on the other hand, is ramping up policy support, bolstering an increase in investments.

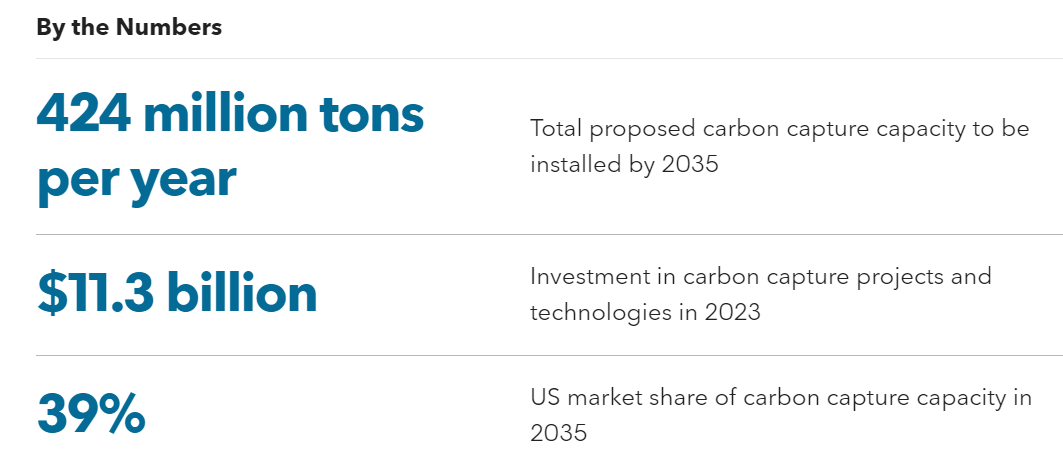

- Capacity growth: Nearly 424 million metric tons per annum of CO2 capture capacity is slated to come online by 2035; no higher than where BNEF saw capacity last year in November. The pause in activity is a testament to uncertainty surrounding policy, financing, and transport and storage permitting woes.

- Sectors: Hydrogen and power generation are set to lead the market by 2035, accounting for 36% of all proposed capture capacity. Cement continues to add capacity at a fast rate with nearly 28 million tons per year of CO2 capture due to come online. The largest direct air capture facility, with a targeted capacity of 36,000 tons of CO2 per year, also began operations in May, marking a milestone for that sector’s growth over the next decade.

- Markets: The US retains its hold as the market leader with a 39% share of all proposed capture capacity by 2035, down one percentage point since last November. The UK and the rest of Europe follow, at 16% and 12%, respectively. This lineup could change if US progress continues to stall while other markets implement favorable policies.

- Company activity: Oil and gas majors, as first movers, continue to drive the market. We are seeing continued international interest in the US market with notable deals including TotalEnergies acquiring Talos and SLB acquiring Aker Carbon Capture.

- Technology: Capture technologies such as liquid absorption will continue to dominate the market through the decade. However, the technology landscape is beginning to fragment. Solid adsorption, especially metal organic frameworks for cement CO2 capture, is gaining traction as technology providers form partnerships. These new technologies will help lower capture costs and are likely to scale up by 2035.

- Investment: Global investment in carbon capture, transport and storage, nearly doubled for the second year in a row, reaching a record $11.3 billion in 2023. Rising political support and subsidies have pushed projects to take final investment decisions in markets such as Europe, the Middle East and the US.

BNEF clients can access the full report here.