By Brenna Casey, CCS and Industrial Decarbonization, BloombergNEF

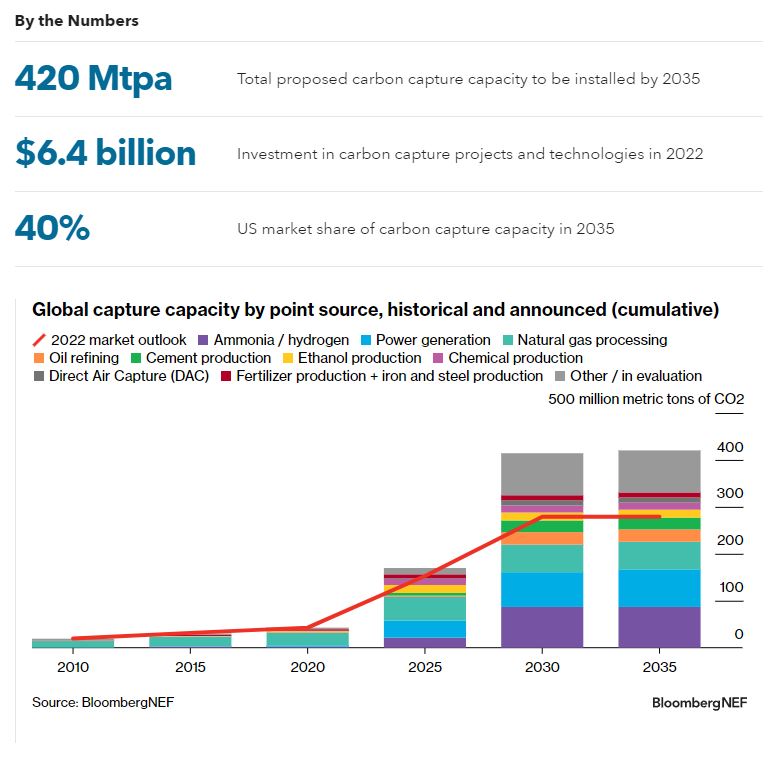

Carbon capture capacity continues to expand – and spread to more markets – in 2023. The industry is set for a 50% growth spurt since the last iteration of BNEF’s market outlook, to reach 420 million metric tons per annum by 2035. This expansion is driven mainly by global policy support. The market, which was once dominated by projects deployed at natural gas processing facilities, is diversifying rapidly into hard-to-abate sectors such as cement, iron and steel, and power. Investments in carbon capture, transport and storage infrastructure hit $6.4 billion in 2022. Investment this year is now expected to reach $5 billion.

- Capacity growth: More than 140 million metric tons per annum of new capture capacity has been announced since BNEF’s last market outlook, in 2022. The industry is now expected to grow at a 18% compound annual growth rate to capture 420 million tons per annum by 2035 – or 1.1% of current global annual emissions from fuel combustion and industrial processes.

- Sectors: Ammonia or hydrogen production and power generation are the two sectors that will dominate carbon capture capacity deployment by 2035, accounting for 33% of announced capture capacity. Proposed carbon capture capacity for the cement sector has risen by 175% compared to BNEF’s last outlook. The first large-scale direct air capture projects could be commissioned in 2026.

- Markets: The US will retain its place as the market leader for the deployment of carbon capture, with a 40% market share in 2035. The UK and Canada will follow, at 16% and 12% respectively, while Australia, the Netherlands and China round out the top tier with 3-4% each. However, this lineup could change if China accelerates the deployment of carbon capture in its power sector, as suggested by a research arm affiliated with China’s State Grid in October.

- Transport and storage: The lack of transport and storage capacity is going to be a major bottleneck for carbon capture deployment. Several governments and the private sector are pushing to commercialize these assets to address this challenge. However, policies like the EU’s Net Zero Industry Act fail to acknowledge the high costs associated with building storage. Many transport and storage permits in the US have been denied in the last six months.

- Company activity: Mergers and acquisitions have been the strategy of choice for oil majors this year as they look to be first movers in some of the most advantaged geographical locations and carbon capture and storage hubs. The most notable acquisitions this year were ExxonMobil’s acquisition of Denbury, and Occidental’s acquisition of Carbon Engineering.

- Costs: For industries where the concentration of CO2 in off-gases is high, such as ethanol, ammonia and natural gas processing, capture costs range anywhere from $20 to $28 per ton of CO2. For industrial sources, BNEF sees costs at $80 per ton of CO2 for cement, $79 per ton of CO2 for hydrogen and $72 per ton of CO2 for steel. With transport and storage fees of $20-$50 per ton of CO2, the total costs add to $92-$130 per ton of CO2. For companies looking to ship liquid CO2, we expect transport costs to be two to four times higher.

- Hard-to-abate industries such as cement, iron and steel, and power are adopting carbon capture as high carbon prices and incentives in places like the US and EU boost the technology’s feasibility. New gas power plants with carbon capture, for example, could be cheaper than unabated power in Germany as early as next year when coupled with the carbon price.

- Direct air capture is far more expensive than previously thought, costing as much as $1,100 per ton today, and potentially falling to $300-$400 per ton by 2030. To realize these cost declines, the industry will have to coalesce around one or two technologies and develop the supply chains to bring these technologies to scale.

- (Corrects compound annual growth rate and share of emissions in the first bullet of the executive summary and in Section 2.1 of the research note.)

BNEF clients can access the full report here.