By Colin McKerracher, Head of Advanced Transport, BloombergNEF

For all the headlines about automakers dialing back their plans for electric vehicles, there have been some pockets of surprisingly positive news on EV adoption the last few months.

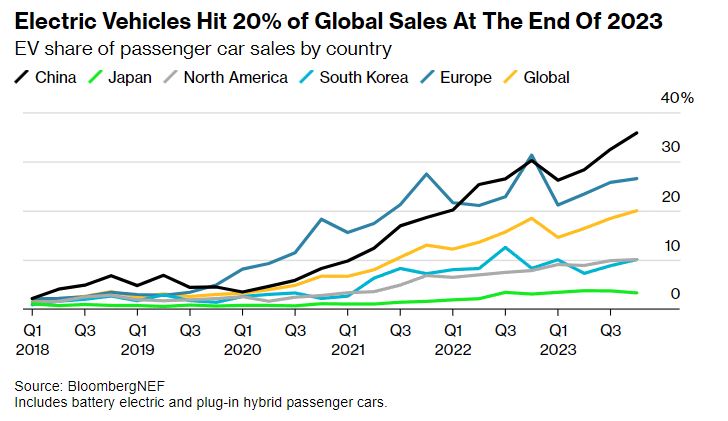

On the passenger vehicle side, BNEF estimates that EVs reached 20% of global vehicle sales in the final quarter of last year. China and Europe are way out ahead, but it was a record quarter in other markets, as well.

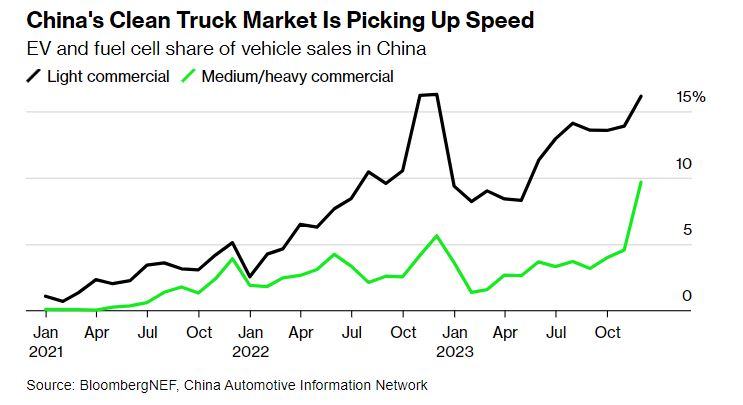

The electric commercial vehicle market is followed less closely, but also saw record sales in the final months of 2023. China has been pushing on this front for several years, and it looks like those efforts are now paying off.

Over 5,600 electric or fuel cell medium- and heavy-duty trucks were sold in China in the final month of the year. That was a remarkable 10% of the total, and pulled the tally for all types of commercial EV sales in China to over 330,000 for the year. Light commercial EVs in China took 16% of the market in December.

Those may seem like modest numbers, but heavy trucks were supposed to be one of the hardest segments to electrify, and many groups expected them to keep oil demand in the country growing for years to come. Hitting 10% of the market is meaningful, and puts them just a few years behind passenger cars.

There’s now a growing list of areas where industry commentators thought electrification would struggle to make inroads, from buses to ferries. Reaching this level of sales in the world’s largest auto market, even if just for a month, means it’s probably time to add heavy trucks to that list.

There are two other interesting storylines in China’s heavy-truck data. The first is that hydrogen fuel cells are finally making their presence felt, with over 1,000 fuel cell-powered heavy trucks sold in December. That’s the highest tally yet and more than twice that of any previous month. China is providing very generous incentives for truck manufacturers to deploy fuel cell vehicles, and the market is starting to respond.

There are still many challenges for fuel cell trucks, and sales probably won’t will continue at this rate once subsidies expire. But it’s good to see a technology that has promised so much over the years finally get some traction. Consumers have shown very little interest in fuel cells on the passenger vehicle side, but the technology could still play a role in some smaller trucking applications.

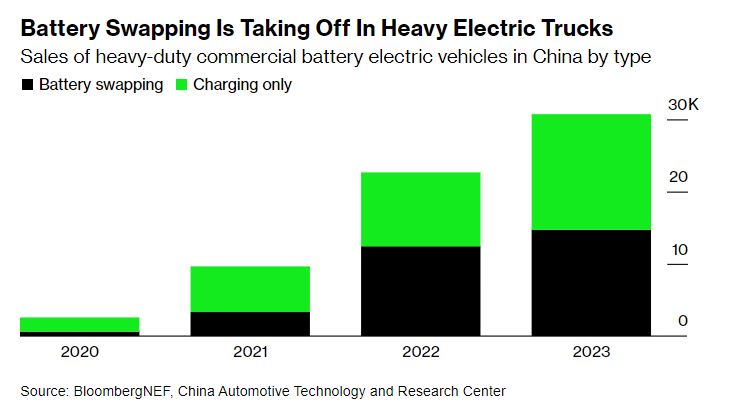

The second storyline is that battery swapping is also helping electrifying China truck sales. BNEF analyst Siyi Mi recently compiled data on all the battery-swappable vehicles sold in the country and found that while swapping remains a niche technology for passenger vehicles, almost half of all heavy battery electric trucks sold last year in China had swappable batteries. That’s up from 34% in 2021.

Many of these trucks are operating in industrial sites, port warehouses, mines and steelmaking factories. Lighter commercial vehicles with swappable batteries also are being used in urban deliveries, an area where BNEF expects to see more growth as better economics and tightened emission requirements draw more attention to electric models. Long-haul trucking will be the last, and most difficult, segment to tackle.

So far, this remains a China story, helped along by its domestic champions. CATL, the largest battery maker in the world, has supported the swapping model in recent years as a way to ensure batteries find their way into big rigs rather than other competing alternatives.

Activity elsewhere is limited. In Europe, Iveco launched an electric delivery van with three sizes of swappable batteries last year, while Mitsubishi Fuso is trialing a battery-swapping truck in Japan. In the longer term, pure battery-electric will probably win out, since lithium-ion batteries continue to get cheaper and better, and maximum charging speeds are rising fast.

All this points to a big shift that may be coming. China has spent the last few years experimenting with the best way to decarbonize heavy trucks. As it crosses these milestones on adoption, it will start to push harder toward higher levels of deployment. That parallels what happened with electric passenger cars — China experimented with different approaches throughout the 2010s, then made a full-court press in the 2020s. BNEF expects plug-in cars to hit nearly 40% of sales this year in China.

While Western automakers are sounding the alarm on slowing growth for electric car demand, other segments are just getting started.