Sustainable finance policies have grown more numerous and complex in recent years, demanding financial institutions comply and regulators learn from each other. These policies intend to drive banks and investors to consider environmental, social and governance (ESG) issues and prevent climate risks.

Policies that intend to drive banks and investors to consider environmental, social and governance (ESG) issues and prevent climate risks have grown more numerous and complex in recent years. Financial institutions need to comply the evolving policy landscape, and regulators around the world are interested in learning from each other.

BloombergNEF’s new report, Navigating Sustainable Finance Policies: Global Overview and Outlook, helps navigate 11 types of policies to explain their purposes, outline keys to success, assess market progress and set expectations on future developments.

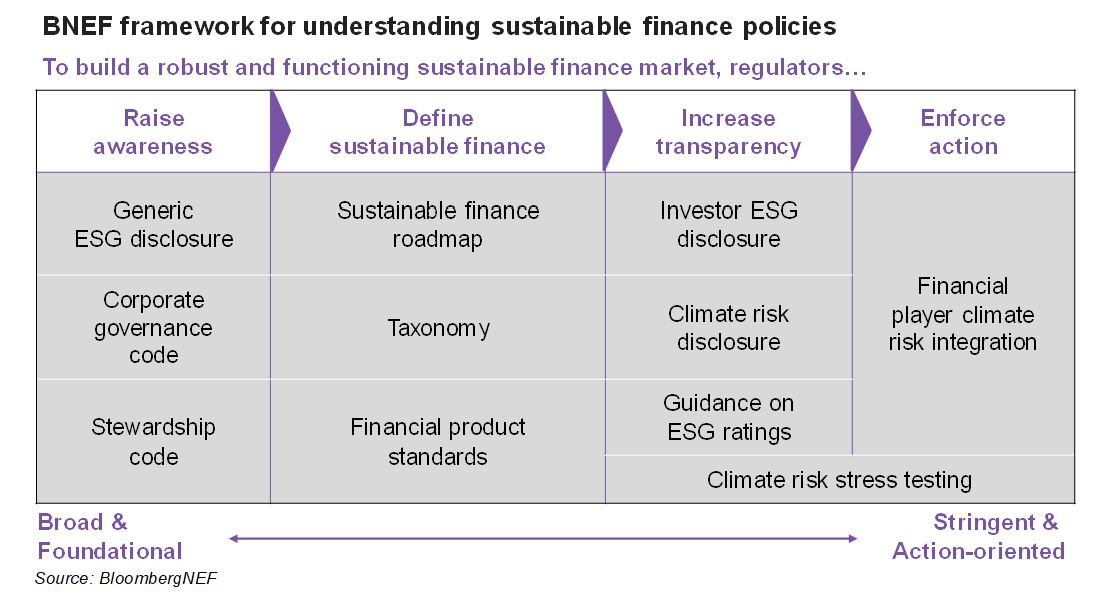

Sustainable finance policies can be grouped into four phases, distinct in their roles in building a robust and vibrant market. Regulators start by raising awareness and defining sustainable finance, before enforcing more stringent disclosures or climate action by market players.

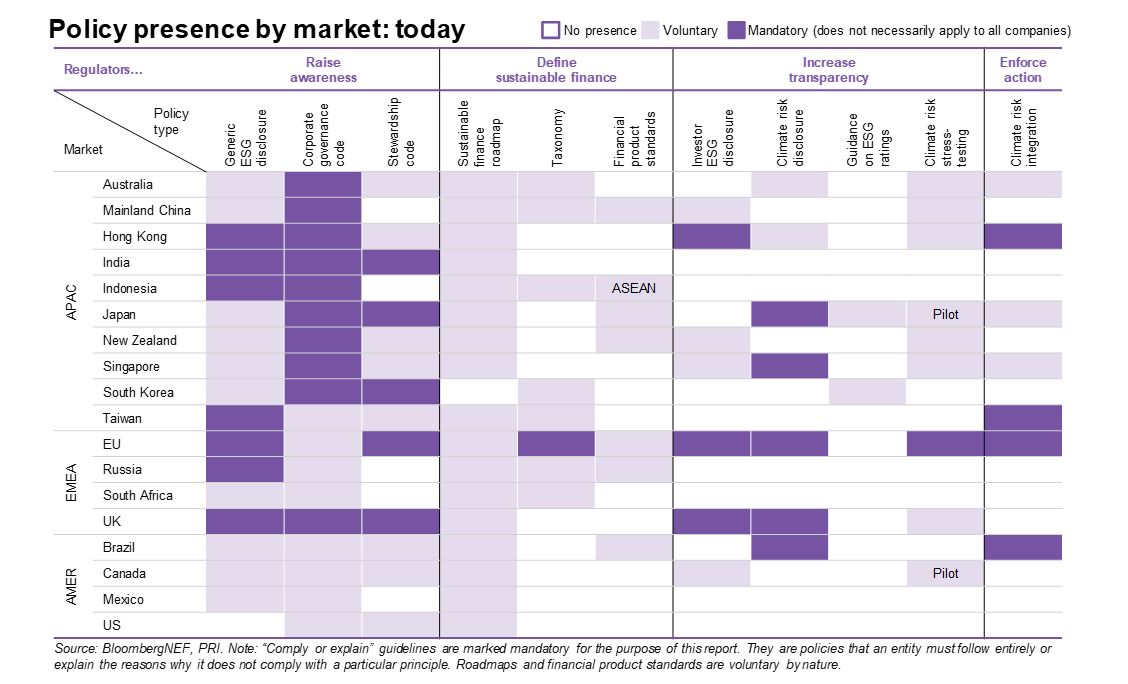

Current policy progress differs significantly across markets. For instance, all G20 member countries have policies in place to raise awareness on ESG and sustainability. In contrast, only select markets like the EU, the UK, Japan or Brazil have focused on mandating climate risk disclosure or climate actions.

In the next two years, climate risk disclosure – mostly informed by the Task Force on Climate-Related Financial Disclosures (TCFD) – will see the biggest advancement, with at least New Zealand, Australia, Switzerland, Canada and Colombia slated to debut policies. ESG disclosure policies will also be released or updated in India, Japan, the EU and Brazil. Climate risk integration policies will gain traction in South Africa, Canada and the US.

Beyond policies on today’s horizon, additional attention should be given on introducing policy roadmaps in early-stage markets, improve the content and coverage of existing policies, deepen climate stress tests to drive policy actions, and use the current sustainable finance policy framework to inform biodiversity policies.