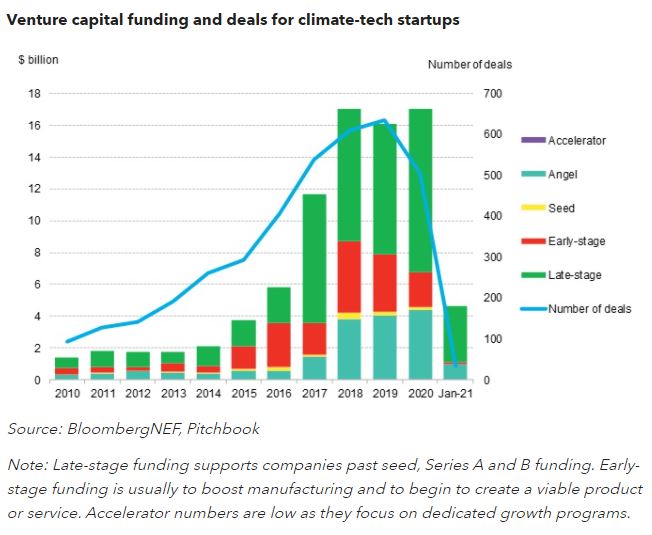

`Climate tech’ is a label for the emergence of technologies addressing the climate crisis, usually targeting both mitigation and adaptation. With lessons learned from the clean-tech boom and bust, venture capitalists believe climate tech can be profitable while helping the environment. A record $17 billion of capital was poured into climate-tech startups last year.

BloombergNEF categorizes climate-tech investment into six key technology themes: energy transition, transport and new mobility, agriculture and land-use, climate and forests, decarbonizing industry and buildings, and the circular economy and new materials.

In this piece we profile Total Carbon Neutrality Ventures, which has shifted its investment thesis to focus exclusively on climate tech as its parent company Total SE moves more toward sustainability. We also include our regular news and VCPE funding sections.

- In January, investments and projects in artificial intelligence (AI) continued to grow, from Asia to the Middle East. On January 12, South Korea’s ICT ministry said it will invest $114 million in AI chips this year and set a goal of owning 20% of the global AI chip market by 2030. Following this, Unilever and Alibaba announced a partnership named the `waste free world initiative’ that uses AI-based machine learning to identify and sort waste plastics. On January 31, Saudi Arabia’s Ministry of Energy announced that a new AI center will be built to review AI strategies in the energy sector.

- Digital industry startups raised almost $2 billion in January – the largest month since BNEF’s records began. Investors again rewarded AI startups and chip manufacturers, including $700 million to 4Paradigm, $279 million to Enflame and $400 million to Horizon Robotics.

- 2020 was the highest year on record for climate-tech startup investment, with $17 billion invested globally. The majority of this investment was in late-stage startups from a variety of new climate-tech funds, resident clean-tech funds and corporate venture capitalists (CVCs). There was a heavy regional skew toward the U.S. and China, both regions with concentrated capital in the transport/new mobility sector: what appears to be the most popular area of climate-tech investment across funds.

- While climate tech is the new hot topic – particularly in Silicon Valley – there have been VCs investing in clean energy and climate themes for decades. We would define climate tech as including all major clean-tech topics while also addressing climate change through technologies to address mitigation and adaptation. While both terms include clean energy (wind, solar, biofuels etc.), and transport, climate tech also includes ag tech, carbon capture and technologies for mapping carbon sinks/forests.

- Mainstream VC/PE firms and celebrities are seeing promise in climate tech – highlighting that the trend is also reaching non-climate or clean energy-focused investors. Three of the largest VC/PE firms made large announcements in January. In the first week of January, TPG announced an exclusively climate-related fund, TPG Rise Climate, targeting solar, mobility and agriculture. While Union Square Ventures announced the close of its $162 million climate fund, already having made one investment in a satellite company to improve forests. Elon Musk’s $100 million tweet for carbon capture technologies made headlines, and Robert Downey Jr.’s new FootPrint Coalition Ventures fund was launched.

- We profile Total Carbon Neutrality Ventures (TCNV), which was renamed in 2019 from Total Energy Ventures to reflect the new focus on carbon-neutral and negative emissions technologies. TCNV runs a $400 million evergreen fund, targeting technologies that can be used for the core business of Total SE, and that have value to scale globally. The fund’s largest investments are in transport and new mobility, and energy transition technologies (such as smart energy and energy access software). Its various partnerships and ambitions for a $2 billion clean hydrogen fund place it in a strong position for the future of climate-tech investment.