By Kwasi Ampofo, Analyst, BloombergNEF

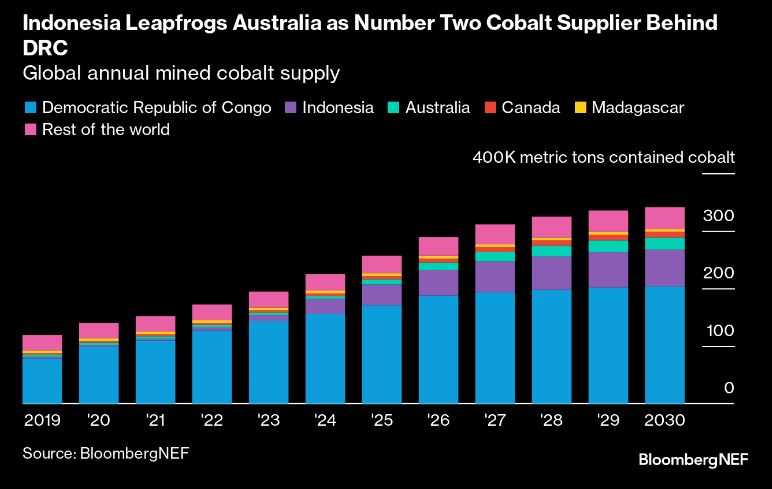

Indonesia overtook Australia to become the second-largest producer of mined cobalt last year, behind the Democratic Republic of Congo.

As demand for cobalt increases, propelled by the need for batteries for electric vehicles, the Southeast Asian nation is expected to increase its output and maintain its number two position this decade. BloombergNEF estimates Indonesia’s share of global mined cobalt will reach 19% by 2030, from 3% in 2022.

Cobalt from Indonesia is a by-product of nickel production. A flood of plans and announcements in recent years is starting to result in material cobalt supply additions in the country. Projects such as Lygend’s Obi Island HPAL and Huayou’s joint venture in Morowali, as well as additional capacity from Tsingshan and other nickel matte producers, have come on stream sooner than expected compared to typical time frames, despite some delays.

BNEF View

Key to Indonesia’s upstream success is its rich nickel resources, restrictions on unprocessed mineral exports and the requirement for miners to set up processing plants in order to access nickel used in the steel industry. The government also overhauled its permitting system to streamline the process.

The country is looking to replicate its policy actions in nickel and cobalt to achieve the same relative success in the lithium-ion battery and electric vehicle supply chain. It is already seeing some early progress, with several partnerships and plans for battery manufacturing investments emerging.

However, it remains to be seen if Indonesia will achieve its goals given the significant difference between the stainless steel and battery sectors. Unlike steel, batteries tend to be closer to their end-use markets due to the complexity and high cost of transporting cells. Without corresponding local demand for batteries, it becomes difficult to enforce a policy that permits the export of only cells or batteries.

In the absence of a favorable business environment that fosters the sustainable production of batteries and electric vehicles, an export ban alone will fail to incentivize a downstream manufacturing industry in the country.

Cobalt supply tends to have difficulty adjusting to changing market dynamics. As automakers and battery manufacturers engage in demand-side responses to cobalt risks, the outlook for cobalt consumption has been continually revised down. This makes it hard for producers to adjust their supply additions and plans, as cobalt is rarely a primary commodity in mining operations.

These challenges are reflected in the peculiar behavior in cobalt prices, which have crashed despite events leading to lower supply.

While cobalt demand forecasts have been revised down significantly through successive outlooks, BNEF expects cobalt to remain an integral part of the battery metals industry. Nickel-manganese-cobalt chemistries will remain dominant and the need for cobalt to stabilize these systems for safety cannot be understated.

The growth of Indonesia’s cobalt production this decade, coupled with new projects coming online in the DRC, will result in the market having enough cobalt to meet demand.