This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Copper miners are beginning to look for ways to grow supply

- BHP and Rio Tinto’s recent bids for copper mines rejected

Copper miners are looking to bolster their assets as they recognize the energy transition will drive up demand for the red metal. Target companies are not giving in easily, however, with Turquoise Hill Resources recently rejecting a £2.7 billion offer from Rio Tinto, and OZ Minerals rebuffing a $5.6 billion bid from BHP.

Learn more in our ‘AskBNEF: Is Copper the New Oil?’ webinar session. Register here.

Copper demand is set to grow by 53% to 39 million metric tons by 2040, according to BloombergNEF. However, supply is only projected to rise by 16% to 25 million tons in a base-case scenario, reflecting declining ore grades and difficulty developing greenfield mines.

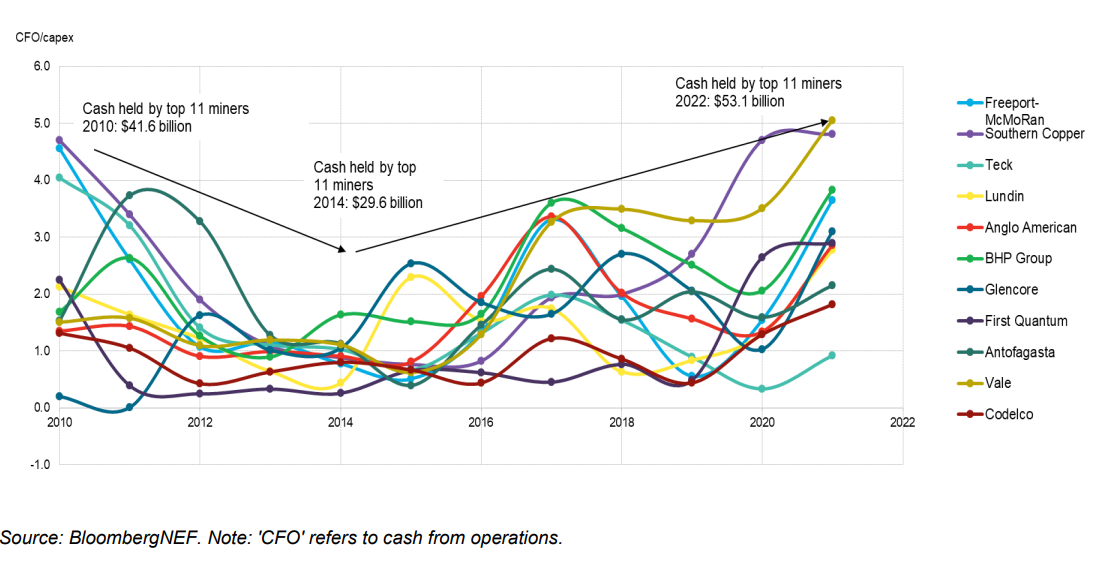

BNEF expects more consolidation in the near term to boost supply and lower costs. Copper miners have the cash to fund mergers and acquisitions, with BNEF analysis indicating the top 11 miners are sitting on $53 billion of cash and cash equivalents — the highest level in a decade.

Strict capital discipline must underpin any M&A wave to avoid a repeat of 2005-2010, when miners expanded indiscriminately in pursuit of growth, leading to a subsequent crash.

For more detail on these findings, an abridged version of the 2022 Energy Transition Investment Trends Report can be downloaded from this page. BNEF subscribers can find the full report on the client website and on the Bloomberg Terminal.