PRESS RELEASE

Data Centers Set to Double Their Power Demand in Europe, Could Play Critical Role in Enabling More Renewable Energy

Hyperscale and colocation data centers can be an important source of flexibility in Europe’s power system, helping to integrate higher renewable energy penetrations

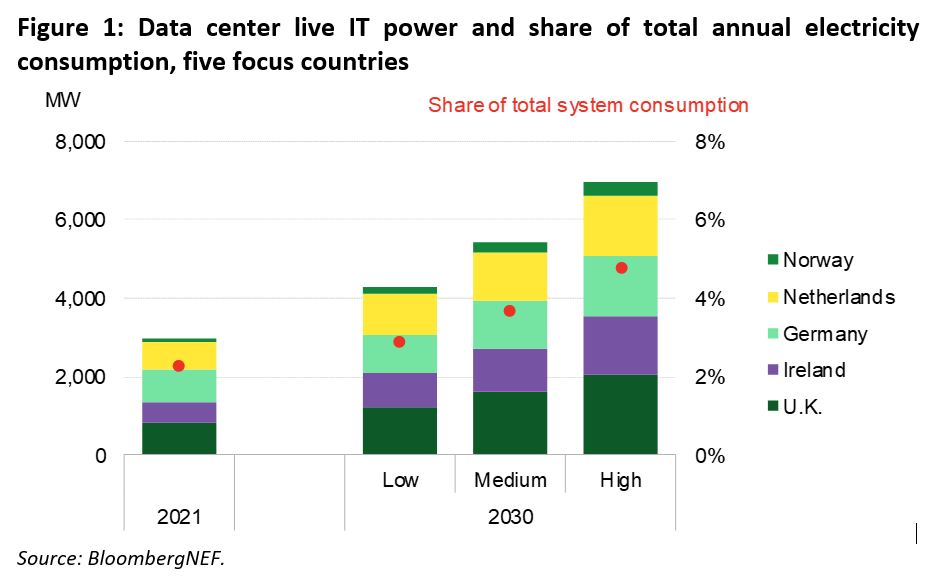

London and Berlin, October 14, 2021 – Large data centers in the U.K., Germany, Ireland, Norway and the Netherlands are projected to draw 5.4GW (gigawatts) in ‘live IT power’ demand in 2030, up from 3GW at the end of 2021, according to a new study published today by research company BloombergNEF (BNEF) in partnership with Eaton and Statkraft. That figure is based on a central scenario; the report also outlines a more aggressive growth scenario, which sees live IT power exceed 7GW by 2030. While generally seen as only a source of demand on the power system, the report finds that data centers are also a largely untapped resource to support the grid and the integration of renewables.

The study, Data Centers and Decarbonization: Unlocking Flexibility in Europe’s Data Centers, explores the growth of data centers in the five markets and how data centers could provide flexibility to the power system. Across Europe, wind and solar power are projected to approach 60% of total power generation by 2030. With these rising penetrations will come a greater need for flexibility. The study highlights the need for greater awareness of data-center flexibility not only among data-center operators and users, but also utilities and regulators.

Data centers could provide 16.9GW of flexibility in total across the five markets examined in the report from their on-site uninterruptible power supply (UPS), back-up generation, back-up batteries and load-shifting. This is greater than the amount of power demand expected from the facilities themselves, because these resources in principle can each independently provide flexibility to the power system, either by reducing the amount of power the data center draws, or by exporting power.

Michael Kenefick, lead author of the report and decentralized energy analyst at BNEF

, commented: “Data centers can be part of the solution for achieving higher renewable energy penetrations in Europe. Their on-site energy resources, such as uninterruptible power supplies and back-up generators, could in future be brought to bear to help support the grid. And computing tasks could also be shifted to times – or locations – of high wind and solar resource.”

Of the resources considered, UPS systems appear to be the most promising source of flexibility in the immediate term. Based on battery technology, they are universally installed in data centers, and are particularly well-suited to the task of providing fast frequency response (FFR), a service designed to help grid operators maintain a stable operating frequency. In the U.K., Ireland and Norway, data center UPS systems could be more than enough to meet total FFR needs. Some data center operators are already experimenting with providing such services using their UPS systems.

However, the report finds that data-center operators remain hesitant to bring these resources to bear to support the power system, citing service-level agreements with customers, a lack of visibility and transparency on the benefits of providing flexibility, and a lack of know-how. For this reason, BNEF estimates that only 3.8GW of flexibility might materialize from data centers in these markets by 2030. This is less than a quarter of the 16.9GW potential capacity, and equates to 1.7% of the expected peak load across the five markets in 2030.

Karina Rigby, president, Critical Systems, Electrical Sector at Eaton in EMEA

, said: “Data center facilities are unique and comparable to microgrids in the opportunities they offer through their computing power and physical infrastructure, particularly the vast amounts of battery energy storage attached to their existing back-up power systems. This study highlights the huge untapped potential of data center flexibility to deliver economic, regulatory and climate benefits. We are calling on grid operators, regulators, data center operators and users to collaborate to unlock data centers’ grid stabilization technology.”

When comparing the five countries in question, each faces different challenges and opportunities regarding data centers and the power system. Driven by growth in demand for computing and data storage services, both from businesses and end users, hyperscale and colocation data centers could account for as much as 24% of electricity demand in Ireland in 2030; 8% in the Netherlands, and 5% in the U.K., in the central scenario. In Norway and Germany, there is more headroom for growth, with data centers only projected to account for 2% of each country’s power demand in 2030.

Ireland is a mature market, where hyperscale operators have been investing for years, and is likely to keep growing despite some challenges integrating data centers into the power system. Ireland, the U.K., the Netherlands and Germany are each expected to post 80-104% in data center capacity from 2021 to 2030.

Norway, starting from the lowest base, is projected to see 205% growth in data center power demand from 2021 to 2030, thanks to its competitive industrial power prices and very high proportion of clean power in comparison with other markets, which make it an attractive destination for data center operators looking to run a ‘green operation’.

Albert Cheung, head of analysis for BNEF

, added: “Data center operators have already been leaders in pursuing renewable power purchase agreements to green their operations, and are increasingly looking for further ways to demonstrate their commitment to climate goals. As the wider power system adopts more renewables, they will have even greater opportunities, not only to buy renewable power, but also to be part of the solution for integrating them onto the grid.”

The full report is available for download via this link.

Contacts

Veronika Henze

BloombergNEF

+1-646-324-1596

vhenze@bloomberg.net

Vera Grishchenko

Eaton

+44-1753-608-851

veragrishchenko@eaton.com

About Eaton

Eaton’s mission is to improve the quality of life and the environment through the use of power management technologies and services. We provide sustainable solutions that help our customers effectively manage electrical, hydraulic, and mechanical power – more safely, more efficiently, and more reliably. Eaton’s 2020 revenues were $17.9 billion, and we sell products to customers in more than 175 countries. We have approximately 85,000 employees. For more information, visit Eaton.com.