Ramping up the deployment of clean technologies and phasing out carbon-intensive activities relies on well-designed, effective government support. A plethora of policy types are available – from contracts for difference and carbon markets, to tax breaks and performance standards – and different mechanisms will suit different technologies, sectors and geographies.

To help decision makers navigate this policy maze, BloombergNEF has released a new public report, Delivering Net Zero: A Framework for Policymakers. This resource explains our revamped NetZero Pathfinders framework designed to help governments and other stakeholders identify and implement the measures necessary to reach and support a net-zero economy.

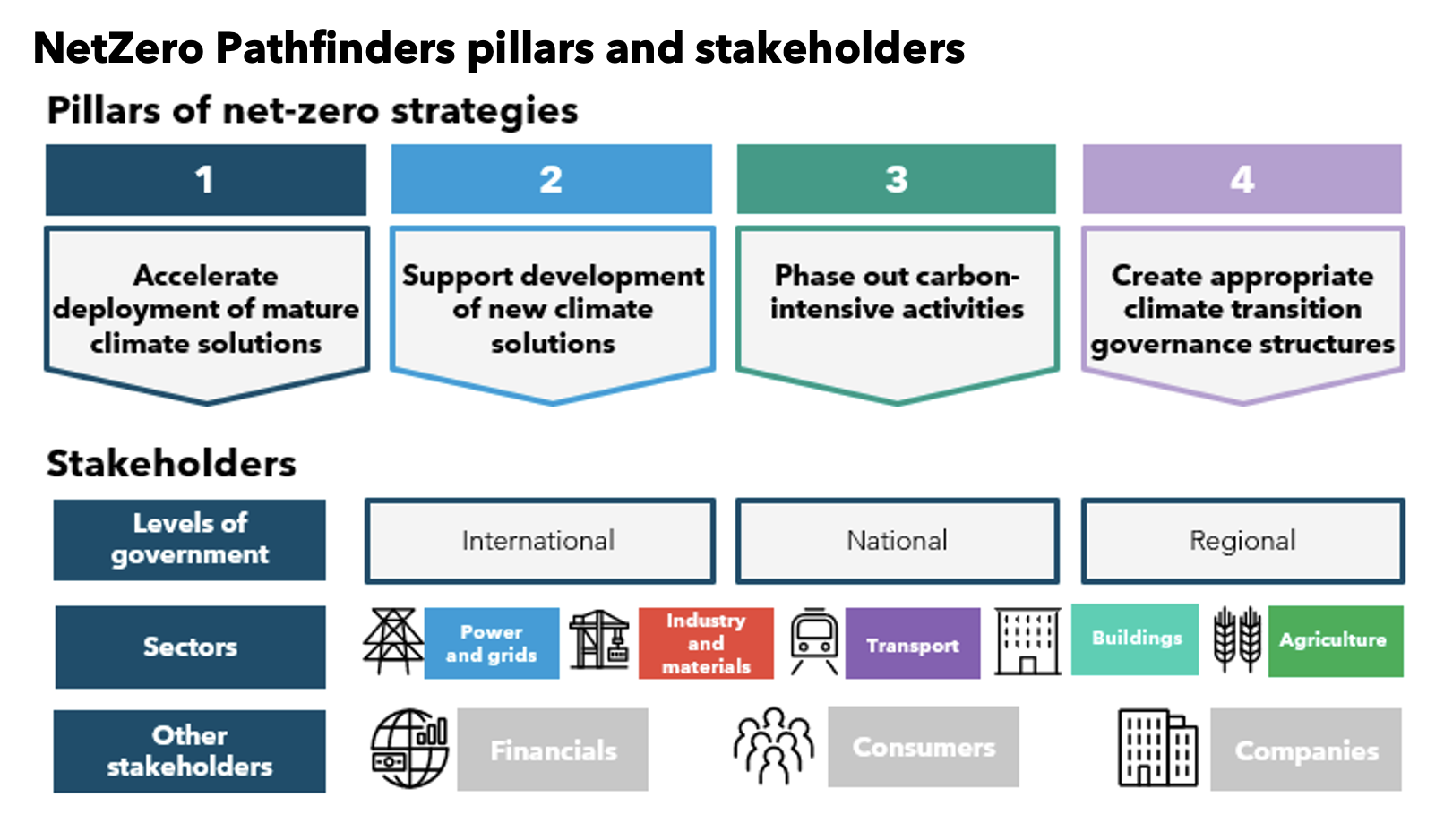

Identifying the pillars of net-zero strategies

The Pathfinders framework identifies four pillars that are central to designing good net-zero policy. These cover how to accelerate and support the deployment of both mature and newer climate technologies, how to wind down carbon-intensive activities and how to create governance structures that can accelerate the transition.

Highlighting effective actions today

For each pillar, BNEF analysts have identified specific policy actions needed to decarbonize each emitting sector of the economy. These actions target the financial institutions, consumers and companies that need to transition their activities, as well as the different levels of government that must lead the way.

Without immediate action, the carbon budget for 1.5C warming above pre-industrial levels will rapidly be depleted. Identifying, replicating, and scaling policy measures with demonstrated impact is thus critical. Pathfinders outlines actionable solutions that could accelerate progress by 2030, while also laying the foundation for decarbonizing harder-to-abate sectors in the years to come.

Telling success stories

Through trial and error, governments and others have been testing low-carbon policies for more than two decades. Pathfinders therefore highlights ‘best practices’ – that is, tried-and-true programs that have proved effective at driving decarbonization, as well as newer measures with high potential for future impact.

The best practices are powered by the expertise of hundreds of BNEF analysts, who use data to find and evaluate the most impactful climate solutions.

Take some examples. Competitive auctions have proved an effective way to accelerate deployment of mature climate solutions, in this case renewable energy (Pillar 1). In particular, they reinforce project bankability and incentivize a diverse clean energy technology mix. One highlighted best practice is Brazil’s pioneering auction program, which has procured more than 33 gigawatts of renewables capacity and helped attract over $200 billion in clean energy funding over 2007-2023.

Policies to phase out emission-intensive activities (Pillar 3) are needed, as long-lived fossil-fuel assets like coal-power plants continue to be built and governments still provide hundreds of billions of dollars in fossil-fuel subsidies. An effective policy action is to implement a carbon-pricing mechanism, with the EU Emissions Trading System offering a good example of this best practice. The world’s biggest carbon market by traded value, the EU ETS has helped cut power and industry emissions by 45% over 2005-2023.

Of course, these case studies are far from the whole story, and Pathfinders best practices aim to serve as inspiration for markets formulating their own net-zero strategies. By showing what really works, Pathfinders builds a community of decision makers and empowers them to drive innovation, implement policies and mitigate climate change.