By Vinicius Nunes, Climate Solutions Associate and Giulia Lopes, Latin America Research Analyst, BloombergNEF

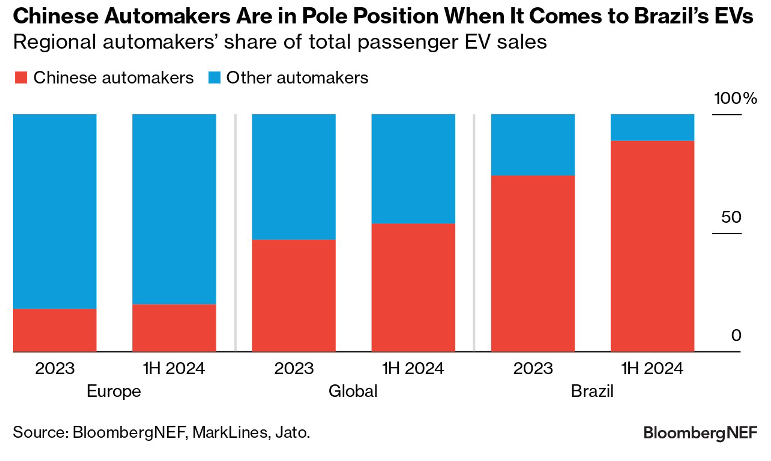

Nine out of 10 passenger electric vehicles sold in Brazil in the first half of this year were made by Chinese companies.

The South American behemoth holds three key attractions for Chinese automakers. First is its massive EV sales growth. Despite being at an early stage of transport electrification, Brazil has seen a rapid uptake of passenger EVs. Sales reached nearly 55,000 units in the first half of 2024, or 5.3% of all new car sales during the semester. That’s more than the number of EVs sold in 2023 in its entirety, and 2023 had already posted a whopping 178% year-on-year growth rate.

Second is the fact that Brazil has seen little political backlash to Chinese-made vehicles. Trade tensions with the European Union and the US and fiscal incentives have driven a wedge between these major markets and China, but Brazil has established no such trade barriers.

Third, focusing on emerging markets with less established competition and growing demand has helped Chinese EV makers – especially BYD – gain a first-mover advantage. Chinese automakers accounted for 89% of EVs sold in Brazil in the first half of 2024, up from 74% in 2023.

Yet the tide is shifting, and many EVs made by Chinese companies could soon be rolling off conveyor belts in Brazil.

A primary goal of President Luiz Inacio Lula da Silva’s administration has been to stimulate local EV manufacturing, and in January 2024, Brazil introduced an import tax on battery-electric and plug-in hybrid vehicles — the two types of EV — regardless of the exporting country. Currently, the import tariff is set at 18% for BEVs and 20% for PHEVs, but it is set to increase every six months until it reaches 35% for both BEVs and PHEVs in July 2026.

The Brazilian government has also offered targeted programs to spur local production. In June, President Lula signed into law the country’s new transport decarbonization policy, the Green Mobility and Innovation Program (Mover), which offers tax incentives to support low-emission vehicles, including standard and plug-in hybrids and fully-electric vehicles.

BYD and Great Wall Motor have thus made plans to start manufacturing EVs in Brazil, either this year or next. Once consolidated in Brazil, which is already the world’s eighth-largest car producer, Chinese automakers may seek region-wide growth. Led by Chinese companies, Brazil could emerge as a key EV export hub for the entire Latin America region.