Other European majors round out leaderboard while coal drags Asian utilities down

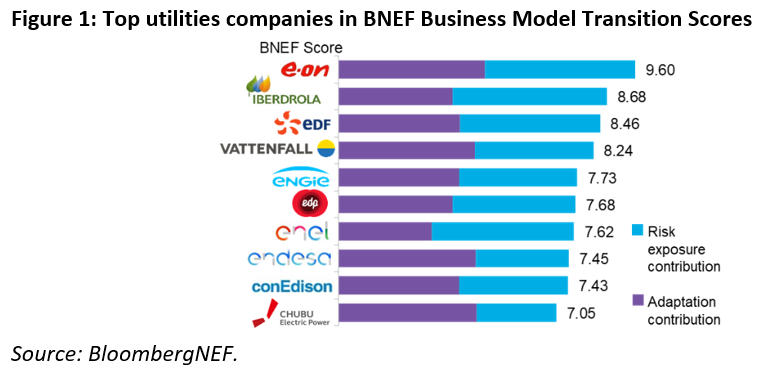

New York, April 6, 2022 – E.ON, Iberdrola and EDF beat other utilities when it comes to managing climate risk and are thus best-poised to take advantage of opportunities arising from the energy transition, according to a new report by research company BloombergNEF (BNEF).

BNEF’s Utility Transition Scores compare 98 major power companies on their preparedness for a low-carbon world. Eight of the top ten scorers are based in Europe, boosted by a policy ecosystem that prioritizes climate transition. In contrast, expansion of coal operations is the common denominator among laggards. Seven of the bottom ten companies have plans to grow coal-fired power generation. Many are located in Asian countries that don’t have government-mandated coal phase-out policies.

The BNEF Business Model Transition Scores help corporate leaders and investors gauge a company’s ability to grow and operate successfully in a net-zero world, relative to its peers. So far, scores are available for the oil, gas, metals, mining and utilities sectors, altogether covering 190 leading global companies. Importantly, scores are fully transparent, meaning all underlying data is published on the Bloomberg Terminal and available for download.

For utilities, the ability to generate relatively low-carbon power from renewables, hydro or even nuclear is a major determinant of transition risk exposure. Leading companies already fare well on this metric. The top ten scorers produce on average 0.16 tons of CO2 per megawatt-hour of power, but this rises to 0.67 tons for companies in the bottom ten.

Leaders are also seeding low-carbon business lines, for instance by developing projects across hydrogen, carbon capture, renewable power purchase contracts, and electric vehicle charging.

Danya Liu, sustainability analyst at BloombergNEF and lead author of the report said: “BNEF’s project-level data across all of these technologies is fundamental to transition risk evaluation. It cuts through the glaze of corporate commitments and makes progress across low-carbon innovation comparable across companies.”

Twenty-four distinct data fields were used to build the scores covering all aspects from company regulatory status to technology investment. “Clean energy enables the climate transition for all other sectors. So to understand how the global economy reaches net-zero, we have to accurately gauge how utilities, the providers of clean energy, are adapting and at what speed,” Danya Liu said.

Jonas Rooze, BNEF’s head of sustainability research, said: “Investors are increasingly asking questions about the climate transition because they recognize that it brings both potential risk and opportunity. Our proprietary transition scores, along with our revenue projections and other related research, help our clients identify and capitalize on the upside of the energy transition.”

The BNEF Business Model Transition Scores are complemented by the Bloomberg Intelligence Carbon Transition Scores, which evaluate a company’s current and projected carbon performance.

Contact

Veronika Henze

BloombergNEF

+1-646-324-1596

vhenze@bloomberg.net