By Daniela Li, Global Gas, BloombergNEF

El Niño conditions have developed in the tropical Pacific for the first time in seven years, according to the World Meteorological Organization. The onset of the first El Niño weather pattern in the region since 2016 foreshadows new challenges to an already delicate global gas balance.

BloombergNEF anticipates that El Niño, if it persists, may result in lower gas demand in Asia and Europe, assuming El Niño weather patterns follow similar trends as the last 10 years. It may also lead to worse typhoons and droughts, which will impact gas demand and delay liquefied natural gas cargo transits through key choke points, bringing more price volatility to the gas and LNG markets.

While El Niño might raise winter temperatures based on the trends seen in the last decade, it may also set the stage for more disruptive weather patterns, such as floods, droughts, extreme heat waves and storms. An El Niño event usually means warmer weather in most of Asia and western Canada in winter, with more rainfall in southern China and the US, according to the US National Oceanic and Atmospheric Administration. While in the summer, El Niño typically produces dry weather in Australia, India, Indonesia, the Philippines and scorches Central America.

Last 10 years suggests El Niño tends to lower winter gas demand of major LNG importers

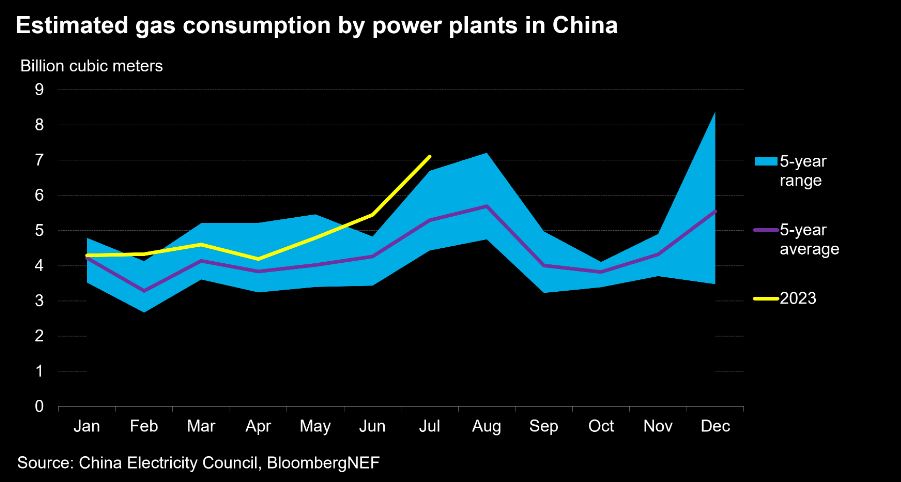

El Niño’s warming effect becomes more acute amid rising global temperatures. June and July this year proved to be the hottest on record. Power grids around the world are struggling to keep up, which boosts demand for gas. China, for example, saw gas burn in power plants rise to an all-time high in June and July to satisfy cooling demand, despite much higher costs than other electricity sources.

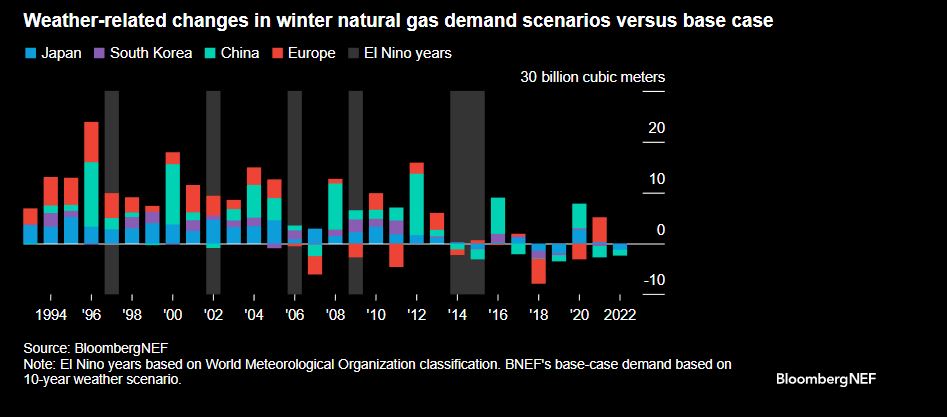

While it brings hotter heat waves during the summer, El Niño might also set the stage for a warmer-than-usual winter as trends in the last 10 years suggest. BNEF developed quantitative models to establish the relationship between temperature and gas demand to model the gas use for the coming winter (October-March) and summer (April-September). Base-case demand assumes the average temperature for the period from 2013 to 2022.

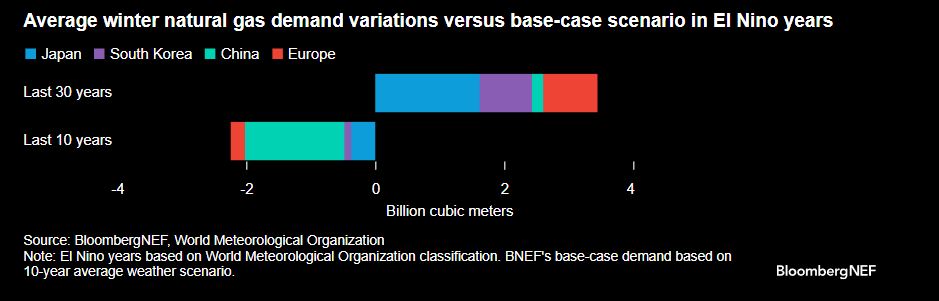

Considering only the last 10 years, the winters in El Niño years such as 2014 and 2015 were warmer than the 10-year average in China, Japan, South Korea and Europe. According to BNEF’s modeling results, gas demand could be 2.2 billion cubic meters, or 1.6 million metric tons of LNG less than the base case if the coming winter’s weather follows El Niño patterns in the last decade.

But if the time frame of analysis is expanded to the last 30 years, winter temperatures in El Niño years were lower than the 10-year average, indicating the possible impact of global warming trends on climate. Demand could be on average 3.4 billion cubic meters above the base case if El Niño conditions follow similar trends as the last 30 years.

Droughts brought by El Niño dry up LNG shipping lanes and reservoirs

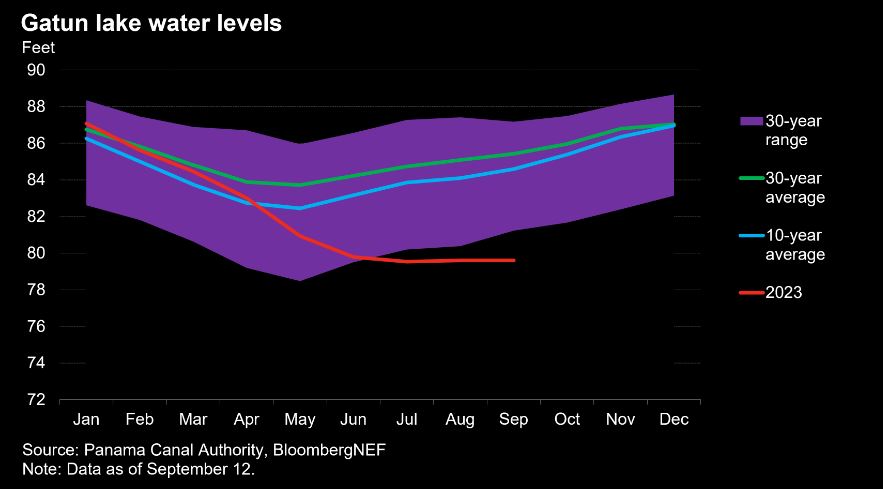

Lower water levels due to dry weather from El Niño are leading to a global shipping bottleneck at one of the world’s busiest shipways, the Panama Canal. Drought conditions have parched shipping lanes, resulting in a backlog of tankers. Gatun Lake, which supplies the canal, saw water levels at just 80 feet on Sept. 12, compared with a 10-year average of 85 feet.

The daily number of ships crossing the canal has dropped from 36 to 32. If shippers want to beat a logjam of vessels snarled at the canal, they need to pay millions of dollars to bid for open slots. Asia-bound US LNG tankers are estimated to be the most affected, accounting for about 20% of the total LNG trade. The Panama Canal Authority has warned that the marine traffic jam may continue into 2024.

Some countries may have to rely more on LNG imports due to El Niño-induced dry weather. For example, Colombia has raised LNG imports to make up for lower hydroelectricity generation due to dry weather amid El Niño. Gas power plants need to ramp up output as hydropower, which accounts for around two-thirds of the country’s installed capacity, is failing to meet electricity demand. In the first eight months this year, the country imported 0.3 million tons of the super-chilled fuel, more than triple of the same period last year. The surge in LNG demand from smaller players like Colombia can take away much-needed spot cargoes, causing unexpected tightness in global supplies ahead of winter.

Typhoons and floods put gas demand and infrastructure facilities at risk

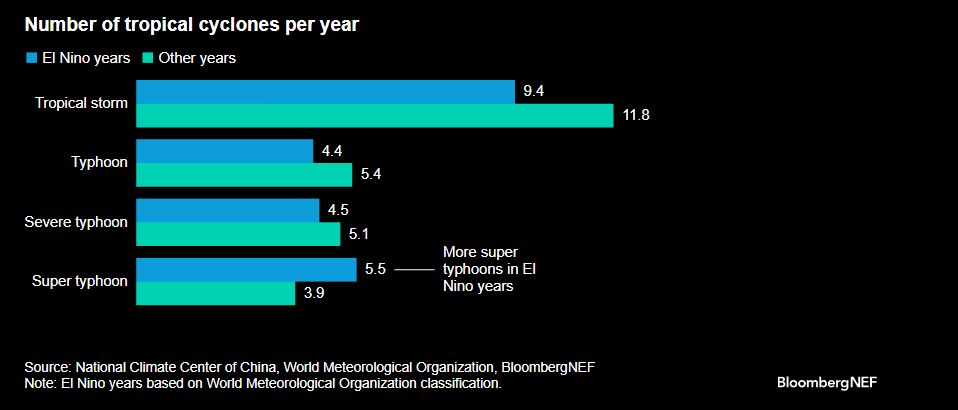

Higher water temperatures in the Pacific due to El Niño are expected to lead to stronger cyclone activity. According to the National Climate Center of China, more super typhoons were formed in the Pacific basin during El Niño years, despite a slightly lower number of cyclones. Super typhoons are the strongest with maximum sustained wind speeds near the center greater than 185 kilometers per hour, while severe typhoons have wind speeds of 150-184km/h near the center. There have been six super typhoons this year, compared with around four on average. Three of these hit China, wreaking havoc along the coast and forcing facilities to close, ranging from gas-burning factories to LNG receiving terminals.

China is also more likely to experience floods in the summer of years following El Niño. The phenomenon is typically associated with heavy rainfall in southern China, especially along the Yangtze river. While this could mean higher hydropower generation and less demand for gas power, severe floods will also damp industrial activities that reduce fuel demand.