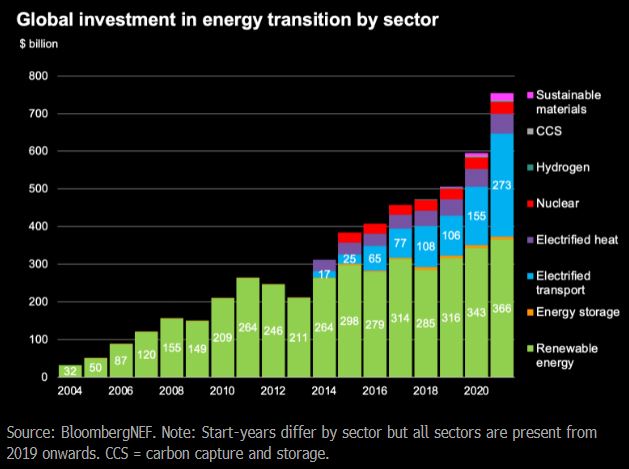

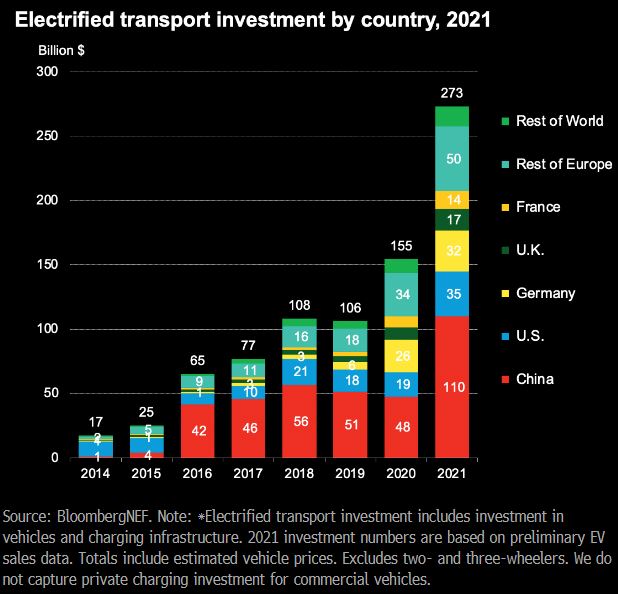

Global spending on electric vehicles (EVs) and charging infrastructure surged by 77% to $273 billion in 2021, according to BloombergNEF’s latest Energy Transition Investment Trends report. Since 2014, investment in the electrified transport sector has risen by a compound annual growth rate of around 48%, narrowing the gap with spending on renewable energy. Based on current trends, EVs are on course to overtake investment in renewables this year.

China was the dominant force in 2021, regaining its crown as the global leader in EV investment after falling behind Europe in 2020. Spending on EVs in China more than doubled last year to $110 billion. Passenger EV sales in the country hit 3.3 million units, which is more than all of the passenger EVs sold globally in 2020.

EV investment in the U.S. increased by 88% to $35 billion, as sales of passenger EVs there also saw a more than twofold increase to around 652,000 units. Tesla’s reign at the top continues, with the automaker comprising over half of the U.S. EV market.

Germany came in third in 2021, investing about $32 billion in electrified transport, followed by the U.K. and France with $17 billion and $14 billion, respectively. Passenger EV sales have soared in Europe, propelled by stringent fuel economy regulations, new models, rising demand and, in some cases, generous subsidies.

Electric buses, commercial EVs trail behind

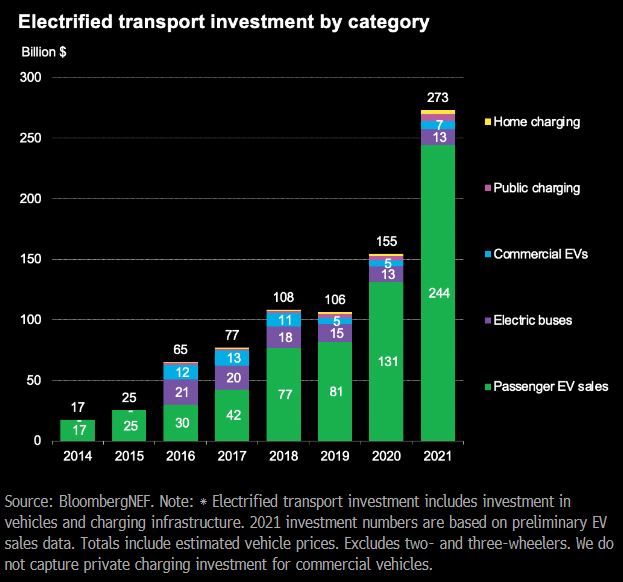

The bulk of global spending on electrified transport is for passenger EVs, with the market having grown 14-fold over the past eight years. Sales jumped by almost 90% in 2021 to $244 billion.

Electric bus sales remain a distant second, and investment was flat last year at around $13 billion. The majority of annual e-bus sales are still in China, as the rest of the world is just beginning to expand its fleets. Meanwhile, higher demand for medium- and light-duty commercial EVs saw investment in this segment rise by 36% to $6.7 billion.

All of these EVs — and those to come — require charging facilities. Investment in public charging continued to outpace spending on home charging in 2021, hitting $5.5 billion compared to $3.7 billion. This was driven by the installation of ultra-fast chargers, which tripled year-on-year. Ultra-fast chargers now make up 27% of all installations, up from 10% in 2020.

For more detail on these findings, an abridged version of the 2022 Energy Transition Investment Trends Report can be downloaded from this page. BNEF subscribers can find the full report on the client website and on the Bloomberg Terminal.