By Aleksandra O’Donovan, Head of Electric Vehicles, BloombergNEF

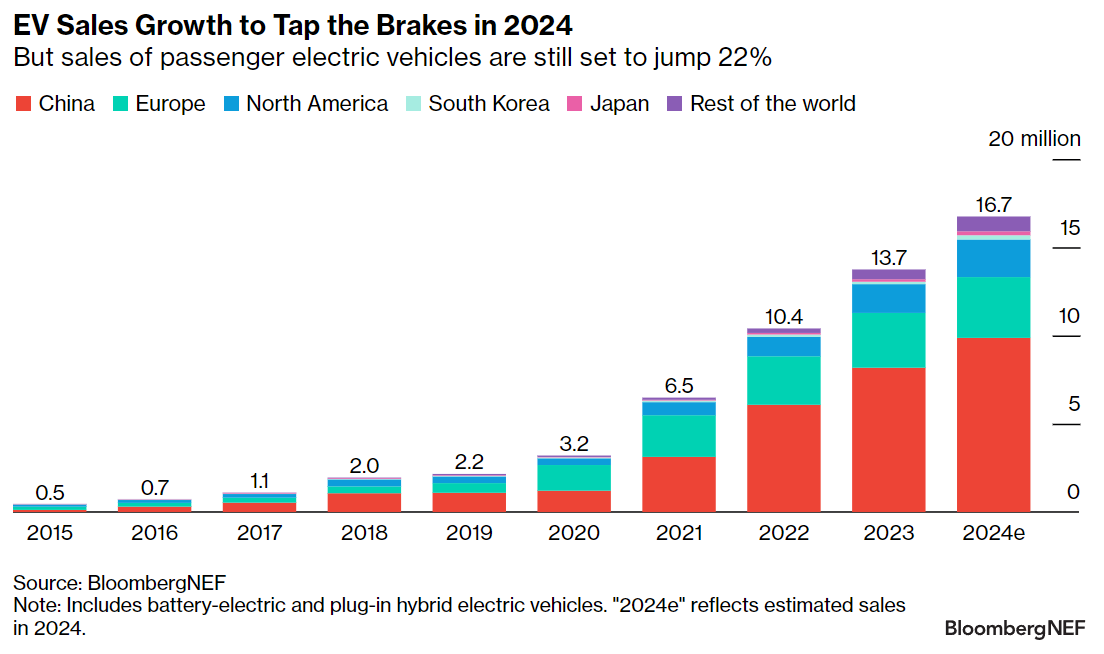

With 4.4 million units sold globally in the fourth quarter, and 13.7 million in 2023 as a whole, electric vehicles made up 18% of total passenger vehicle sales in the world last year.

But while EV sales are forecast to keep rising – BloombergNEF expects them to reach 16.7 million in 2024 – a likely slowdown in annual growth rates is on the horizon. A regulatory reshuffle in Europe, market saturation in China and uncertainty in the lead-up to the US presidential election could all take a bite out of consumer confidence.

- The passenger EV market in China grew 44% year-on-year in 4Q 2023, with nearly 2.9 million cars sold. The year as a whole saw a growth rate that was almost as impressive, with a 35% rise from 2022 to close to 8.2 million EVs. Still, a slowdown is approaching: BNEF anticipates EV sales in China will climb by just 21%, to 9.9 million units, this year, dragged down by weaker regulations, market saturation and a tough economic outlook.

- EV sales in Europe fell 11% in 4Q 2023, to just over 840,000 units, marking the region’s first year-on-year decline since 2016. Diminished pressure from fuel-economy targets and subsidy changes in markets like France and Germany will keep growth in the region muted in 2024. Sales are expected to reach 3.4 million cars this year – just 10% more than in 2023.

- In North America, EV sales rose 37% in 4Q 2023. Some 1.6 million EVs were sold across the US and Canada in 2023 as a whole, up 49% from the year before. In 2024, BNEF forecasts a further 31% growth, to hit 1.9 million units sold in the US and 230,000 in Canada. Still, for that total to be reached, the Big Three automakers – GM, Ford and Stellantis – need to step up their efforts.

BNEF clients can access the full report here.