By Yayoi Sekine, Head of Energy Storage, BloombergNEF

Battery overproduction and overcapacity will shape market dynamics of the energy storage sector in 2024, pressuring prices and providing headwinds for stationary energy storage deployments. This report highlights the most noteworthy developments we expect in the energy storage industry this year.

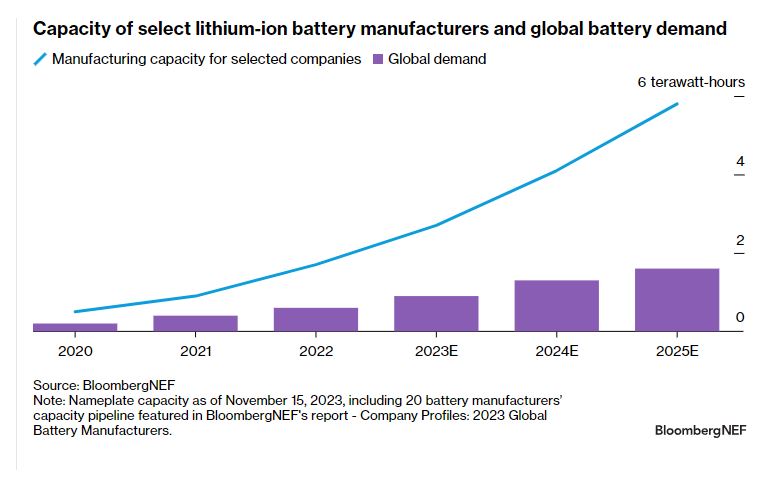

- Prices: Both lithium-ion battery pack and energy storage system prices are expected to fall again in 2024. Rapid growth of battery manufacturing has outpaced demand, which is leading to significant downward pricing pressure as battery makers try to recoup investment and reduce losses tied to underutilization of their plants.

- Markets: Lower prices are good for EVs and stationary storage markets. Stationary storage additions should reach another record, at 57 gigawatts (136 gigawatt-hours) in 2024, up 40% relative to 2023 in gigawatt terms. We expect stationary storage project durations to grow as use-cases evolve to deliver more energy, and more homes to add batteries to their new solar installations. EV sales are headed for another record year in 2024 (though there is some caution with US and Europe market slowdown).

- Battery improvements to watch include the uptake of larger cells at a record pace, catalyzed by intense competition to drive costs down. Both prismatic LFP cells in stationary storage and large cylindrical cells for EVs are gaining traction, taking away market share from pouch cells.

- Beyond lithium-ion batteries, other long-duration energy storage (LDES) technologies have a critical year ahead. China has forged ahead with its LDES development and will remain the frontrunner this year, even as US, UK, Australia and other markets support LDES growth.

- Battery recycling heads for an interesting year, as new material availability does not keep up with recycling capacity scale-up. BNEF expects projects delays and even cancellations.

- How we did in 2023: Our predictions came out looking good: we were mostly right on the impact of policies like IRA on other markets such as China and Europe, and on technologies like sodium-ion batteries, solid-state batteries and pumped hydro storage. Our biggest miss was on battery prices.

BNEF clients can access the full report here.