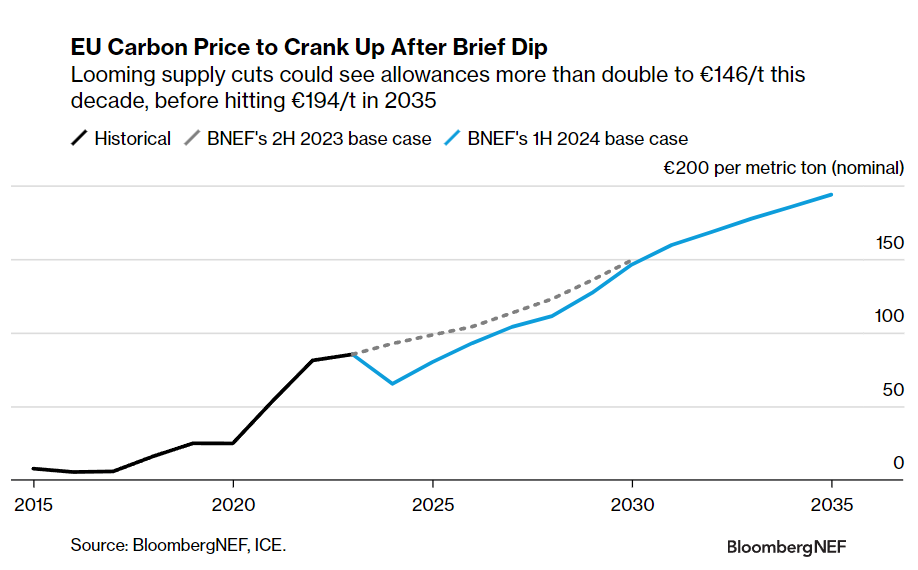

The moment of calm in the European Union’s carbon market after widespread reforms were finalized in 2023 was short-lived. The decision to front-load allowance supply amid tumbling emissions has since pushed prices into a valley. But the implementation of the agreed reforms and a plethora of additional policy reviews to come set the stage for a bullish run from 2026.

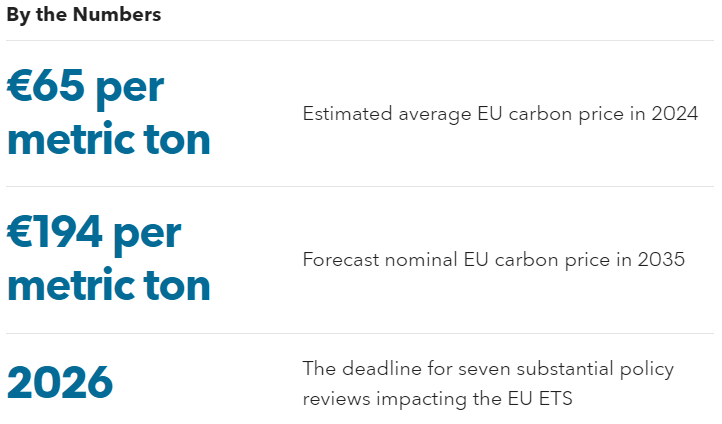

BloombergNEF expects the price of EU emission allowances to dip to an average of €65 per metric ton ($70/t) this year, before more than doubling to €146/t by the end of the decade. Prices could approach the €200/t milestone in 2035 if policy parameters remain unchanged.

- Price outlook: BNEF’s latest forecast for the price of EU emission allowances averages €95/t across 2021-2030 – a downward revision from €104/t in the 2H 2023 Outlook. This reflects ample supply and lower emissions, with prices averaging just €65/t this year, before increasing to €80/t in 2025. An embedded bullishness is expected to push prices to almost €150/t by 2030, as cheaper forms of emissions abatement are exhausted and the supply of allowances is reduced. By the middle of the next decade, if policy parameters stay the same in Phase 5 of the EU Emissions Trading System, prices could hit €194/t in 2035.

- Drivers: Growth in renewables capacity will continue to support power sector decarbonization and reduce the need for utilities to hedge their future exposure. Meanwhile, Europe’s energy-intensive industries have been slow to recover from the energy crisis. Both factors will suppress emissions and in turn prices in the near term. But 2026 could mark a tipping point as a variety of largely bullish policy amendments and legislative reviews unfold. The maritime sector will be fully phased in to the EU ETS, aviation’s receipt of free allowances will cease, the reduction of free allocation due to the Carbon Border Adjustment Mechanism will start, and seven substantial carbon market policy reviews will be finalized.

- Risks: The exact volume of allowances needed to reach the €20 billion REPowerEU funding target remains to be seen. Moreover, the restoration of the relationship between carbon and natural gas prices will keep the carbon market sensitive to geopolitical events. Finally, discussions around the potential inclusion of carbon removals and international aviation, or adjustments to free allocation benchmarks, could also start to impact prices.

BNEF clients can access the full report here.