By Emma Coker, European Carbon, BloombergNEF

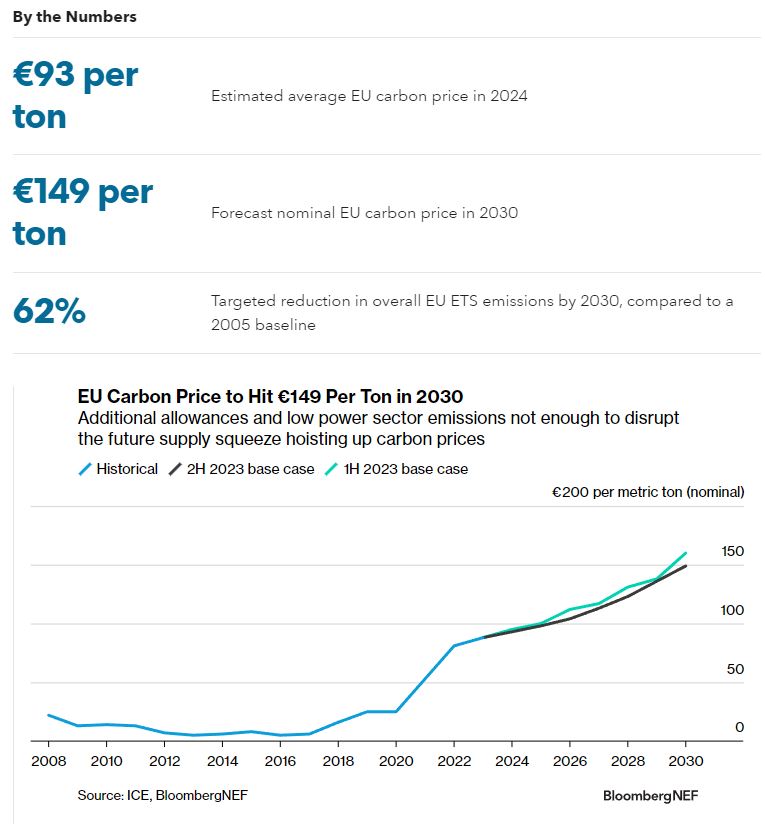

The European Union’s Emissions Trading System is cementing its status as the world’s most valuable carbon market. With the bloc having managed to legislate ambitious reforms during an energy crisis, allowance prices have stabilized at around €88 per metric ton ($93/t) this year. This resiliency has reinforced the market’s efficacy as a decarbonization policy tool, tipping the economics in favor of low-carbon options in the absence of Russian pipeline gas. BloombergNEF expects an average allowance price of €93/t in 2024, rising to €149/t by the end of the decade.

- Price outlook: BNEF’s latest forecast for the price of EU emission allowances in the fourth phase of the trading system is slightly lower than estimated six months ago – averaging €104/t across 2021-2030 compared to €108/t in our 1H 2023 Outlook. This reflects a dampened outlook for near-term power sector emissions and the latest proposals for front-loading allowance supply to raise money for the REPowerEU plan to shift away from Russian fossil fuels. BNEF still expects prices to keep climbing steadily, however, to €98/t in 2025 and more rapidly to €149/t in the latter half of the decade.

- Drivers: BNEF expects REPowerEU’s €20 billion fundraising target to be reached before the full amount of allowances set out in draft amendments for the plan is auctioned, exacerbating the bearish near-term effect of this measure. In the long run, prices are forecast to be buoyed by aggressive supply cuts to align the market with its objective to lower emissions by 62% by 2030 compared to 2005 levels – a particularly ambitious goal for the maritime and industrial sectors, where few cheap abatement options are currently available.

- Risks: Though gas prices have fallen significantly, energy security remains front of mind as Europe enters its second winter with minimal Russian pipeline gas. Any market jitters that reverse the economics of power generation in favor of more emissions-intensive coal, or cold weather that ends persistent gas demand reduction could boost emissions and, in turn, allowance prices and demand

BNEF clients can access the full report here.