By Corey Cantor, Electric Vehicles, BloombergNEF

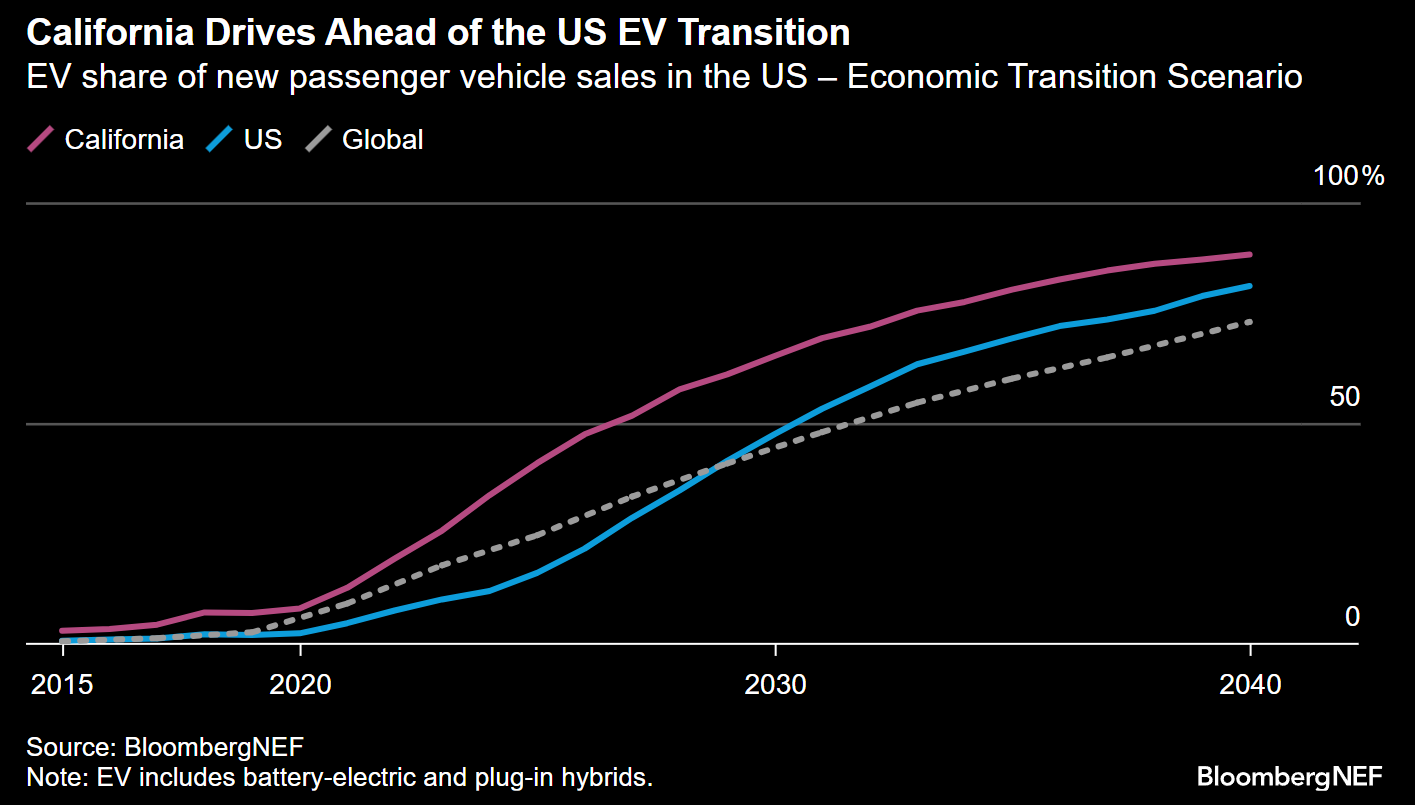

The slowdown in US electric vehicle sales may be a mere blip. They could make up almost a third of new car sales by 2027, according to BloombergNEF’s latest electric vehicle outlook, assuming the current policies remain in place. Electric vehicles accounted for 10% of new US car sales last year.

The modest near term growth gives way to a much stronger momentum as new EV models — with many in the “affordable” category — are launched by Ford, Rivian and Tesla, while the local manufacturing capacity of automakers like Hyundai, BMW or Toyota is ramped up.

By 2027, US EV sales are seen rising to 4.5 million units, against less than 1.5 million last year. EVs are projected to reach 48% of new passenger vehicle sales by 2030, almost meeting President Biden’s target of 50%, in BNEF’s Economic Transition Scenario or ETS, which tracks how current techno-economic trends drive the EV transition with no new policy intervention. This means sales of about 7.7 million EVs in 2030.

The old saying of “ So goes California, so goes the nation ” may very well play out in electric vehicles. The golden state remains a leader in US vehicle electrification, having pushed EVs through the utilization of purchase incentives, charging infrastructure funding and forceful fuel economy standard regulations for years. In 2023, nearly one in four of all vehicles sold in the state were electric. Electric cars will represent 65% of new car sales by 2030, under the ETS, and reach almost 90% by 2040.

California is planning to phase-out sales of conventional internal combustion engine vehicles by 2035 — while still allowing for 20% of new car sales to be plug-in hybrids or PHEVs after that time. The state could once again model what an electric vehicle future looks like for the rest of the country.

Some automakers like Toyota are arguing that plug-in hybrids should be part of the solution for US vehicle electrification. PHEVs represented around 20-25% of US EV sales over the past three years, which is lower than the global average. Under the ETS, BNEF does not expect the PHEV share of EV sales in the US to change dramatically, though they will continue to represent around a fifth of new car sales, peaking at the end of this decade.

Challenge with hybrids

The major challenges facing PHEVs globally and in the US include unfavorable public policies, limited model availability and high upfront costs. In the US, nearly half of all PHEVs were sold by one automaker: Stellantis.

There are only a number of high-volume PHEV models, most prominently Jeep’s Wrangler PHEV, Toyota’s Prius and RAV4 Prime. These vehicles in the US offer a far less compelling package than in other regions in terms of mileage, with around 48 kilometers (30 miles) of all electric range on average — nearly half of what Chinese PHEVs offer for an all-electric mode.

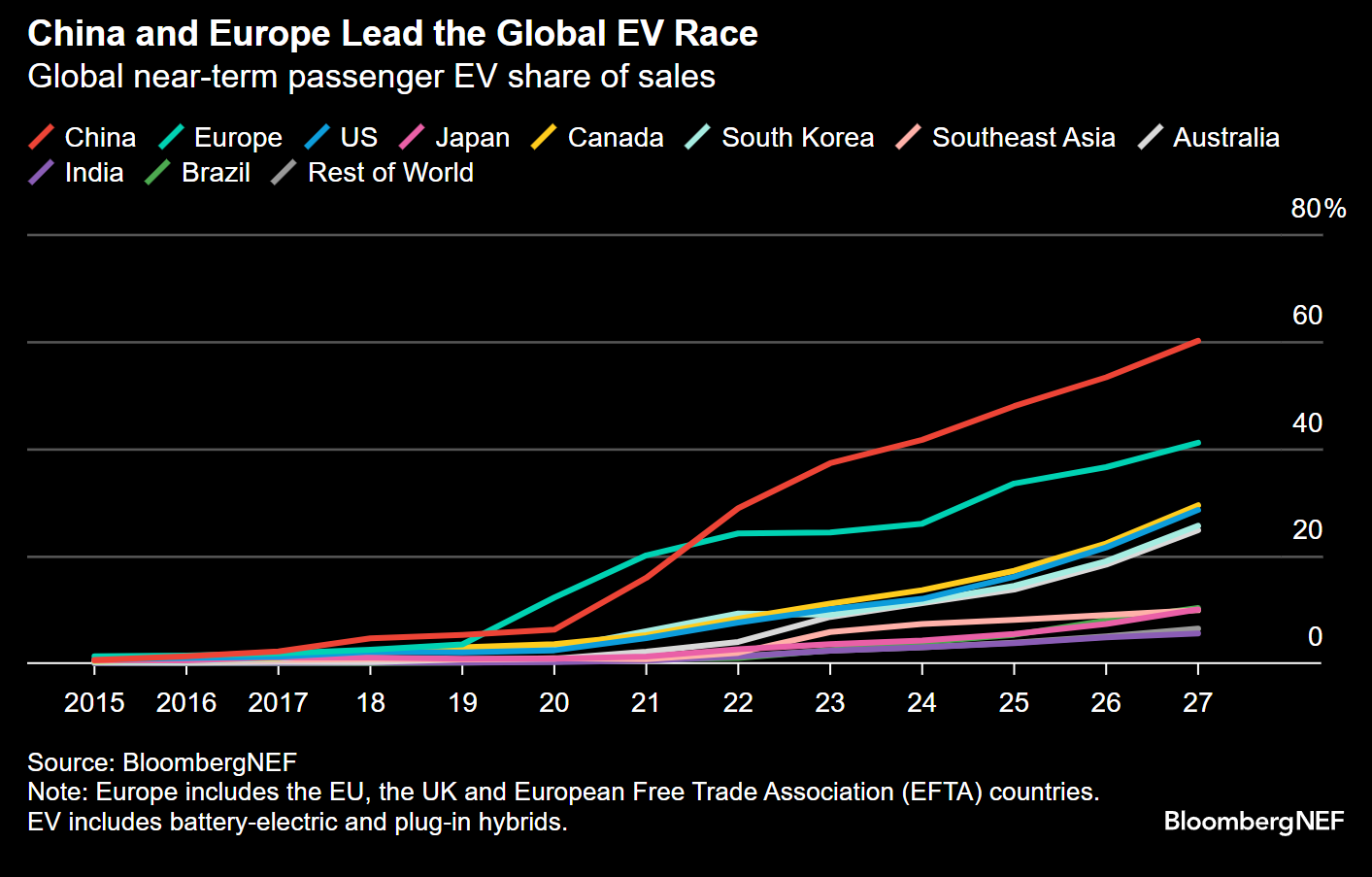

The global EV picture mimics what is happening in the US market. There has been a slowdown. Electric car sales are seen rising 21% annually to 2027, compared to the average growth of over 60% between 2020 and 2023.

US market growth trails that in China and Europe, where EV sales are expected to make up 60% and 41% by 2027respectively.