ARTICLE

Financing the Transition: Energy Supply Investment and Bank-Facilitated Financing Ratios 2022

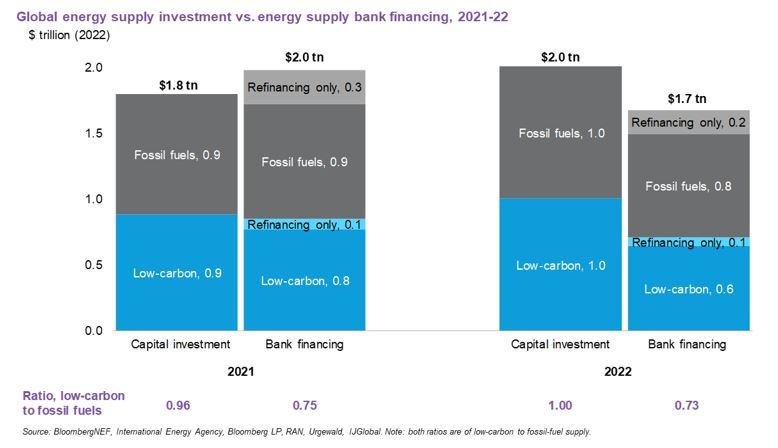

Investment in energy supply, including low-carbon sources, increased last year as the recovery from the Covid-19 pandemic and Russia’s invasion of Ukraine triggered a spike in commodity prices and capital investment in energy assets. Simultaneously, many economies – both developed and developing – hiked interest rates to address inflation, which affected financing volumes. As a result, the volume of bank financing diverged from capital investment in 2022. Various secondary factors, such as higher operating cash flows and the growing share of small-scale solar compounded this.

In this second edition of our annual report on energy supply financing, we analyze the factors affecting both capital investment and financing, and update our analysis of bank-facilitated financing. In 2022, financing for low-carbon energy was 73% of that for fossil fuels – meaning that

for every dollar supporting fossil-fuel supply, $0.73 supported low-carbon energy

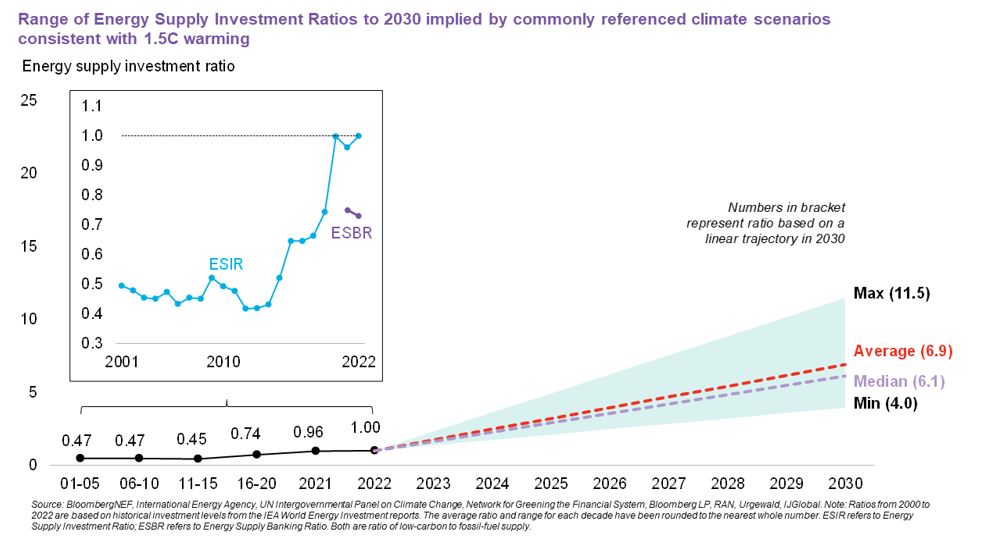

, a slight decline from $0.75 in 2021. Despite improvements in the ratio of real-economy investment, neither this nor bank financing is changing at the pace or scale required to hit the minimum 4:1 ratio needed this decade, as implied by commonly referenced climate scenarios that limit global warming to 1.5C.

Download the summary report here.

-

Real-economy investment activity

reached parity between fossil fuels and low-carbon supply, and grew in volume in 2022 to $2 trillion. But bank-facilitated financing diverged. Elevated energy prices bolstered operating cash flows, enabling higher capital expenditure that was independent of bank-facilitated financing, the latter of which was less economically attractive due to higher interest rates. Finally, small-scale solar grew to 20% of low-carbon capex and as this is not captured in banks’ financing or real economy corporations, we believe it contributed to the divergence.

- At 0.73:1, the 2022

Energy Supply Banking Ratio

, or ESBR, declined slightly from 2021, when it stood at 0.75:1. Overall energy supply financing volumes also fell. Bank financing for energy supply totaled $1.7 trillion, down from $1.95 trillion in 2021. Meanwhile, low-carbon financing dropped more than for fossil fuels, from $851 billion to $708 billion.

-

The ratio of coal investment to fossil fuels

is currently at 0.18:1 but needs to decline to 0.06:1 this decade to be on track for 1.5C warming. For bank-facilitated financing of coal, the ratio to fossil fuels is at 0.13:1, or $122 billion, 76% of which is within China.

Download the summary report here.

For more BloombergNEF analysis on energy transition investment ratios, BNEF clients can read Investment Requirements of a Low-Carbon World: Energy Supply Investment Ratios (web). For institution-level volumes and ratios, see Financing the Transition: Energy Supply Investment and Bank-Facilitated Financing Ratios (web | terminal).