By Andreas Gandolfo, Team Leader, and Kesavarthiniy Savarimuthu, Associate, European Power, BloombergNEF

European gas prices are continuing to ease as it becomes increasingly evident that the region will head into next winter with its storage tanks full. Falling prices are bringing gas generators back into the money, displacing coal and lignite plants from the supply stack.

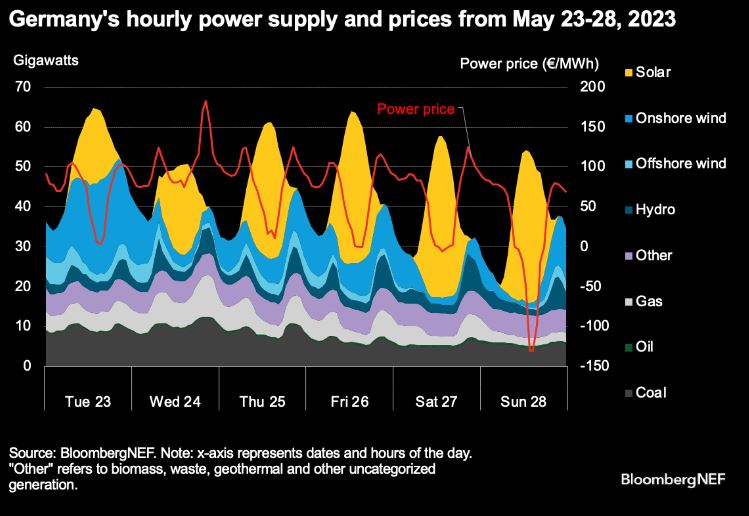

As gas prices decline, the impact of rising renewables is also becoming ever more evident. Germany saw negative power prices over the last weekend of May, as high solar output coincided with low electricity demand.

Negative price events will become more common as intermittent renewables spread across the continent. European utilities are ramping up their climate ambitions. RWE AG announced it would align its decarbonization strategy with a 1.5-degree global warming target. This will be no easy feat for the company, which relies on fossil fuels for over two-thirds of its output.

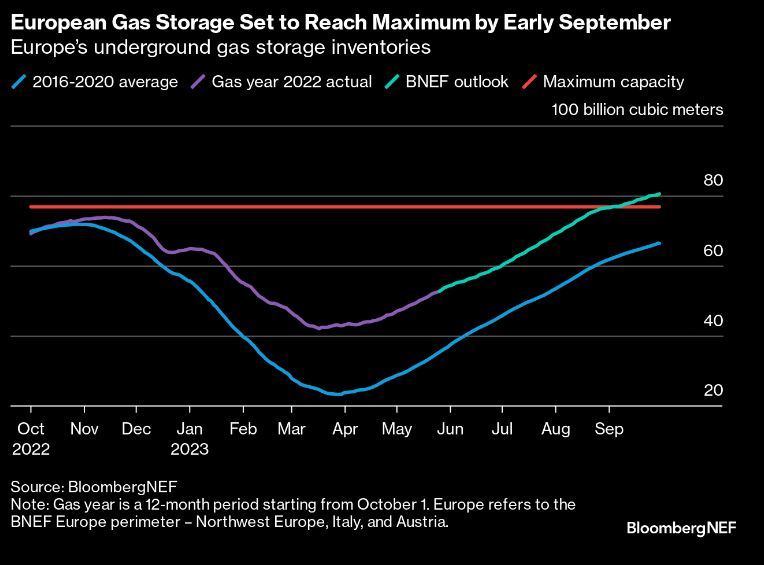

Filling storage eases gas prices

Europe is on course to completely fill its gas storage ahead of winter, relieving gas price pressure. According to BloombergNEF’s latest outlook for the region’s gas market, the ‘Europe Perimeter’ – Northwest Europe, Austria and Italy – is on track to reach tank tops by early September. This reduces the chance of gas shortages in the coming winter, bringing down power prices and volatility.

The storage projection does hinge on Asia’s liquefied natural gas demand staying at current levels, although this is not an unreasonable expectation. In the power sector, record-high wind and solar generation in 2023, combined with continued electricity demand destruction, have kept gas burn in the power sector in check, despite a recovery in the relative economics of gas plants compared to coal.

BNEF observes lignite-to-gas fuel switching in Germany. The decline in gas prices has made gas plants cheaper to run than lignite-powered plants in Germany. As a result, lignite’s share of fossil-fuel-fired generation in Germany dropped to 40% at the end of May, from 60% at the start of the month – for more, see BNEF’s European Power Markets Monitor. For the time being, gas generators are displacing only the least efficient lignite plants. To displace the remaining 4 gigawatts of highly efficient lignite assets, gas prices would have to dip below €20 per megawatt-hour ($22/MWh). They are currently around the €23.5/MWh mark.

Weather driving power prices in spring and summer

A mixed weather forecast for Europe suggests an easy June for power. Weather forecasters expect higher-than-average June temperatures over a band in Europe running from Ireland to Germany and Poland. At the same time, the Nordic and Mediterranean regions should see cooler weather. This should help keep gas use in Europe’s power sector over June in check.

Electricity demand in the countries expected to see higher temperatures, like Germany, is not as responsive to heat as in the Mediterranean region. At the same time, forecasters expect more rain in Southern Europe. This would help replenish hydro reservoirs in Spain and Italy, which have struggled to refill due to dry weather – for more, read Europe’s Hydro Recovery Muted as Reservoirs Conserve Water. A recovery in hydro reservoirs would drive an increase in hydropower generation, which is critical for keeping Southern European gas consumption down in the summer.

High solar generation brings negative power prices in Germany. On May 28, mid-day power prices in Germany turned negative, dropping to -€130/MWh, the lowest hourly price of the past six years. Solar generation rose to 38 gigawatts and combined with low weekend demand to drive prices down.

Such negative price events will become ever more common in Europe as variable renewables grow and legacy, inflexible thermal assets continue to operate as backup. This is a double-edged sword. On the one hand, negative price events provide the necessary investment signal to flexible technologies like batteries and demand response. On the other, they erode the investment signal for renewables – for more, see 2023 Spain Power Market Outlook.

RWE ups its climate ambition

RWE’s more ambitious climate plan is no easy task. On May 31, the utility announced plans to align its CO2 emissions reduction target with global efforts to limit warming to 1.5 degrees above pre-industrial levels. While lowering emissions is likely a one-way street for RWE, achieving this objective without suffering a loss in value will not be easy.

Market dynamics in the coming years are going to eat into the share of RWE’s fossil-fuel-fired generation, which contributed 69% of its total generation in 2022. At the same time, growing renewables, which supplied just 22% of RWE’s output last year, is going to be tough. Delays in permitting and grid construction make it hard to develop new projects and add a premium on ready-to-build projects.