Prices across some carbon markets are expected to inch closer together in 2024, as newer programs break records and more mature schemes cool. Looming net-zero targets are pushing regulators to tighten supply and include more sectors. Meanwhile, the gap between compliance and voluntary markets continues to narrow, as recently established compliance programs appear more lenient on the inclusion of carbon offsets.

- Policy: Carbon border adjustment taxes are gaining support, although the momentum in economies without a carbon price will likely lose steam. Market-tightening reforms across the US and Australia are boosting allowance prices, contrasting the European Union, which will likely see subdued prices in the near term from interventionist measures. New markets and the expansion of existing programs are on the cards: a linkage between the states of Washington and California, the start of a cap-and-invest scheme in New York State, new participants in South Korea, the addition of the cement and aluminum sectors in mainland China, and the inclusion of direct air capture in the EU.

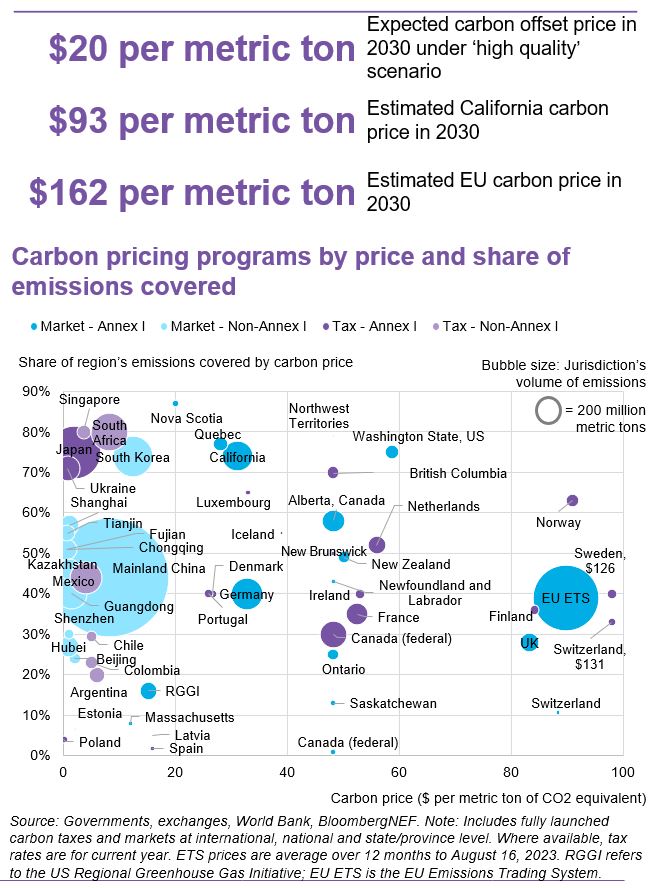

- Price: California’s carbon price is expected to average around $42 per metric ton in 2024 and $46 per ton in 2025, according to BloombergNEF. That’s up from $34 per ton in 2023, supported by financial intermediaries. It could reach as high as $93 per ton by the end of the decade. Meanwhile, carbon prices in the EU are forecast to average €71 per ton ($76 per ton) this year, down from €85 per ton in 2023. BNEF then projects the bloc’s prices will head towards €149 per ton in 2030. Carbon markets offer investors access to a tool that tracks a diverse set of low-carbon technologies. They could also attract investors looking to shield their returns from high interest rates and inflation.

- Industrial sectors: Recession risks and cost inflation have taken a toll on European industrials, lowering their activity, emissions and demand for carbon allowances. Declining power sector emissions in both the EU and across US states covered by a regional carbon market will also limit demand for allowances. Meanwhile, budget cuts for energy transition projects in California could delay emission reductions in the state. Mainland China is also looking to add industrial sectors to its market in 2024, pushing up emissions covered by its mechanism.

- Offsets: The price of carbon offsets remains contingent on whether the standards can be agreed. Credits could trade at just $13 per ton by 2030 – not much higher than current prices – if the market continues to operate without rigorous standards, and greenwashing and integrity concerns drive companies away from offsets. But if a robust, universal definition of ‘high quality’ is established, BNEF modeling puts credit prices at $20 per ton at the end of the decade. Prices could skyrocket to $146 per ton by 2030 if the market is restricted to only carbon removals, such as from direct air capture technology that pulls CO2 out of the sky.

BNEF clients can access the full report here.