By Bo Qin and Emma Coker, Carbon, BloombergNEF

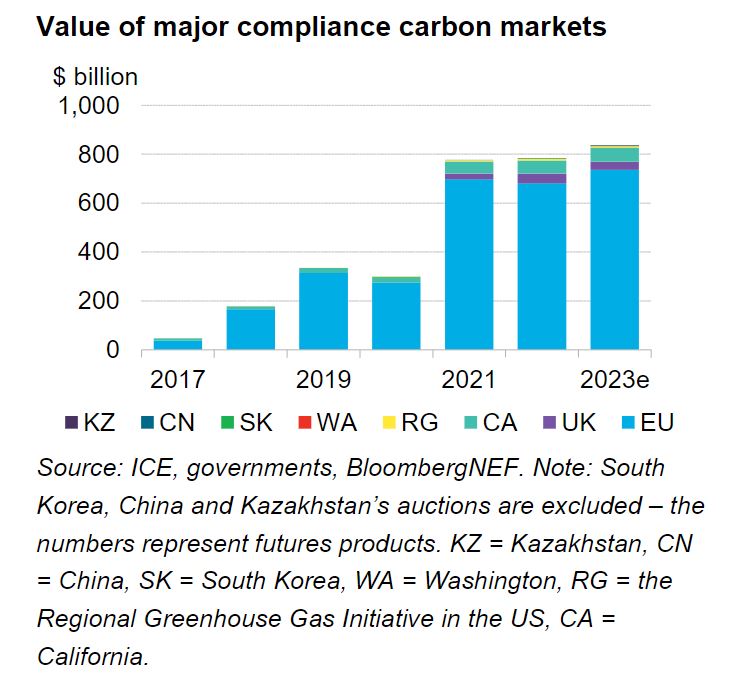

The total value of major compliance carbon markets is expected to top $800 billion this year, despite trading volumes being on track to fall amid the lingering fallout from Russia’s invasion of Ukraine.

The 5% growth in value reflects the rally in allowance prices from reforms looking to leverage carbon markets to achieve climate targets, tempered by concerns related to energy affordability and security.

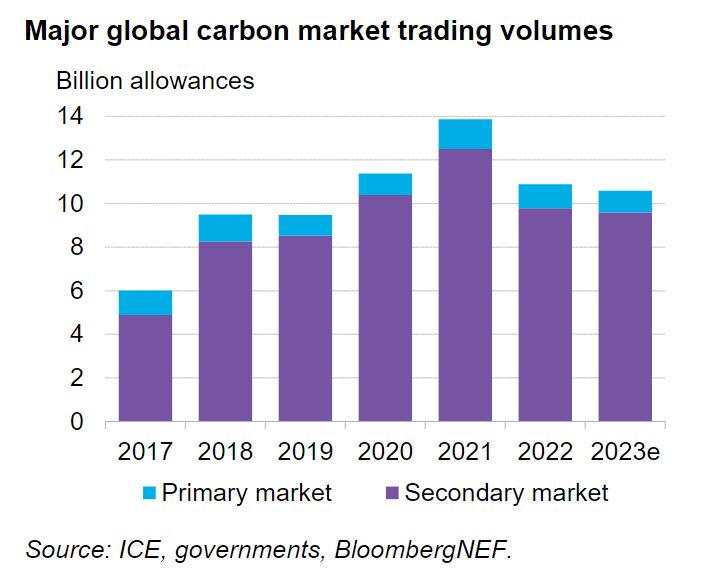

Meanwhile, the retreat in allowance trading volumes from their peak in 2021 is a function of the war in the Ukraine and the ensuing turmoil in commodities drawing liquidity from carbon markets.

While trading levels are subdued, BloombergNEF expects compliance carbon markets to remain an essential tool for lawmakers this decade. New markets are set to be launched in Brazil, Mexico and India, and regulators will continue to implement supply-cuttingreforms in existing markets, increasing prices.

BNEF’s latest outlook for the European Union’s Emissions Trading System estimates allowances prices will reach €149 per metric ton ($157/t) in 2030, up from around €85/t right now. Across the Atlantic, our projection for the California-Quebec market sees prices almost doubling to $63/t by the end of the decade.

Carbon trading goes global

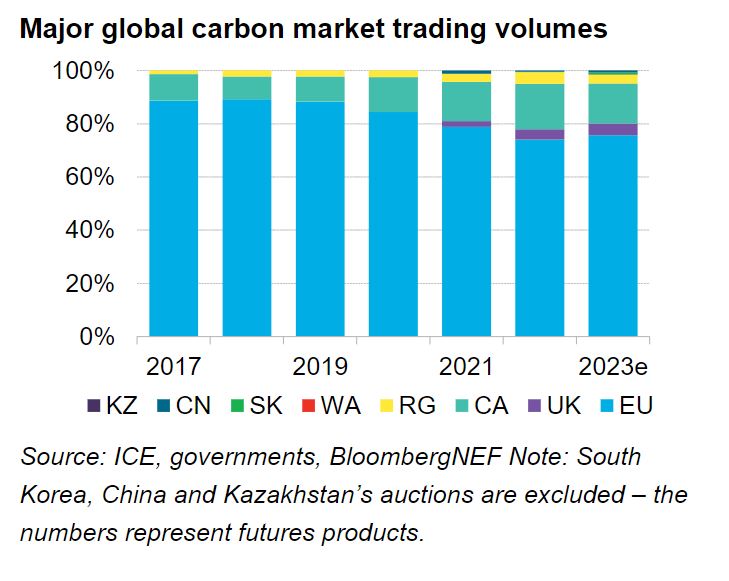

The EU is set to close out the year maintaining its place as the world’s largest carbon market in terms of both traded volume and value. But its dominance is slipping. Some 75% of global carbon market futures and auctioned volumes, or around 8 billion allowances, are currently traded in the EU. This is down from almost 90% in 2017.

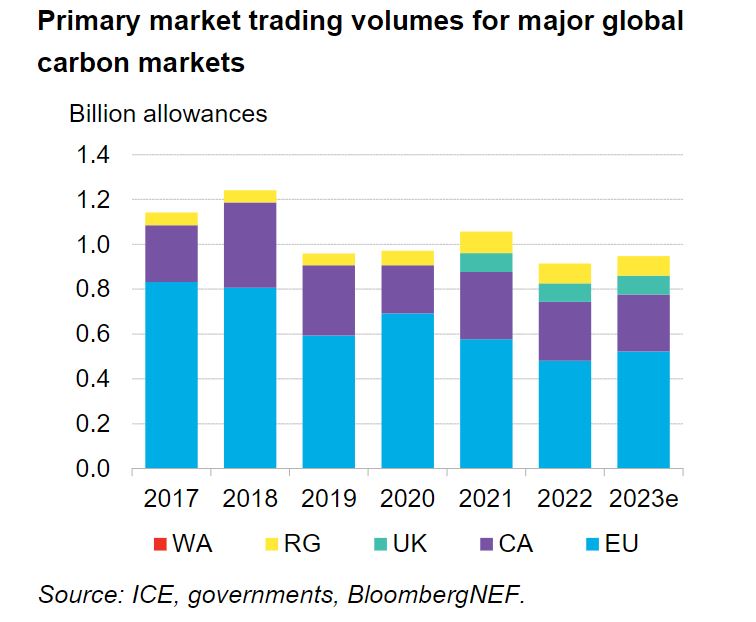

The proliferation of carbon trading across the globe has seen new primary markets auctioning allowances for the first time. As a result, the EU’s share of auctioned volumes has fallen from 73% in 2017 to 53% this year.

But while there are now more primary markets being established, 90% of allowances are still being traded on the futures market, where transactions are easier and faster to settle and clear.

Volumes fall as less hedging is required

Trading volumes have been trending downwards from their peak in 2021. More than a fifth was shaved off last year as a consequence of the war in Ukraine and subsequent increased volatility in commodities. Policy uncertainties surrounding carbon market reforms and higher interest rates also contributed to the decline in trading activity.

In the case of EU, dampened emissions have also contributed to lower hedging demand – whereby compliance entities pre-purchase allowances to cover future obligations.

The total long and counter (short) positions in the EU’s futures market have fallen by around 23% compared to a year ago, according to Commitment of Traders data. Of these, positions deemed to be held for “risk reducing” – in other words, for hedging purposes – have dropped 32%.

Meanwhile, long positions from “risk reducing’ participants, also known as “long hedges”, have shrunk. This is likely due to the outlook of reduced emissions in the EU ETS as more renewable energy capacity is brought online, accelerated by measures encouraging the transition away from Russian fossil fuels.