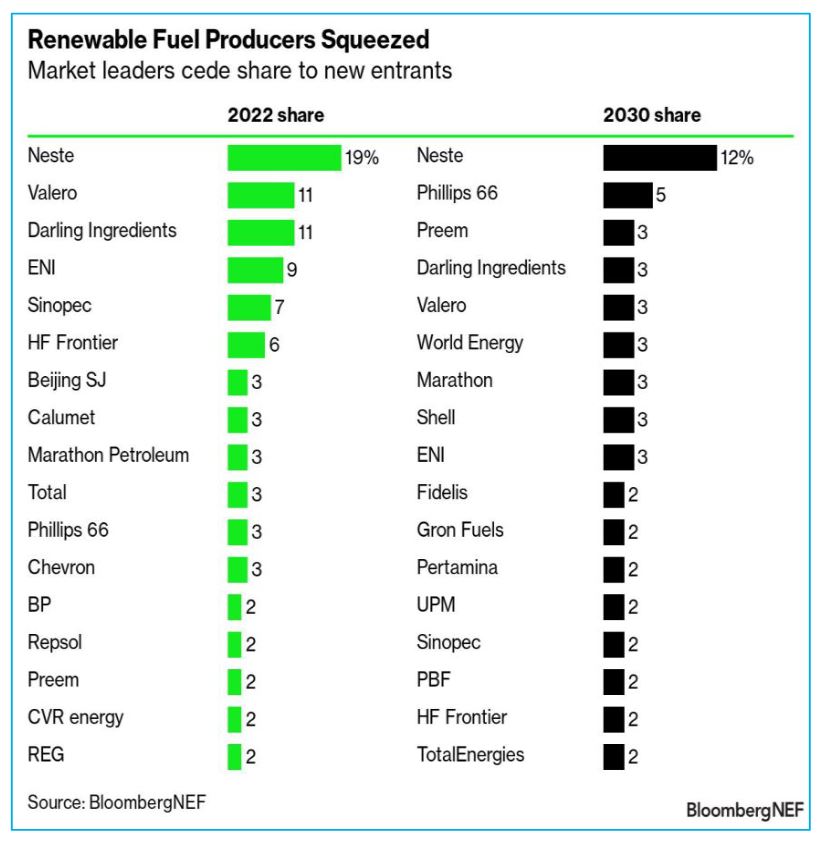

Renewable ‘drop–in’ fuels – the substitutes of fossil fuels that face no blending limits – are set to see a tripling of supply by 2030. A host of new entrants will squeeze the leading producers of these fossil–fuel substitutes, eating into the market shares of Neste, Valero, Darling Ingredients, ENI and Sinopec.

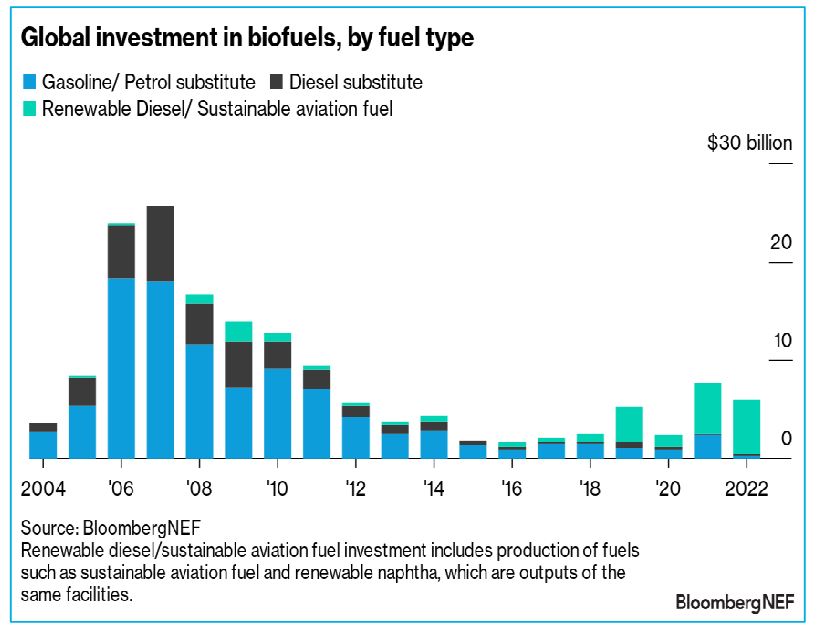

“Drop–in fuels change the biofuels game, since the so–called blend wall doesn’t exist for them,” said Anastacia Davies, BloombergNEF’s head of renewable fuels. “Almost all the investment in biofuels is now in this segment.”

The number of suppliers is expected to jump more than fourfold to over 180 by the end of the decade, according to the latest update from BNEF, while the share of the top five is seen dropping from almost 60% to just 26% as companies jostle for market traction.

Drop–in fuels have an edge over traditional biofuels like ethanol and biodiesel, which can only be blended into gasoline and diesel in limited quantities. Two options currently dominate the market – renewable diesel and sustainable aviation fuel – and account for the bulk of investment.

Demand for these fossil–fuel substitutes is being driven by policy, as well as the decarbonization targets of companies and leading airlines.

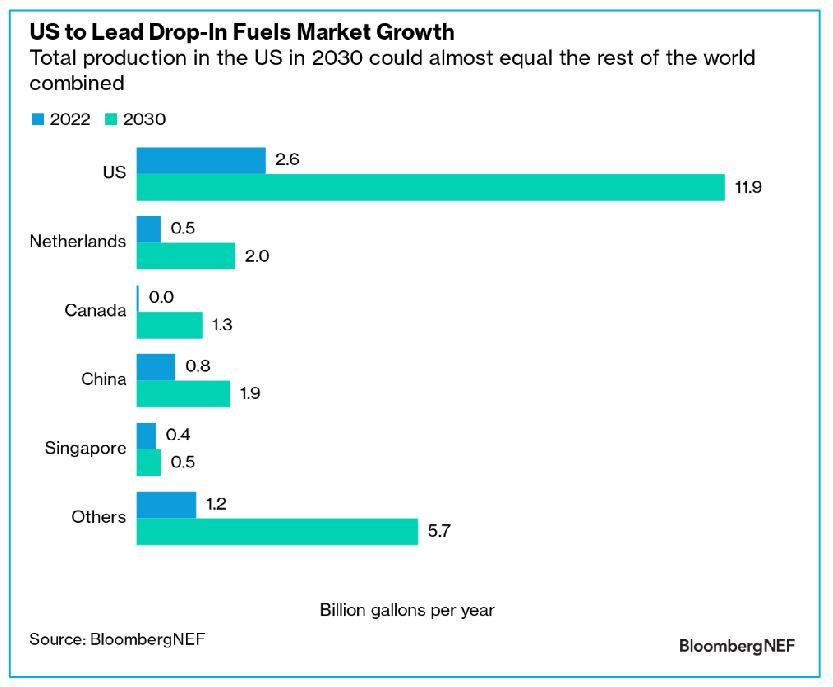

The US leads the drop–in fuels market, mainly because of the demand created by California’s Low Carbon Fuel Standard. Under this program, fuel suppliers generate credits or deficits based on the carbon intensity of the fuels sold. Renewable diesel has been generating the highest volume of credits in the LCFS for the last two years.

The landmark Inflation Reduction Act also offers tax credits for these fuels. Looking ahead, the US is expected to continue lead growth in the drop–in fuels market this decade.

There is a catch, however – the limited supply of the right kind of feedstock.

“There is a feedstock wall that threatens the growth of this industry,” said Davies. The raw material for these fuels is virgin oils or waste products like used cooking oil or animal fats. Waste oils are the feedstock of choice thanks to their lower carbon intensity, but there isn’t enough volume available. One solution could be to rely on alternative technologies that can utilize a wider variety of feedstocks, such as power–to–liquids, alcohol–to–jet and thermal gasification.

Demand is seemingly assured, particularly in the aviation sector. The list of airlines announcing net–zero targets and committing to decarbonization is growing ever longer. The use of sustainable aviation fuel is the most popular route for that.