By Nelson Nsitem, Energy Storage, BloombergNEF

The global energy storage market almost tripled in 2023, the largest year-on-year gain on record. Growth is set against the backdrop of the lowest-ever prices, especially in China where turnkey energy storage system costs in February were 43% lower than a year ago at a record low of $115 per kilowatt-hour for two-hour energy storage systems.

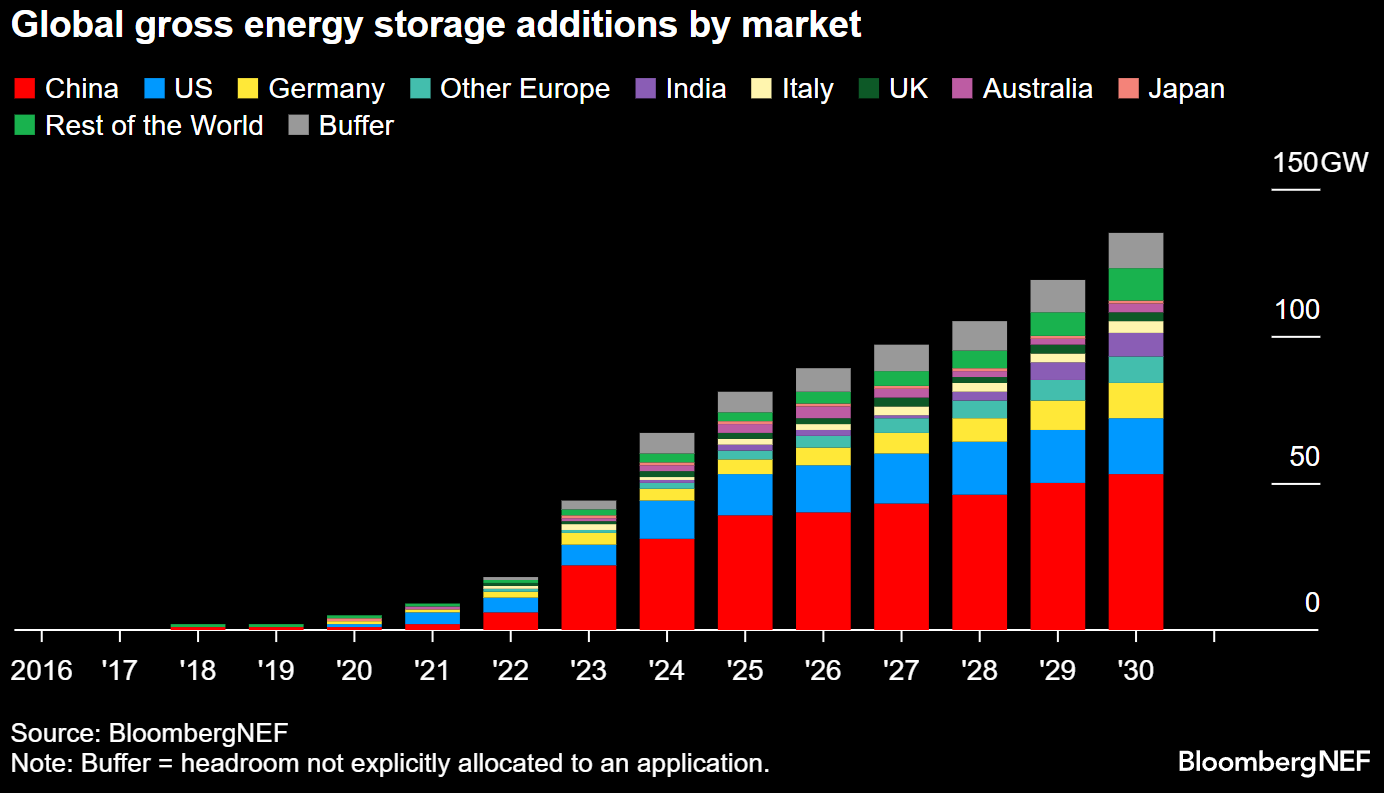

Last year’s record global additions of 45 gigawatts (97 gigawatt-hours) will be followed by continued robust growth. In 2024, the global energy storage is set to add more than 100 gigawatt-hours of capacity for the first time. The uptick will be largely driven by the growth in China, which will once again be the largest energy storage market globally.

The next-largest market will be the US, where state targets, utility procurements and attractive merchant economics in places like Texas drive the market. In Europe, Middle East, and Africa, residential batteries will continue to be the largest source of storage demand, led in particular by Germany and Italy, as well as markets like Austria, Switzerland, Belgium, Sweden, Spain, and the UK.

Out to 2030, the global energy storage market is bolstered by an annual growth rate of 21% to 137GW/442GWh by 2030, according to BloombergNEF forecasts. In the same period, global solar and wind markets are expected to see compound annual growth rates of 9% and 7%, respectively. Much of the growth in energy storage investment is being driven by mandates and targeted subsidies, ranging from solar and wind co-location mandates in China, to the Inflation Reduction Act and state-level policies in the US. New support schemes are also emerging across Europe, Australia, Japan, South Korea, and Latin America.

Falling energy storage costs, as seen in China, will be key to support more economic deployments globally. The main enabler of these falling costs has been lithium iron phosphate (LFP) batteries, which use no nickel and continue to take market share from lithium-ion batteries using nickel manganese cobalt (NMC). The growth in LFP’s market share is made possible by a scale-up in manufacturing capacity led by Chinese battery makers.

Battery makers outside China, many of which historically specialized in nickel-based lithium-ion batteries, are also looking to start manufacturing energy storage system (ESS) products using LFP. Major examples include South Korea-based LG Energy Solution and Samsung SDI, Japan-based Panasonic and Norway-based Freyr. BNEF expects NMC to hold a market share of only around 1% by 2030.